Boeing (BA) Stock: Latest News & Analysis - Is Now A Buy?

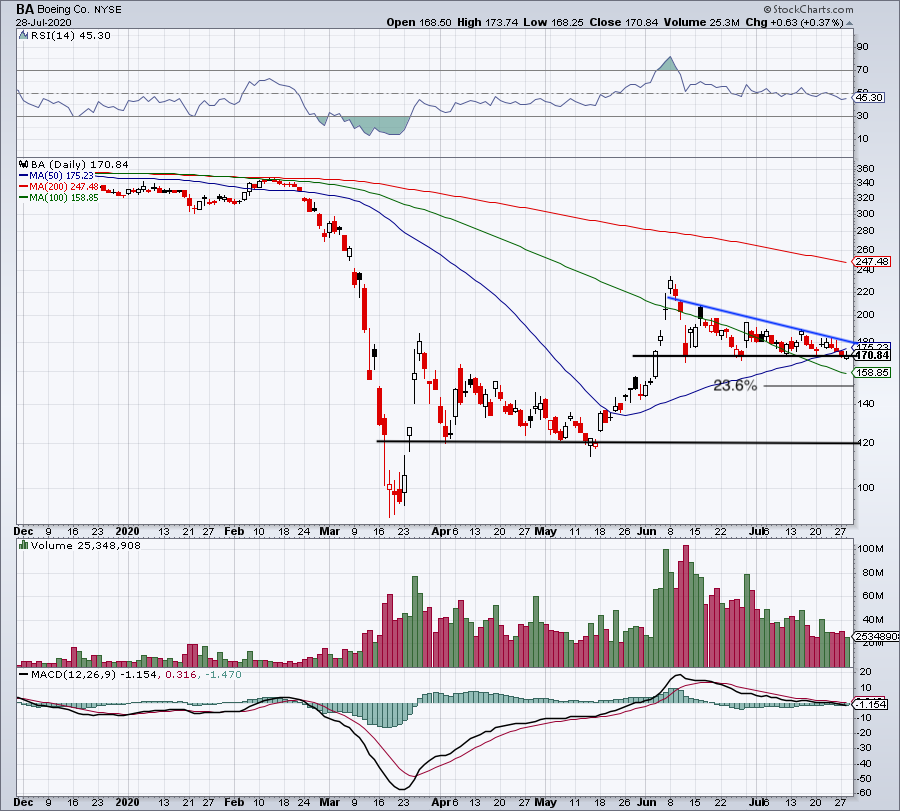

Is Boeing's (BA) Recent Surge a Sign of Recovery or a Fleeting Rally? Despite a tumultuous period, Boeing's stock has seen a 23.5% jump in the last three months, prompting investors to question the sustainability of this upward trend and whether it signals a genuine turnaround.

The aerospace giant, Boeing (NYSE:BA), remains a complex subject of scrutiny for investors. The company, a titan in the aviation industry, has navigated a turbulent period marked by significant challenges, from safety concerns and production setbacks to macroeconomic pressures. The stocks performance, a reflection of these trials and tribulations, has been closely watched and dissected by analysts and investors alike. Recent movements, particularly the observed surge, have triggered a renewed wave of interest, with market participants attempting to decipher the underlying drivers and predict future trajectories.

One of the critical factors influencing Boeing's stock performance has been its operational challenges. The company's reliance on a complex supply chain, coupled with stringent regulatory requirements, has made it particularly vulnerable to external shocks. The fallout from the 737 MAX incidents in 2019, which included the Ethiopian Airlines Flight 302 crash, cast a long shadow over the company, eroding investor confidence and necessitating significant overhauls in safety protocols and operational practices. These events, along with subsequent production delays and supply chain bottlenecks, have translated into net losses for several years. This has kept the stock in a bearish trend for a longer period.

- Intriguing Insights Into Catherine Of Beetle Juice A Comprehensive Guide

- Stylish Mens Thick Curly Hairstyles A Guide To Perfect Locks

Beyond its operational hurdles, Boeing has also been exposed to macroeconomic headwinds. The impact of tariffs and trade disputes has been felt acutely, particularly as the company depends on imported components. On Tuesday, March 4th, concerns over the potential impact of new tariffs drove Boeing's stock down by 7%, demonstrating the sensitivity of the company's financial health to global trade dynamics. This vulnerability necessitates a careful assessment of the broader economic landscape and its potential effects on Boeing's operations.

The financial performance of Boeing is crucial when analyzing the stock movement. The company's ability to generate consistent revenue and profitability has been under pressure. Boeing's revenue streams are diverse, including commercial airplanes, defense systems, and space exploration ventures. The fluctuating demand and increasing competition in these segments further complicate financial predictions. The analyst estimates and financial information provide valuable insights into the company's earnings per share (EPS), revenue forecasts, and potential for future growth, making it important to monitor its financial health.

Boeing's recent performance offers a glimmer of hope. Shares of the aerospace and defense company jumped by 7% during a morning session, boosted by positive updates from CFO Brian West about the company's financial position. This constructive communication with investors is important, as it highlights the company's ability to manage challenges and to outline a clear path forward. The ability of the company to adapt and react to the present and predict the future shows the value of BA stock.

- Mastering White Tips With Gn A Guide To Perfection

- Mastering The Art Essential Tips For Tattoo Success

Furthermore, a closer look at the market sentiment surrounding Boeing reveals a nuanced perspective. Discussions in forums such as Yahoo Finance offer a window into the opinions and perspectives of other traders and investors. The collective insights, along with analyst ratings and stock price targets, assist investors in shaping their own investing strategies. It is also important to consider the stock's valuation, dividends, and related news to create an informed decision, and it's also important to keep track of historical stock prices, financial information, and price forecasts.

The Boeing Company (BA) is currently the focus of intense scrutiny and analysis. Heres a deeper look into its stock performance, the issues it faced, and what might lie ahead:

| Aspect | Details |

|---|---|

| Company Name | The Boeing Company |

| Stock Ticker | BA (NYSE) |

| Industry | Aerospace and Defense |

| Key Products/Services | Commercial Airplanes, Defense, Space, and Security Systems |

| Recent Stock Performance | Volatile, with a recent 23.5% increase over the last three months (despite a challenging 2024) |

| Recent News Highlights |

|

| Key Issues Faced |

|

| Analyst Perspectives |

|

| Market Sentiment |

|

| Historical Data |

|

| Resources for Further Research | Yahoo Finance - BA |

Examining the historical data provides a critical context for evaluating the company's current situation. Tracking the Boeing Company (BA) price, its historical values, financial information, and price forecasts, along with other insights, is very important for empowering your investment journey. Data from platforms like MSN Money and Yahoo Finance provides insights into the historical stock prices, enabling investors to identify trends, patterns, and potential turning points. Understanding past performance is crucial for making informed predictions about future price movements. Furthermore, its important to consider the daily, weekly, and monthly formats to track the stock's history. For the investors, these historical tools assist in making informed decisions about their investments.

The market has witnessed a dramatic shift in recent months. Despite a tough 2024, Boeings stock quietly went up by 23.5% in the last three months, indicating a shift in investor sentiment. However, the question of whether this increase signifies the start of a sustained upward trend or simply a recovery from an oversold situation remains a subject of debate. The stock performance and its price forecasts give an insight into where the company might be headed.

The road ahead for Boeing is complex. With challenges in production, supply chain issues, and macroeconomic risks, including tariffs, the company faces a need for strategic foresight and proactive management. The market's perception of Boeing is continuously changing. Analyst ratings, earnings estimates, and price targets play a crucial role in assessing the stock's value. As Boeing navigates these challenges, its performance and its ability to make changes will be key determinants of its future trajectory in the market.

In the complex arena of investment analysis, a comprehensive strategy is very important for investors looking at Boeing. This includes continuous monitoring of company news, staying aware of the companys financial reports, and a careful analysis of market indicators and expert opinions. Keeping informed about analyst ratings, earnings estimates, and financial data such as dividends are very important. By doing these practices, investors can navigate the market's volatility and make well-informed decisions.

The impact of the 737 MAX crashes had a huge impact on Boeing. The need to upgrade safety protocols, the decline of investor confidence, and the disruptions in production were critical. These instances led to significant losses, affecting the companys performance in the market and the ability to recover. The incidents made the investors more aware of the safety measures and the effect of the airline industry. The incidents influenced the investment decisions of many people in the industry.

Boeing is a significant player in the defense sector. The Defense, Space, and Security division of the company is an important contributor to its financial revenue. The defense contracts, technological advancements, and governmental needs all impact the companys performance and its position in the market. Investors will always be monitoring the development in the defense industry and the strategic moves of the company in this sector.

The recent jump in the company's stock sparked an interest in what the future will look like. Constructive updates from CFO Brian West are seen as a positive step. The company's ability to engage in positive communication with its investors and stakeholders, showing transparency and confidence, is very important in regaining market trust. These updates helped to explain the financial health and the companys plan of action.

The ongoing discussions and analysis in various financial forums provides investors with a window to see the diverse perspectives of the market. The exchanges and opinions of different traders and investors, the shared insights, and the collective wisdom all assist in improving the companys performance. Accessing the data from Yahoo Finance and other sources helps in making well-informed investment decisions. Keeping informed will guide the investor in a dynamic and changing market.

Article Recommendations

- Compatibility Aries And Aries Love Friendship And More

- Fortnite Hime Skin A Complete Guide To Mastering The Aesthetic

Detail Author:

- Name : Lavonne Bogan

- Username : ldamore

- Email : freddie.ward@gmail.com

- Birthdate : 1978-01-06

- Address : 1273 Turcotte Dam New Elwynville, ND 32742-1329

- Phone : 1-610-460-8818

- Company : VonRueden, Franecki and Reinger

- Job : Packer and Packager

- Bio : Deleniti et quae molestiae saepe. Molestiae pariatur et nostrum officiis dolorem cupiditate. Voluptatem necessitatibus autem unde libero sunt quam laboriosam. Laboriosam veritatis et nostrum aut.

Socials

instagram:

- url : https://instagram.com/mschmitt

- username : mschmitt

- bio : Et illum quis consequatur qui alias. Sint eos quae autem sit.

- followers : 3803

- following : 2561

twitter:

- url : https://twitter.com/markschmitt

- username : markschmitt

- bio : Voluptas deserunt repellat est deleniti et fugiat. Dolor impedit ad ullam quo officiis magni. Consequatur ad amet reprehenderit reprehenderit.

- followers : 6712

- following : 2407