Poppins Payroll: Simplify Nanny Payroll & Taxes | Start Today!

In the ever-evolving landscape of household management, how does one navigate the complex world of nanny payroll and taxes without succumbing to a sea of paperwork and potential financial pitfalls? The answer lies in embracing the simplicity and efficiency of modern payroll solutions, and Poppins Payroll offers a compelling example.

The modern family often juggles multiple responsibilities, and managing household staff whether it's a nanny, housekeeper, or senior caregiver can add a significant layer of complexity. Ensuring accurate payroll, adhering to tax regulations, and staying compliant with ever-changing employment laws requires expertise and time. This is where specialized services like Poppins Payroll step in, offering a streamlined solution that simplifies the entire process.

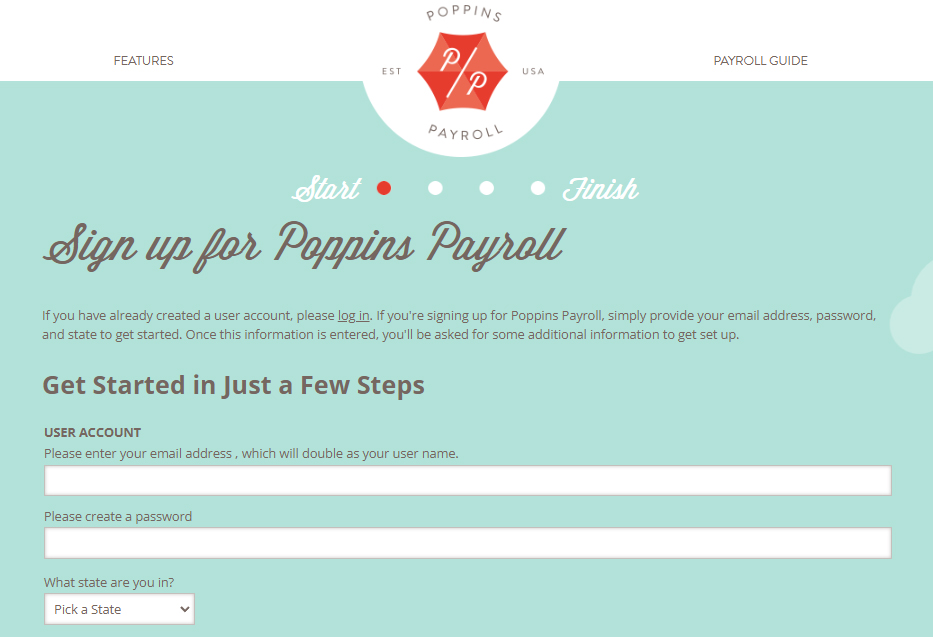

Poppins Payroll distinguishes itself not just through its services, but also through its user-friendly design. The platform is designed for ease of use, offering a colorful and enjoyable interface that makes the process of managing payroll and taxes less daunting. Transparency is key: The service clearly outlines its offerings and fees, enabling users to make informed decisions. Setting up an account is straightforward, requiring only basic information about the employer and the employee, as well as payment details. Once configured, the platform handles the rest, including payroll calculations, tax filings, and record-keeping. For those who have previously wrestled with the complexities of household employment, the benefits of such a system are immediately apparent.

- Ingredients Of Nail Polish Essential Components And Their Impact

- Paraffin Wax At Walmart Your Complete Guide And More

To provide a clearer understanding of the specifics of the "Poppins Payroll" service, here's a breakdown of its key features and what it offers to its users. The table below is designed for easy integration into various platforms, including WordPress, and provides a comprehensive overview:

| Feature | Description |

|---|---|

| Core Services | Payroll processing, tax filing (federal, state, and local), direct deposit, pay stubs, year-end tax forms (W-2s) |

| Pricing | Typically a flat monthly fee, often starting around $49 per month, depending on the plan selected. |

| User Interface | Designed to be colorful, intuitive, and easy to navigate. Includes dashboards for easy management and access to records. |

| Compliance | Ensures compliance with all relevant federal, state, and local tax regulations. |

| Record Keeping | Maintains a digital library of tax and payroll documents for a specified period (e.g., five years), accessible through the platform. |

| Customer Support | Offers customer support to address inquiries and provide assistance. |

| Additional Features | May include PTO tracking, integration with other services, and the ability to manage multiple employees. |

| Mobile Accessibility | Website is mobile-friendly, but a dedicated phone app may or may not be available, depending on current platform offerings. |

Reference: Poppins Payroll Official Website

The ease of use is a recurring theme in user feedback. Previous users often commend the simplicity of the sign-up process and the platform's straightforward approach to payroll and tax management. Rather than a drawn-out, complicated process, Poppins Payroll emphasizes a quick and efficient setup, typically involving entering essential information about the employer, employee, and payment details. The platform then takes over the more complex tasks, ensuring accurate payroll calculations, the generation of pay stubs, and the timely filing of necessary tax forms. This efficiency can save time and reduce the stress associated with managing household employment.

- Benefits And Usage Of Tea Tree Cream For Eczema Relief

- All About June 21st Birthstone Meaning History And Benefits

The affordability of Poppins Payroll is another key selling point. With a flat monthly fee, the service provides a comprehensive suite of payroll and tax services without the unpredictable costs often associated with traditional methods. This is particularly attractive to families seeking a budget-friendly solution to their household employment needs. The platform's focus on simplicity and affordability makes it an accessible option for a wide range of families, including those new to employing household staff.

The advantages extend beyond mere convenience. By using a service like Poppins Payroll, employers can ensure compliance with tax laws and labor regulations, mitigating potential legal and financial risks. This adherence to best practices is critical, protecting both the employer and the employee. Services like Poppins Payroll also handle the year-end tax form distribution, helping employers and employees avoid many of the common pitfalls associated with household employment taxes.

Despite the many benefits, a well-rounded analysis should include a critical look at potential drawbacks. While the platforms user interface receives positive feedback, the absence of a dedicated phone app is a noted concern for some users, who would prefer greater mobile functionality. Additionally, some users have expressed a desire for enhanced features, such as the ability for employees to directly enter their hours. While these points may not be deal-breakers, they highlight areas where Poppins Payroll could potentially improve.

The experience of using Poppins Payroll has been positive for many. The service's efficiency in managing taxes and payroll allows families to spend more time on the things that matter most. Streamlining these processes is a significant advantage in today's fast-paced world. Users who have transitioned to using Poppins Payroll often report a reduction in stress and a greater peace of mind, knowing that their household employment obligations are being handled correctly.

The positive feedback extends to the platforms ease of use and overall customer satisfaction. Many reviews highlight the simplicity of setting up and managing payroll, and the value provided by the service's affordability. The customer reviews available on the Better Business Bureau (BBB) website provide valuable insights into the platform's performance and the experience of its users. These reviews are a useful resource for anyone considering using Poppins Payroll.

Poppins Payroll offers a comprehensive and cost-effective solution for families seeking to simplify their nanny and household employee payroll and taxes. By handling the complexities of payroll and tax compliance, the service frees up time and reduces stress, allowing families to focus on their priorities. While there may be limitations, such as the absence of a dedicated phone app, the overall benefits and ease of use make Poppins Payroll a compelling option for those managing household employment. The platforms commitment to transparency, combined with its affordable pricing, places it as a strong choice in the competitive landscape of nanny payroll services.

The company offers a full range of services, from payroll to taxes, at a low monthly price. The platform also helps ensure compliance with all tax regulations and offers a digital library of tax and payroll documents for easy access and record-keeping.

For those seeking an easier way to handle taxes and payroll for nannies, housekeepers, senior caregivers, and other household employees, Poppins Payroll provides a practical and efficient solution. The platforms user-friendly interface, affordable pricing, and commitment to accuracy make it a standout choice in the field. The ability to handle all aspects of payroll and taxes at an affordable price, combined with its user-friendly design, places Poppins Payroll in a favorable position.

The platform is designed to be simple and straightforward. Setting up an account is quick and easy, and the system guides users through each step of the process. The websites mobile responsiveness and the intuitive dashboards help ensure that managing payroll is simple.

In conclusion, Poppins Payroll offers a streamlined, accessible, and affordable approach to managing nanny payroll and household employment taxes. It provides an effective solution for modern families looking to simplify a traditionally complicated area of their lives, offering significant advantages in terms of time savings, reduced stress, and compliance.

Article Recommendations

- Perfecting Your Look Haircuts For A Heart Shaped Face

- Foundation The History And Evolution Of Beautys Base

Detail Author:

- Name : Dr. Hardy Wolf DDS

- Username : dabernathy

- Email : rlakin@bednar.com

- Birthdate : 1980-09-09

- Address : 736 Brannon Creek South Ivah, ND 57652-7011

- Phone : (702) 884-7679

- Company : Stracke, Steuber and Bode

- Job : Restaurant Cook

- Bio : Tempore nostrum nobis est autem. Sed est placeat quidem corporis aut iusto. Non sint nihil non est placeat consequatur est sequi. Exercitationem ut qui molestiae maxime error voluptas et.

Socials

twitter:

- url : https://twitter.com/roderickprice

- username : roderickprice

- bio : Harum quisquam voluptatum consectetur praesentium magnam. Velit cupiditate quaerat omnis harum quasi. Id sapiente amet nisi inventore ea rerum.

- followers : 5138

- following : 1603

tiktok:

- url : https://tiktok.com/@roderick_real

- username : roderick_real

- bio : Ut adipisci recusandae consequuntur architecto aut quia nostrum omnis.

- followers : 4226

- following : 1403

linkedin:

- url : https://linkedin.com/in/price2024

- username : price2024

- bio : Omnis nisi ipsum natus aperiam atque fugit quis.

- followers : 1553

- following : 2692

facebook:

- url : https://facebook.com/price1998

- username : price1998

- bio : Eveniet est aut ducimus et repudiandae quibusdam.

- followers : 2353

- following : 1248