New York State Income Tax Guide: Your Filing Checklist & Tips

Are you ready to navigate the complexities of New York State income taxes? Understanding your tax obligations in the Empire State is crucial for every resident, impacting everything from your paycheck to your financial planning.

This guide delves into the intricacies of New York State income tax, providing essential insights for the 2024 tax year. Whether you're a seasoned taxpayer or new to the state, this comprehensive resource will equip you with the knowledge to confidently fulfill your tax responsibilities.

In the vibrant landscape of New York, where opportunities abound, understanding your tax obligations is paramount. From the bustling streets of New York City to the serene landscapes of the Adirondacks, every resident and business owner must navigate the state's tax system. Similar to the federal income tax, New York imposes taxes on earnings, creating a financial framework that touches every aspect of life in the state.

- Laboriously Meaning Decoding The Depth And Significance

- Ascendant Vs Rising Sign A Comprehensive Guide To Astrological Concepts

The New York State Department of Taxation and Finance is your primary resource, offering a wealth of information and services. Their official website is your gateway to understanding your tax responsibilities. You can check your refund status, access online services, and stay informed about the latest updates. Remember that the NYS Department of Taxation and Finance is a reliable source, use only the official website.

Keep in mind, some forms and instructions on the website may not reflect recent changes in tax department services and contact information. For accurate information, especially regarding any tax relief programs that you are eligible for, always consult the most recent updates on the official website of the NYS Department of Taxation and Finance.

Filing your income tax return involves several key steps. To get started, make sure you have all the necessary documentation. This typically includes your W-2 forms from employers, 1099 forms for any other income, and records of deductible expenses. Enter your name precisely as it appears on your personal income tax return to avoid any issues in tax processing. You'll also need your social security number to file your return or check your refund status.

- Mastering Hair Trends Types Of Highlights For A Stunning Look

- 25th October Horoscope Insights And Predictions For Your Zodiac Sign

For those who file jointly, remember to submit a separate estimated tax voucher for each spouse. Direct payment options, like paying from your bank account, offer convenience and efficiency. The tax system now offers automatic calculations of the amounts due, taking the guesswork out of figuring out your tax liability.

If you're an employer in New York State, you'll need to register with the state if you havent already. This ensures that you can withhold income tax from your employees regular wages correctly. If you do withhold tax from your employees regular wages, you can use one of the following methods for the supplemental wages. Withhold at the New York State supplemental rate of 11.70% (0.1170) is one of the method to consider.

Navigating the complexities of the New York State income tax system requires a thorough understanding of its key components. This section offers a detailed overview of the critical elements that impact your tax obligations, including how residency, filing status, and income levels determine your tax liabilities. The state has nine income tax rates, so understanding the range from 4% to 10.9% is the first step.

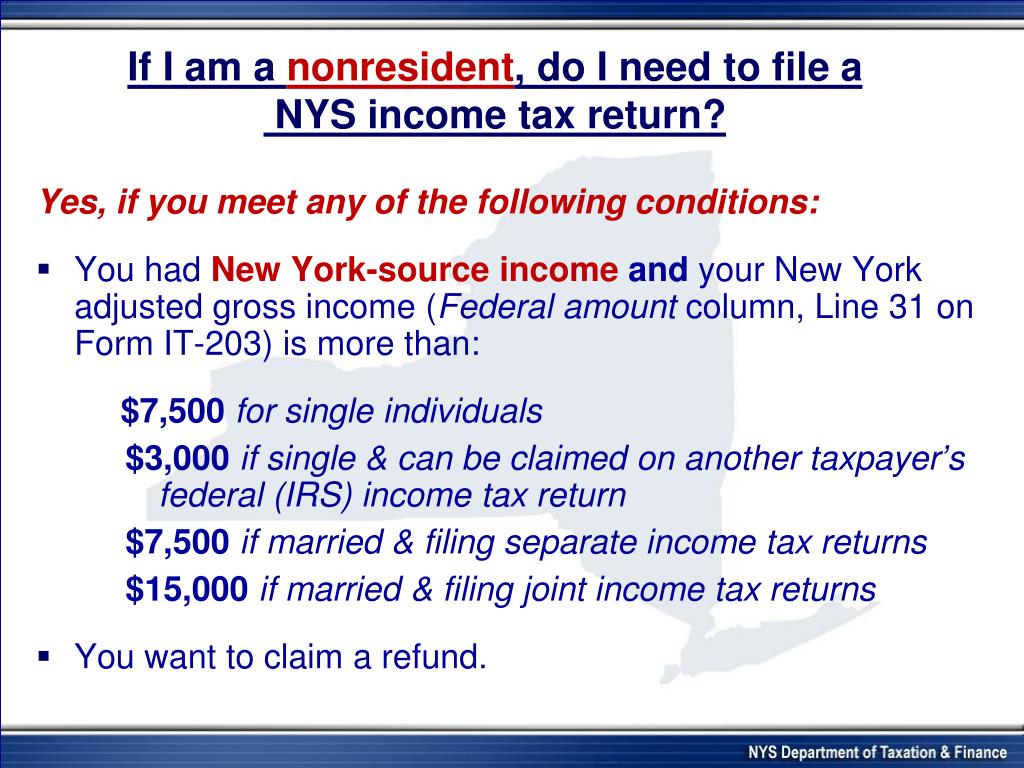

Understanding residency is pivotal. New York taxes its residents on all their income, regardless of where it's earned. Non-residents are taxed only on income sourced from New York. Your filing status (single, married filing jointly, head of household, etc.) also influences your tax obligations. The state applies taxes progressively, with higher earners paying higher rates. Tax credits and deductions can significantly affect your tax liability, and these will depend on your individual circumstances.

New York State's tax system has nine income tax rates. The tax brackets for 2024, which are reported in 2025, are detailed on the official website of the NYS Department of Taxation and Finance. For the 2024 tax year, only individuals are the focus of these guidelines.

New York City and Yonkers residents face an additional layer of complexity: city income tax. If you reside in either of these cities, you may be subject to local income taxes on top of state income tax. If you are a resident of new york city or yonkers, you may also be subject to a city income tax in addition to state income tax.

To understand the tax brackets and rates for your specific situation, it is always best to use the latest information available on the NYS Department of Taxation and Finance website.

This guide provides a general overview of New York State's tax structure. Always refer to the official website of the NYS Department of Taxation and Finance for the most current and detailed information.

Understanding how to calculate your tax liability is a crucial part of tax planning. You can use the online services offered by the New York State Department of Taxation and Finance to calculate your tax. Taxpayers can also use tax calculators to get an estimate of what they owe. The online calculator will allow you to customize your tax estimate based on your filing status, deductions, exemptions, and more.

In addition to your annual income tax, you may also be subject to other taxes depending on your circumstances. If you file for an extension of time to file and owe tax, you must make your extension payment by the due date. Also, if you apply for an extension of time to file, you must make your extension payment by the due date.

The withholding tax filers will benefit from improvements to the withholding tax and wage reporting that are now live. New York States top marginal income tax rate of 10.9% is one of the highest in the country, but very few taxpayers pay that amount. The state applies taxes progressively (as does the federal government), with higher earners paying higher rates.

The NYS Department of Taxation and Finance offers multiple convenient options for filing and paying your income tax. Direct file can be accessed from a smartphone, laptop, tablet, or desktop.

You can pay, or schedule a payment for, any day up to and including the due date. Pay income tax through online services, regardless of how you file your return.

New York offers various resources to help you navigate the tax process. You can pay a bill, file an income tax extension, respond to a department notice, and sign up for refund notifications with an individual account. The Volunteer Income Tax Assistance (VITA) and AARP Tax-Aide programs provide free tax help to those who qualify. Visit the NYS Department of Taxation and Finance website to find locations near you.

Additionally, MilTax, the military's free tax service, helps members of the military file their taxes, ensuring they can claim all of the credits and deductions that are applicable to them.

Checking your refund status is a common step after filing your return. To check your refund status, you need the amount of the New York State refund you requested. Enter your requested refund amount and social security number to see the status of your New York State income tax refund.

If you're expecting a refund, you can choose direct deposit to receive your refund directly into your bank account. The status message will clarify your refund status. If the Department requires additional information, you'll be notified on the status page, where you can respond to a request for information. Learn how to understand your refund status message, respond to a request for information, and troubleshoot common issues on the official website of the NYS Department of Taxation and Finance.

Before you file, you may need to gather certain forms and instructions. Find current and past year forms and instructions for various tax types, such as income tax, sales tax, and property tax on the official website. Some forms and instructions are now webpages for easier access and understanding.

To avoid delays in processing your tax return, use Respond to Department Bill or Notice to upload documentation we request from you. If the department provides a fax number in correspondence or on a form, use only that number to fax them information. To avoid delays, follow these guidelines.

For more guidance, visit the Individuals Homepage on the NYS Department of Taxation and Finance website. This page offers additional help, resources, and links to other useful services.

For individuals looking to file their taxes, several resources are available to assist with the process. The Volunteer Income Tax Assistance (VITA) and AARP Tax-Aide programs offer free tax help to those who qualify. For taxpayers, the NYS Department of Taxation and Finance website provides a comprehensive collection of forms, instructions, and guidance. Find information and services related to personal and business taxes in New York.

The NY.gov website belongs to an official New York State government organization. Always use the official website of the NYS Department of Taxation and Finance for accurate and secure tax information and services.

Barns may qualify for an income tax credit for rehabilitating the property. Also, if you're filing a return, you may want to review driver license requirements for taxpayers. Take control of your tax information. Visit the official NYS Department of Taxation and Finance website to take control of your tax information.

In the Empire State, income taxes are applied progressively, with higher earners paying higher rates, similar to federal taxes. Your tax liability is shaped by various elements, including filing status, credits, and deductions. Taxpayers can use online services regardless of how they file their return. You can pay, or schedule a payment for, any day up to and including the due date.

To learn more about the New York State income tax, use the official website of the NYS Department of Taxation and Finance, and use the online tools available to find out your tax obligations.

If you have additional questions regarding your New York State taxes, visit the official website of the NYS Department of Taxation and Finance for more information. For the most recent updates, learn about the latest updates, credits, and tips for the 2024 tax season on the official website.

Remember, the information in this guide is for informational purposes only and should not be considered professional tax advice. Consult a qualified tax professional for personalized guidance.

Important Note: Tax laws and regulations are subject to change. Always consult the most up-to-date information from the official NYS Department of Taxation and Finance website for the most accurate guidance.

Article Recommendations

- Stylish Mens Thick Curly Hairstyles A Guide To Perfect Locks

- Elf Makeup Affordable Beauty And Quality For Everyone

Detail Author:

- Name : Chaim Koch

- Username : brandt55

- Email : chegmann@douglas.com

- Birthdate : 1998-06-14

- Address : 114 Sanford Spring Steuberchester, SC 72911-1805

- Phone : +13149319405

- Company : Steuber Group

- Job : Social Science Research Assistant

- Bio : Enim ipsam maxime in illum a cumque. Numquam ea consectetur dolor blanditiis voluptas tempore. Consectetur cum officia laudantium nulla quis hic.

Socials

instagram:

- url : https://instagram.com/archibaldnikolaus

- username : archibaldnikolaus

- bio : Nihil voluptates dolore fuga aut. Adipisci sed eum consequatur aut ipsam.

- followers : 3967

- following : 2226

linkedin:

- url : https://linkedin.com/in/archibald.nikolaus

- username : archibald.nikolaus

- bio : Assumenda animi architecto nisi enim earum.

- followers : 3524

- following : 2473

twitter:

- url : https://twitter.com/nikolaus1977

- username : nikolaus1977

- bio : Est eos consectetur commodi in voluptas magni. Ea neque eum repellat qui eligendi magnam. Incidunt numquam sunt deserunt voluptatibus.

- followers : 272

- following : 1245

tiktok:

- url : https://tiktok.com/@archibald8939

- username : archibald8939

- bio : Quo quia assumenda corrupti quia cumque molestias.

- followers : 4027

- following : 1151

facebook:

- url : https://facebook.com/archibald.nikolaus

- username : archibald.nikolaus

- bio : Repellat laudantium est id vitae dicta id est. Aut accusantium ut dolor.

- followers : 716

- following : 1664