FTB: Find Info, File Taxes, & More - Quick Guide

Are you navigating the often-complex world of California taxes, perhaps searching for specific information, forms, or services? You're not alone, and the Franchise Tax Board (FTB) is here to help you navigate these waters. The FTB website, a vital component of California's government, provides a wealth of resources for individuals, businesses, and tax professionals alike. Whether you're seeking to file a return, make a payment, check a refund, or simply understand your tax obligations, the FTB's online portal, MyFTB, is your central hub for access to information and services. The information provided on this website is for general guidance only.

If you find yourself staring at a search result page that says, "We did not find results for:", don't despair. The FTB website is designed to be user-friendly, but sometimes a slight misstep in spelling or a query that's too broad can lead to this message. Instead, try rephrasing your search, checking your spelling, or using more specific keywords. Also, consider exploring the "popular topics" and "online services" links to find what you are looking for.

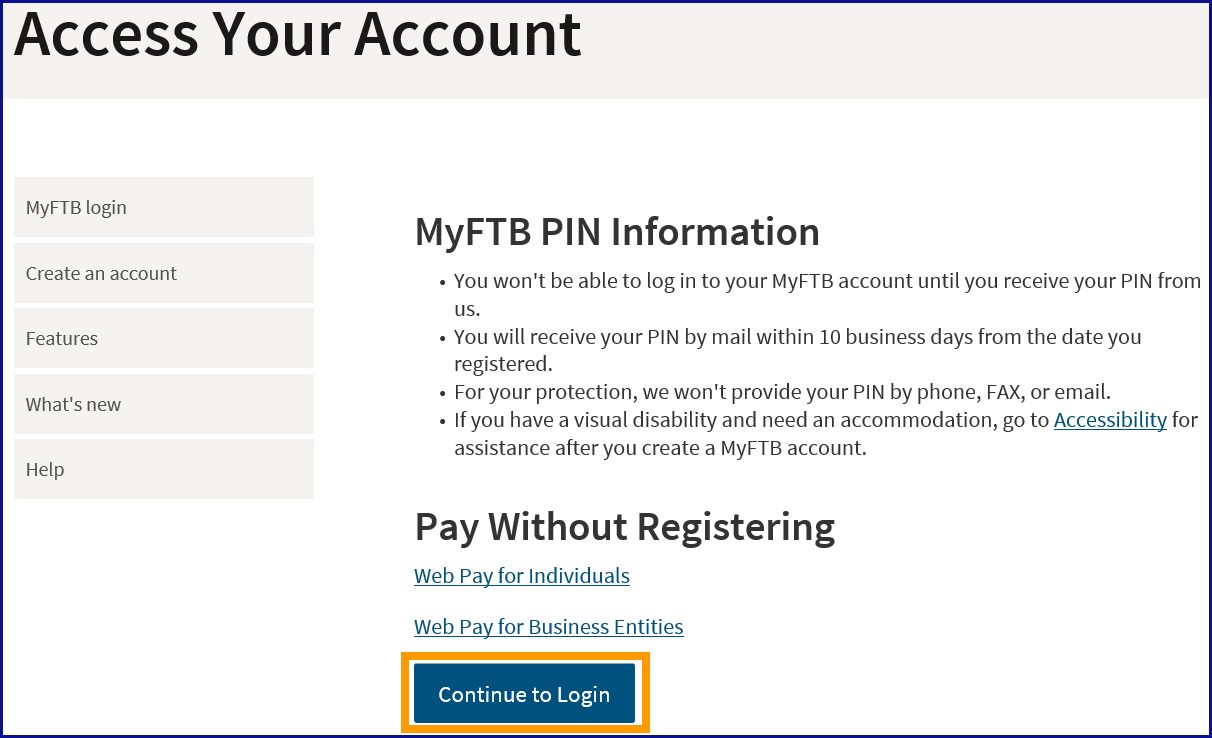

For instance, if you're seeking to file a return, make a payment, or check your refund, you can find these services readily available. MyFTB, the online portal, allows you to easily access your tax account information and services. This convenient portal gives individuals, business representatives, and tax professionals access to tax account information and services. When logging in to your MyFTB account, you can check your refunds, payment history, notices, and much more.

- Ultimate Guide Effortless Styles For Short Hair For Thin Hair

- Perfecting Your Skincare Routine The Ultimate Guide To Moisturizer Primer And Sunscreen Order

The California Franchise Tax Board (FTB) is part of the California government operations agency, responsible for administering and collecting state personal income tax and corporate franchise and income tax of California. For those who prefer, the FTB website offers a Google translation feature. While this tool is provided for general information, it's essential to consult with a professional translator for official business to ensure accuracy.

As of July 1, 2023, the FTB website is designed, developed, and maintained to be accessible, complying with California Government Code sections 7405 and 11135. This commitment ensures that all Californians, regardless of ability, can access and utilize the resources available on the site. It's worth noting that any changes to entity names made through the Secretary of State might take up to 30 days to be reflected in FTB records. Consequently, requests for entity status letters during this period may temporarily display the old entity name.

To access certain services, like checking your refund status or payment history, you will typically be prompted to log in to your MyFTB account. If you are unable to find what you need by using the search function, make sure to review the "Popular Topics" or "Online Services" section. The site also provides an online tool to estimate your California income tax for 2024. By entering your filing status, taxable income, and other required fields, you can obtain an estimated tax amount and see if you are due a refund or need to make a payment.

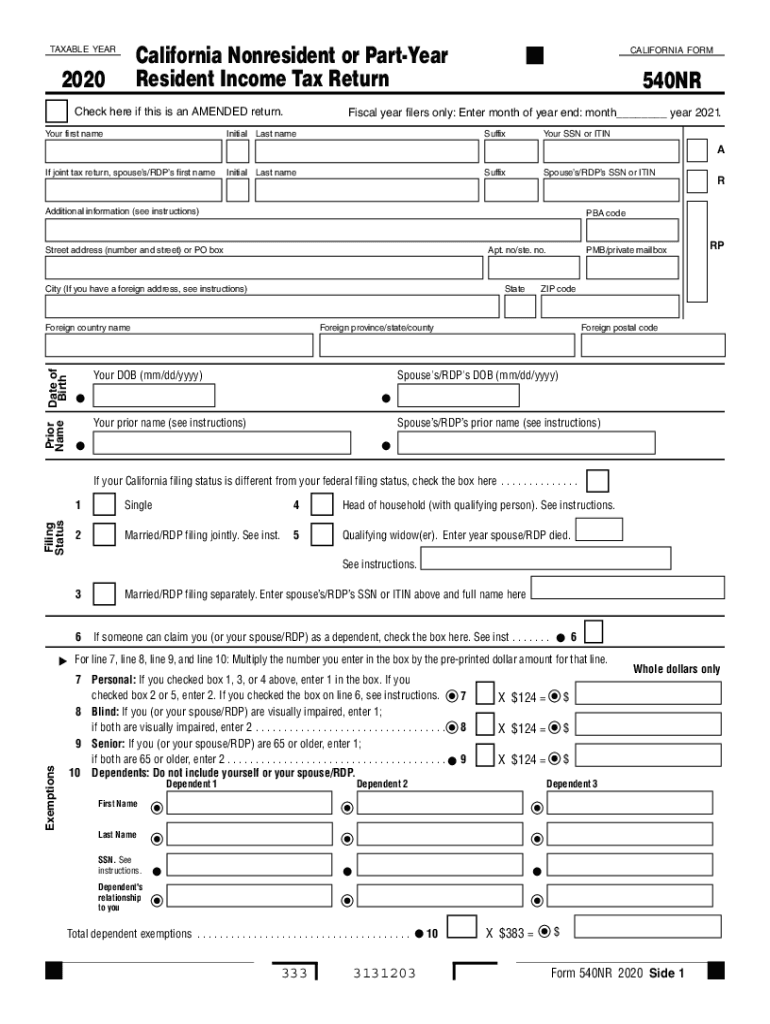

If you are looking for specific forms, the FTB website offers 2024 instructions for form 568, the Limited Liability Company Return of Income. The resources available cite the Internal Revenue Code (IRC) as of January 1, 2015, and the California Revenue and Taxation Code (R&TC). Be aware that when clicking links that take you away from ftb.ca.gov, you're entering a website that the FTB neither owns nor controls, and it is not responsible for the privacy practices or content on these external sites.

To search for an entity, you can enter either an entity ID or entity name. Eligible entities for the Entity Status Letter include corporations and limited liability companies.

The FTB collaborates with partner agencies, including the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service, to provide integrated services and resources to California taxpayers. The FTB is dedicated to ensuring its website accessibility as of July 1, 2023. This certification indicates compliance with the necessary California government codes.

The California Franchise Tax Board (FTB) website is an essential resource for all things California taxation. Remember to check your spelling or to try a new query if your initial search doesn't produce the desired results.

Article Recommendations

- Are Ascendent And Rising Signs Identical Astrology Insights

- Essential Tips For Tattoo Artists Mastering The Craft

Detail Author:

- Name : Magnolia Will

- Username : mitchell.lonie

- Email : hyman91@gmail.com

- Birthdate : 1984-04-22

- Address : 8479 Hermiston Meadows Apt. 805 Jameychester, ND 98646

- Phone : +16026004049

- Company : Spinka Ltd

- Job : Brattice Builder

- Bio : Aut sit magnam ut repellendus. Et perferendis occaecati rerum ullam atque et. Id vel sint ducimus voluptatem nihil laboriosam. Molestiae distinctio quis nemo.

Socials

instagram:

- url : https://instagram.com/daisha.kirlin

- username : daisha.kirlin

- bio : Sunt et sit laudantium unde alias odit assumenda. Modi et sed enim. Eos est modi incidunt.

- followers : 5691

- following : 263

tiktok:

- url : https://tiktok.com/@kirlind

- username : kirlind

- bio : Quia modi et voluptate rerum autem fugiat. Sed dicta id quae quia sit.

- followers : 5566

- following : 605

twitter:

- url : https://twitter.com/daisha7134

- username : daisha7134

- bio : Aliquid minima laboriosam ipsa placeat ab. Quaerat magnam aut at voluptate non vel veniam. Corporis quidem facere qui.

- followers : 2376

- following : 2013