California Franchise Tax Board: Your Guide & Resources

Are you grappling with the complexities of state taxes, particularly those levied by the California Franchise Tax Board (FTB)? Navigating the landscape of tax obligations can be daunting, but understanding the process and available resources is the first step toward compliance and peace of mind.

The California Franchise Tax Board (FTB) stands as a pivotal agency within the California government, tasked with the vital responsibility of administering and collecting state personal income tax, as well as corporate franchise and income taxes. Its operations are overseen by the California Government Operations Agency. The FTB's reach extends to a wide array of taxpayers, including individuals, businesses, and tax professionals. They offer services designed to assist these groups in meeting their tax obligations. These services range from providing detailed guidance on how to file returns and make payments, to offering mechanisms for checking refund statuses and accessing free tax help resources. The FTB maintains a comprehensive website, which serves as a central hub for these various functions.

The digital accessibility of the FTB's website is a critical consideration. As of July 1, 2023, the FTB's website has been certified to be accessible. This signifies that the site is designed, developed, and maintained in a way that ensures usability for individuals with disabilities, in compliance with California Government Code sections 7405 and 11135, and also includes accessible technology program guidelines.

- Mastering The Art Essential Tips For Tattoo Success

- The Real Deal On Eyebrow Tinting Cost What You Need To Know

To gain a better understanding of the California Franchise Tax Board's role and the services it provides, consider the following table:

| Aspect | Details |

|---|---|

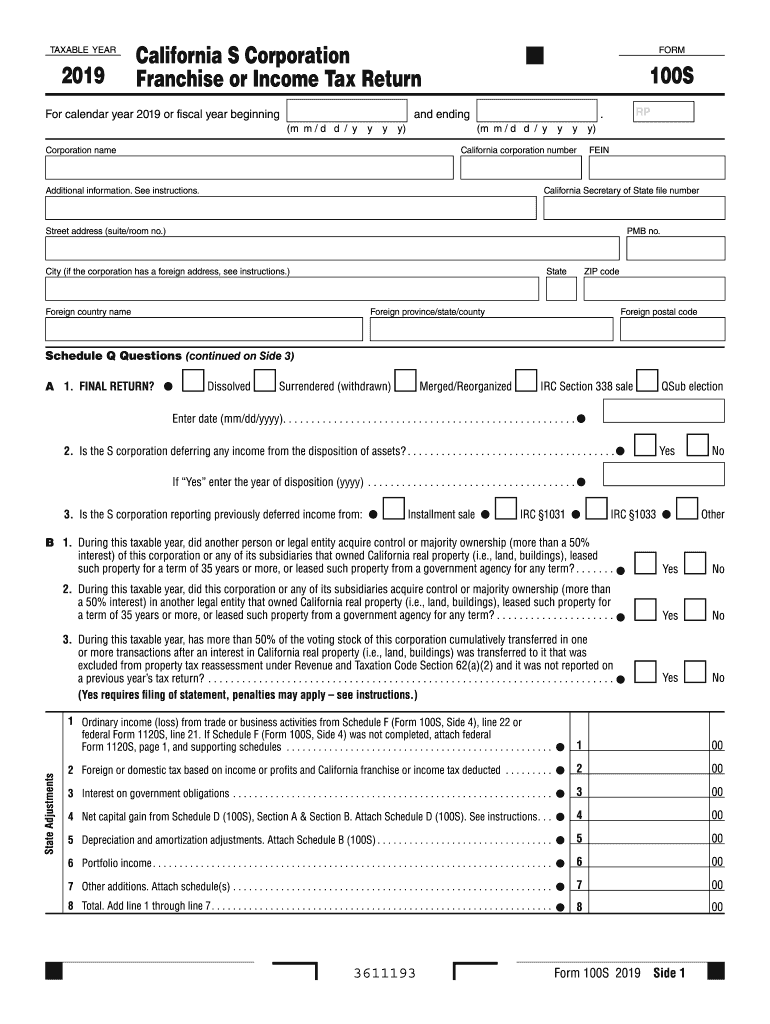

| Primary Function | Administering and collecting state personal income tax and corporate franchise and income tax within California. |

| Governing Body | Part of the California Government Operations Agency. |

| Taxpayers Served | Individuals, businesses, and tax professionals. |

| Key Services | Filing returns, making payments, checking refunds, providing free tax help, accessing account information. |

| Online Portal | MyFTB: An online portal for managing tax account information and accessing services. |

| Website Accessibility | Certified accessible as of July 1, 2023, adhering to accessibility standards and guidelines. |

| Contact Information | To find the latest contact information and access additional resources, visit the official website of the California Franchise Tax Board. |

When it comes to interacting with the FTB, taxpayers have multiple avenues. For those seeking to pay their state taxes, the FTB provides options such as paying online through the Web Pay service, using your social security number and last name, or utilizing payment methods like checking or savings accounts and credit cards. Remember that records must match those in the FTB database to use Web Pay. It is essential to ensure the accuracy of any information provided during the payment process.

For those who prefer to pay via mail, it's critical to follow the FTB's specific instructions. When paying with a check or money order, it should be made payable to the "Franchise Tax Board." Crucially, avoid sending cash. Include your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) along with "2023 FTB 3582" on the check or money order. This helps ensure that your payment is correctly applied to your tax account.

- Pin Up Hair Styles Timeless Elegance And Modern Flair

- Is Ascendant The Same As Rising Discover Their Astrological Significance

Taxpayers dealing with state income tax obligations often encounter various specific scenarios. For instance, individuals who are legal residents of Texas but stationed in California on military orders may find themselves subject to California's tax regulations. Providing appropriate documentation, such as proof of residency and military orders, is crucial in such cases. There are instances where individuals have received notices of state income tax due, even when believing they are not liable or have provided correct documentation. These situations underscore the need to maintain accurate records and promptly address any inquiries from the FTB.

The FTB also addresses the potential for fraudulent tax return filings. The agency implements measures to identify and notify potential victims of identity theft through a letter, FTB 3904, request to confirm tax return filing. This letter puts the recipient on early notice and asks them to confirm whether or not they have filed a tax return. The FTB only sends this notice if the tax return appears suspicious. If you receive this notice and did not file the tax return, it is vital to contact the FTB at 916.845.7088 within 15 days from the notice date. If, however, you did file the tax return, you must complete the request to confirm tax return filing and fax it to 916.843.6124.

The agency's website, MyFTB, is a valuable resource for taxpayers. It allows individuals, businesses, and tax professionals to access their account information and various services. Users can log in or create an account to check their refunds, view payment history, review notices, and more. The website also offers information on making payments for California taxes, including details on online options, payment plans, and information on any associated interest or penalties.

Taxpayers who find themselves in situations where they are expecting a refund should be aware of the correct mailing address for their tax returns. The FTB provides the correct address based on the specific scenario of their return. The instructions for California taxes, particularly page 12, provide further information. When dealing with tax returns, especially if no amount is due, taxpayers should mail their tax return to the provided address. Similarly, if state taxes are owed, the return must be mailed to the designated address, to ensure proper processing.

Businesses operating within California, particularly LLCs, should understand the state's franchise tax regulations. If an LLC conducts business in California, it may be required to register and pay franchise taxes. It is essential to determine the applicability of the tax to your business.

It's also important to understand the broader scope of tax filing procedures, particularly for final franchise tax reports when terminating, converting, merging, or withdrawing registration with the Texas Secretary of State. A Texas entity undergoing these changes must file its final tax report and settle any outstanding amounts in the year it plans to complete the process. While the context may differ between California and Texas, understanding the procedural necessities is essential for businesses. The emphasis is on complying with tax regulations and ensuring all filings are accurate and timely.

When a discrepancy arises, such as a deposit received from the FTB that does not match the tax return, taxpayers need to understand how refunds are distributed. In such situations, contacting the FTB for clarification or checking the status of the refund is essential to understand whether the refund is being issued in installments or if there's an error. It is vital to reconcile the amounts received with what was initially claimed on the tax return.

In any interaction with the FTB, maintaining records and documentation is critical. For example, if you receive a letter from the State of California Filing Compliance Bureau, it is essential to respond promptly, and to provide any requested information. If there are any concerns about the authenticity of the request, it's advisable to independently verify the contact information through the FTB's official channels.

In summary, the California Franchise Tax Board is a crucial component of the state's financial infrastructure, playing a key role in collecting revenue and offering essential services to taxpayers. From providing accessible websites to implementing anti-fraud measures, the FTB continues to adjust to ensure that the process of paying taxes and interacting with the state is as straightforward and transparent as possible. The FTB website and other official channels remain the best sources for the latest guidance.

Article Recommendations

- Erykah Badus Tattoos Art Meaning And Influence

- Artistic Nail Designs With White Tips The Ultimate Guide

Detail Author:

- Name : Prof. Trent Parisian III

- Username : ojenkins

- Email : ohara.bryce@corwin.org

- Birthdate : 2007-02-04

- Address : 670 VonRueden Heights Suite 047 Zemlakshire, HI 80166

- Phone : 423.510.0381

- Company : Kirlin, Schinner and Funk

- Job : Legal Secretary

- Bio : Aliquid et perferendis optio. Voluptatem vitae officiis et ut voluptas. Dolorem atque quasi in rerum dignissimos non saepe.

Socials

facebook:

- url : https://facebook.com/waltere

- username : waltere

- bio : Qui consectetur placeat qui temporibus.

- followers : 2039

- following : 316

twitter:

- url : https://twitter.com/ericwalter

- username : ericwalter

- bio : Esse in voluptatem sunt reprehenderit. Et at officiis quasi. Aut fugit et ullam impedit.

- followers : 116

- following : 484

tiktok:

- url : https://tiktok.com/@eric3346

- username : eric3346

- bio : Et deleniti et et consectetur. Et animi velit impedit reprehenderit.

- followers : 2491

- following : 2236