TIAA Retirement & Annuities: Your Guide To Secure Finances

Are you ready to secure your financial future and ensure a comfortable retirement? TIAA (Teachers Insurance and Annuity Association of America) offers a range of solutions designed to help you achieve your long-term financial goals, from annuities to financial planning and investment options.

Understanding the landscape of retirement planning can be complex, but with the right guidance, you can navigate it successfully. TIAA has been a trusted provider of retirement solutions for over a century, helping individuals and institutions plan for a secure future. Their comprehensive offerings are designed to meet a variety of needs, whether you are an individual investor or part of a larger organization.

Here is some insight of data for your reference, to understand TIAA:

- How To Know Signs A Man In Love With You Simplified

- Top Picks For Gentle Shampoo For Color Treated Hair Enhance Amp Protect

| Category | Details |

|---|---|

| Company Name | Teachers Insurance and Annuity Association of America (TIAA) |

| Founded | July 1, 1929 |

| Headquarters | New York, NY |

| Primary Products | Annuities, Retirement Plans, Financial Planning, Investment Solutions |

| Target Audience | Individuals, Educational Institutions, Non-profit Organizations |

| Key Features | Guaranteed Growth Annuities, Lifetime Income Options, Professional Financial Advice, Investment Management |

| SIPC Coverage | SIPC only protects customers' securities and cash held in brokerage accounts. |

| Website | www.tiaa.org |

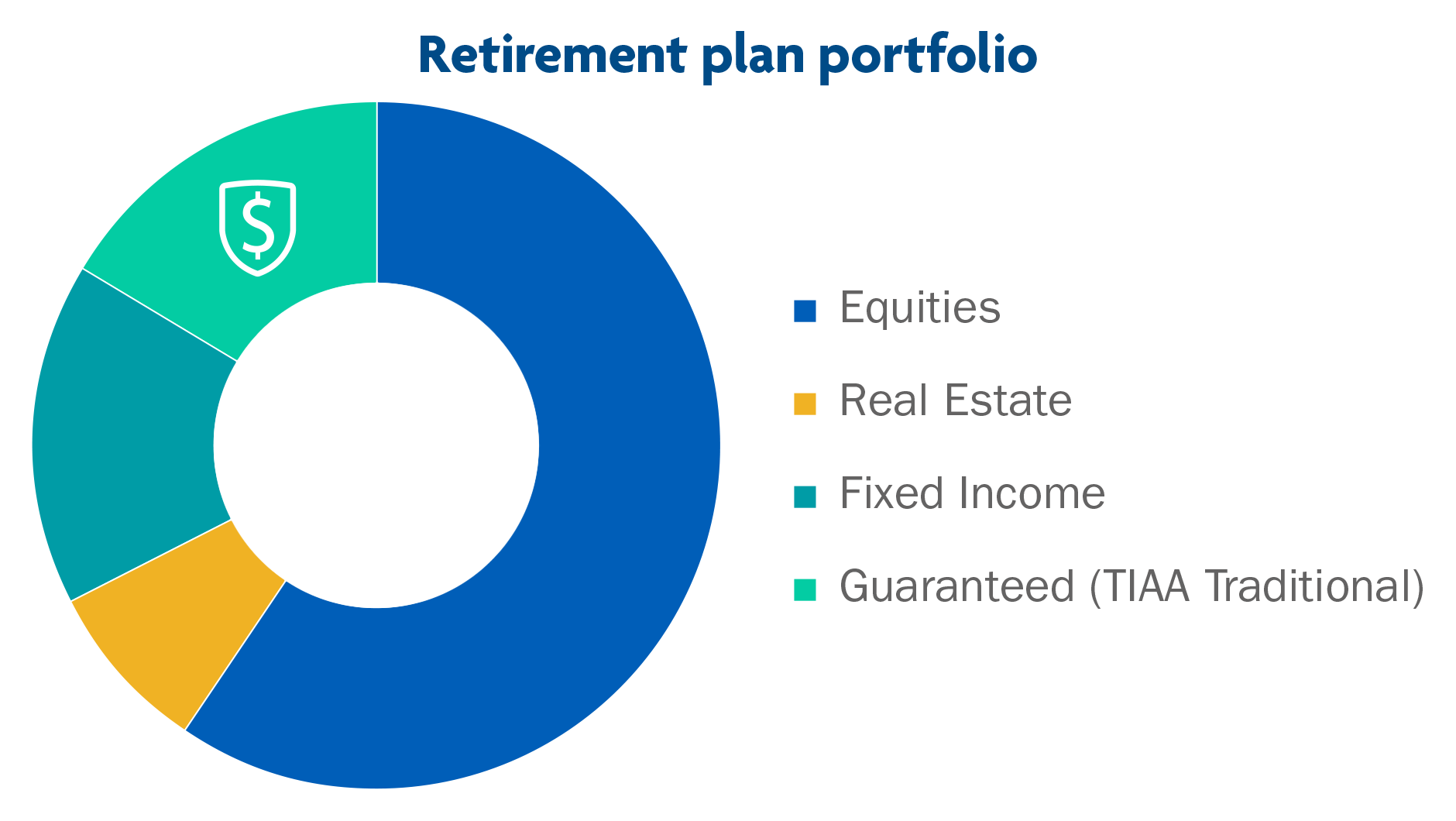

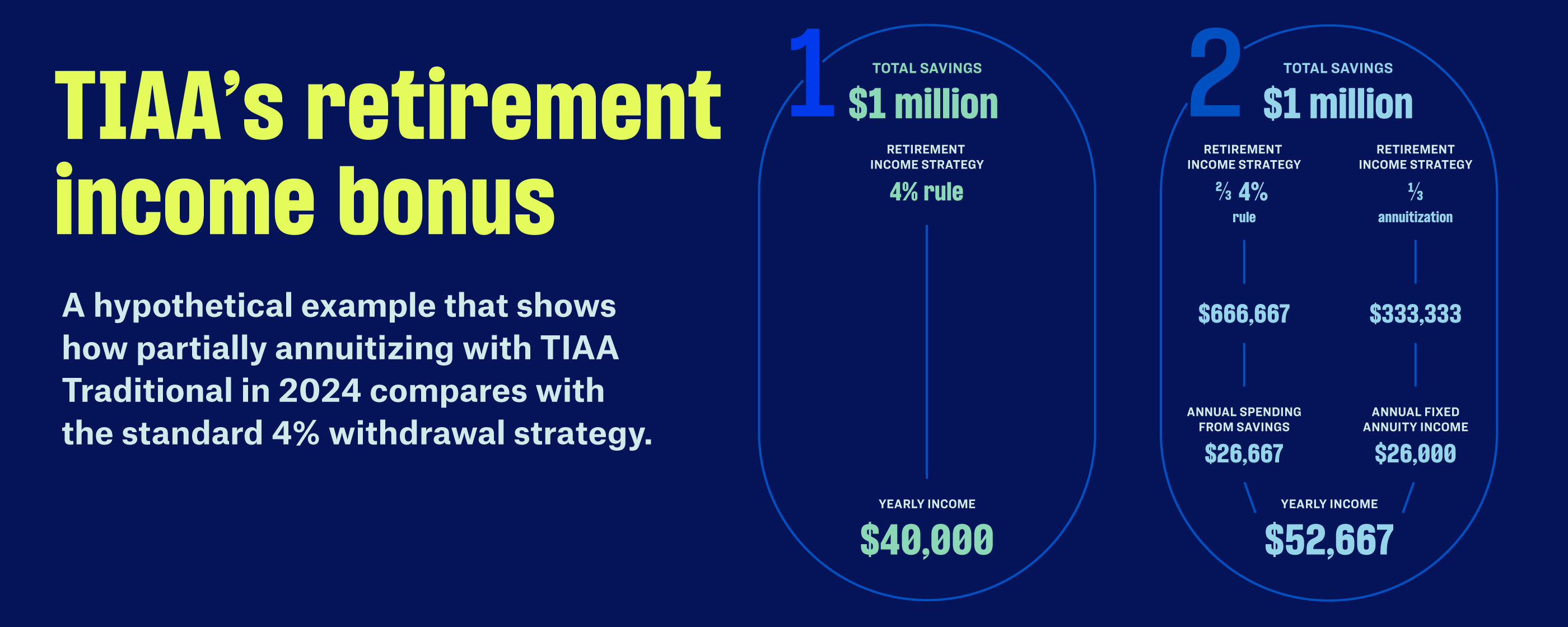

One of the core offerings from TIAA is its traditional annuity, a fixed annuity that provides guaranteed growth and lifetime income for retirement. This type of annuity is designed to offer stability and predictability in your retirement plan. TIAA also offers variable annuities. It's worth noting that none of the variable annuities have liquidity restrictions, giving you flexibility.

For those seeking a dependable income stream, TIAA's fixed annuity can be an attractive option. It offers guaranteed growth and provides a reliable source of income throughout retirement. TIAA provides this benefit through its traditional annuity, which offers exclusive benefits designed to help you reach your retirement goals. The annuity is issued by Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF) in New York, NY. These entities are each solely responsible for their own financial condition and contractual obligations.

TIAA also caters to institutional clients, providing retirement solutions for various organizations. For example, TIAA is a provider for UABs voluntary retirement programs, and they offer a choice in how to distribute the total deposit. The company also supports retirement plans established as far back as July 1, 1929. These plans are available to eligible employees of TIAA and certain of its subsidiaries and affiliates that have adopted the retirement plan with approval from TIAA.

- Perfect Hairstyles Short Hair For Heart Shaped Face

- Optimal Choices For Best Cheap Testosterone Booster

If you are currently in a 401(k), 403(b), or individual retirement account (IRA) and have concerns about contribution limits, TIAA could be a viable option for continuing to invest retirement money. TIAA retirement plans have virtually no contribution limits.

TIAA believes that everyone deserves a secure retirement and offers resources to help you plan and manage your finances. They offer various options to meet your needs, including annuities, financial planning advice, and investment solutions. TIAA accounts provide a platform to view balances, manage investments, and access professional advice. You can also start and maintain your retirement plan with TIAA, helping you create a financially secure future.

TIAA's digital experience allows you to monitor your account, manage investments, and explore how to receive monthly retirement checks for as long as you live. For those looking to maximize their financial strategy, TIAA can also assist with rollovers. You may be able to transfer or roll over money from other employer plans to the TIAA retirement plan. However, it's important to note that TIAA does not offer loans on Roth accumulations in 403(b)/401(k) plans.

To gain more in-depth insights, TIAA encourages you to log in to your account with your user ID and password, or use a passkey if available, to access your products and services. You can also consult with professional advisors to set goals and savings strategies, and access insights and support. Additionally, the company offers resources such as a brochure titled "Getting to Know TIAA's Individual Financial Solutions and Its Financial Professionals" to guide you.

Another way that TIAA structures its solutions is through the use of the Retirement Choice Annuity (RC). This retirement choice annuity offers guaranteed growth, dependable lifetime income, and exclusive benefits through its fixed annuity. TIAA offers a retirement solution for people in various fields, such as employer plans, IRAs, and annuities, demonstrating its commitment to providing accessible and flexible retirement solutions.

The Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF), the issuing entities, are independent and solely responsible for their financial health and contractual obligations. Sipc only protects customers' securities and cash held in brokerage accounts. This detail clarifies how TIAA's offerings are structured, with each entity managing its own financial commitments.

Regardless of your chosen path, TIAA's mission remains constant: to help you secure your retirement. With guaranteed growth, professional support, responsible investing, and demonstrated performance, TIAA positions itself as a partner in your journey toward financial security, providing the tools and resources you need to make informed decisions.

Article Recommendations

- Secrets Of The Zodiac The Truth About Not All Geminis

- How To Know Signs A Man In Love With You Simplified

Detail Author:

- Name : Zechariah Larkin

- Username : jadyn.howell

- Email : santos10@gmail.com

- Birthdate : 1978-09-17

- Address : 46173 Roxane Valleys West Delfinahaven, MD 46010-9990

- Phone : 269.270.7587

- Company : Block-Rau

- Job : Photographer

- Bio : Delectus quam est et ratione assumenda ea deleniti. Repudiandae quod excepturi similique vel ad aspernatur. Nam voluptas consequatur iusto nulla. Ut expedita ut et rerum sed voluptatem.

Socials

tiktok:

- url : https://tiktok.com/@priscilla6828

- username : priscilla6828

- bio : Illo doloribus consequuntur sequi delectus voluptate est.

- followers : 5500

- following : 2311

twitter:

- url : https://twitter.com/priscilla7322

- username : priscilla7322

- bio : Velit eos omnis accusantium cumque quae itaque. Nobis blanditiis non aut eum. Tenetur rerum assumenda mollitia cupiditate est.

- followers : 6773

- following : 1048

linkedin:

- url : https://linkedin.com/in/priscilla_id

- username : priscilla_id

- bio : Harum tenetur sed enim voluptas veritatis quia.

- followers : 1084

- following : 2493

instagram:

- url : https://instagram.com/priscilla_ward

- username : priscilla_ward

- bio : Fugit nostrum aliquam culpa. Ex vel iusto est quae tempore magni. Aut veniam vitae voluptatem aut.

- followers : 3878

- following : 1041