Bitcoin Price: Live BTC/USD & Market Updates | [Your Website Name]

Is Bitcoin's current volatility a cause for concern, or an opportunity? The price of Bitcoin, the world's most traded cryptocurrency, is constantly in flux, presenting both risks and rewards for investors. Understanding these movements requires a close examination of the factors influencing its value and a real-time grasp of the market dynamics.

Bitcoin, the pioneering cryptocurrency, has undeniably revolutionized the financial landscape. Its decentralized nature, operating without the control of central banks, has captivated a global audience. However, navigating the Bitcoin market requires more than just a casual interest; it demands an understanding of its technical underpinnings, market trends, and the factors driving its price fluctuations. This article delves into the intricacies of Bitcoin, examining its price history, technical analysis, and the broader context of its influence on the financial world.

The core function of Bitcoin is to serve as a digital, decentralized currency. This means transactions are recorded on a public, distributed ledger known as the blockchain. This transparent system, maintained by a network of computers, ensures the integrity and security of transactions. The process of "mining," where powerful computers solve complex mathematical problems to validate transactions, underpins the creation of new Bitcoin and secures the network.

- August 30 Horoscope Sign Zodiac Insights For Virgo

- What Is The Animal For Sagittarius Meaning And Significance

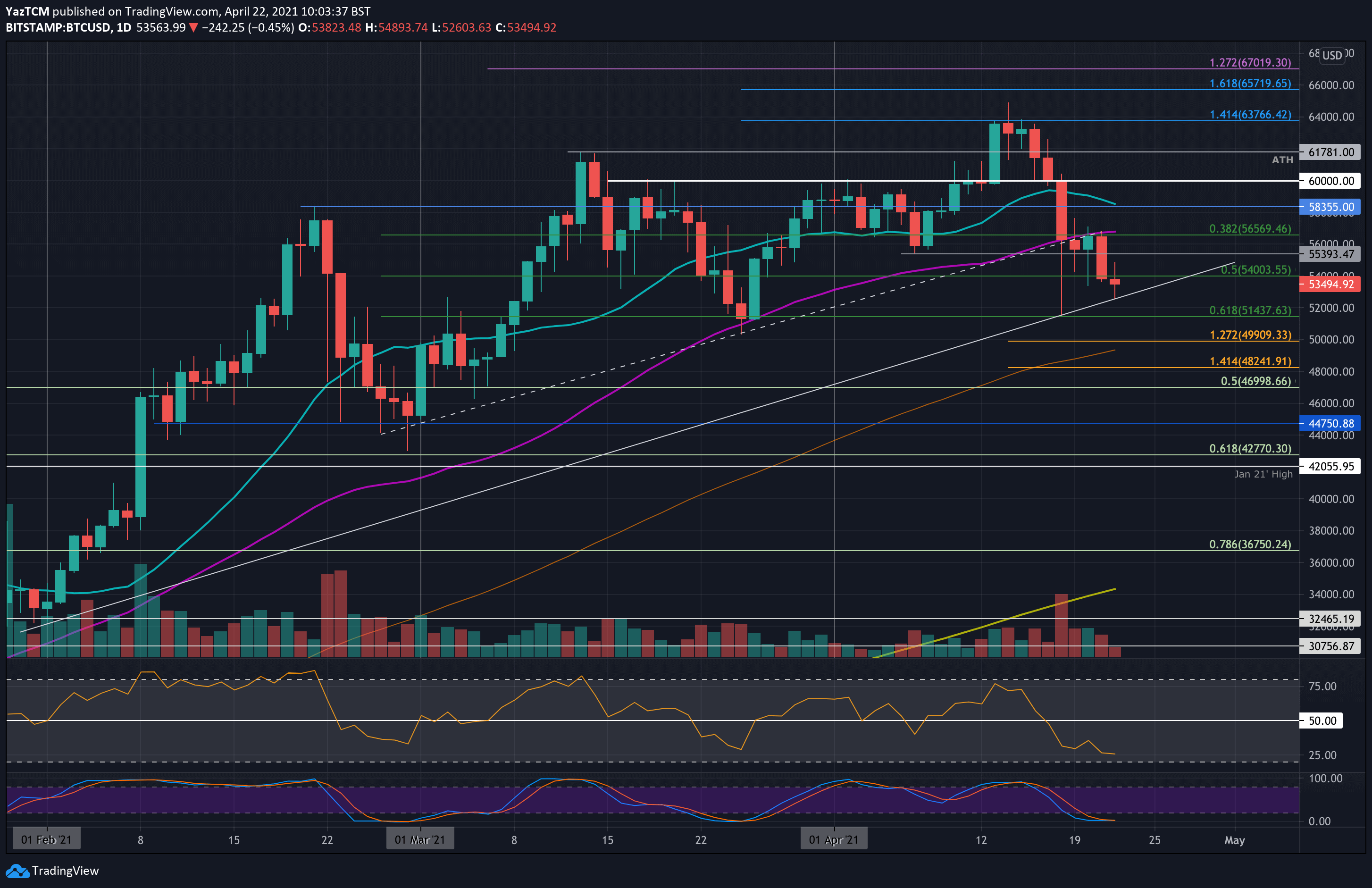

Real-time monitoring of Bitcoin's price against the US dollar (BTC/USD) is essential for informed decision-making. Various platforms offer live Bitcoin to USD charts, allowing users to track price movements and identify trends. These charts typically display the current price, trading volume, and historical price data. This real-time data is crucial for investors and traders aiming to capitalize on market fluctuations.

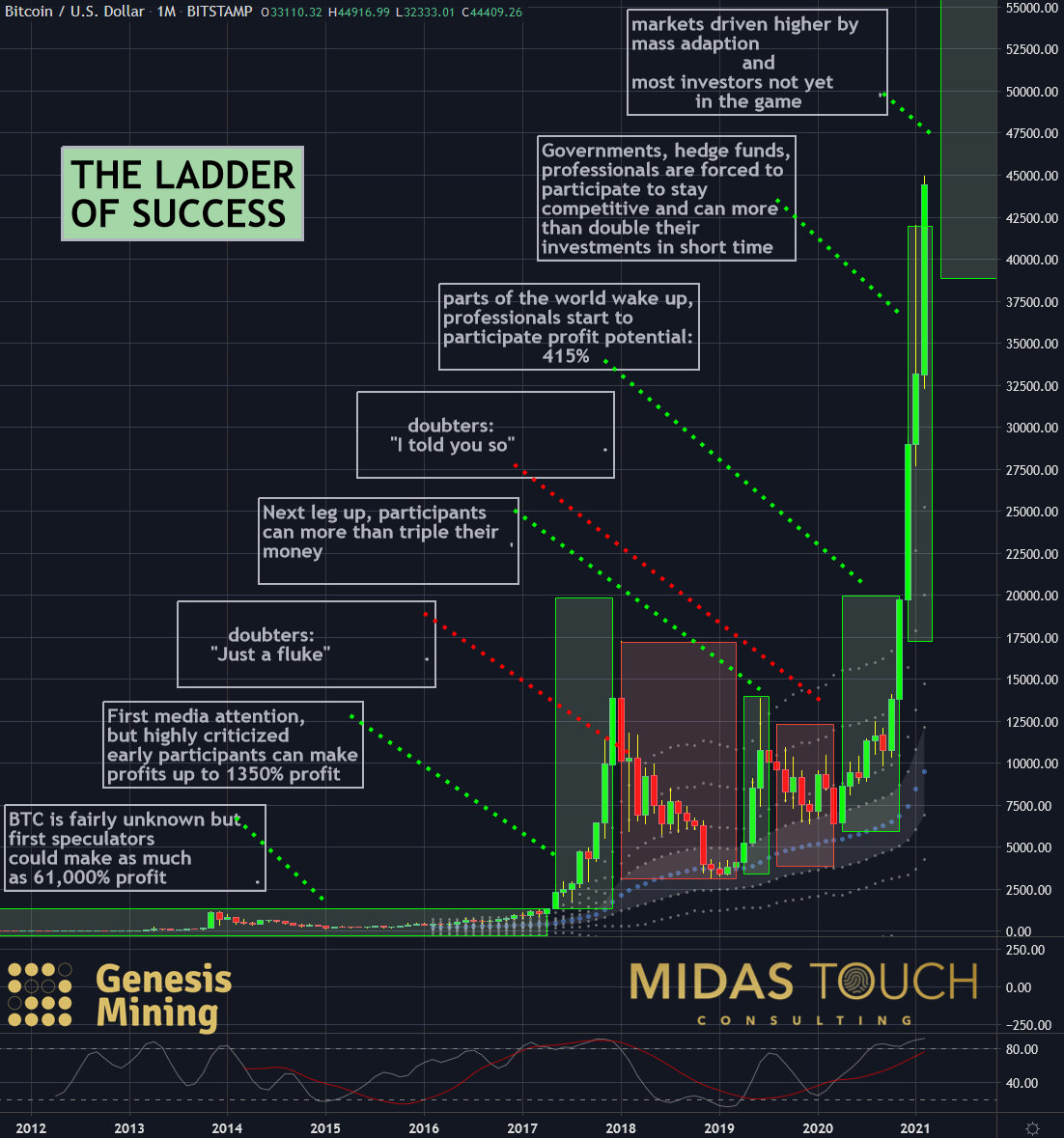

Technical analysis plays a vital role in Bitcoin trading. It involves studying price charts, identifying patterns, and using technical indicators to predict future price movements. Analyzing the Bitcoin price chart over different timeframes, such as hourly, daily, or weekly, helps traders identify potential entry and exit points. Traders use tools like moving averages, relative strength index (RSI), and Fibonacci retracements to assess market sentiment and potential price targets.

Bitcoin's price is influenced by various factors, including market sentiment, adoption rates, regulatory developments, and competition from other cryptocurrencies. Positive news, such as increased institutional adoption or favorable regulatory rulings, often leads to price increases. Conversely, negative news, such as security breaches or unfavorable regulations, can cause price drops. Understanding these factors is crucial for interpreting market trends and making informed investment decisions.

- Astrology Signs Taurus Aries Compatibility And Characteristics

- Ladys Choice Deodorant The Ultimate Guide To Freshness And Confidence

The Bitcoin market is characterized by volatility, meaning that prices can change rapidly and unexpectedly. This volatility stems from various factors, including speculative trading, market sentiment, and the relatively new nature of the asset class. While volatility presents risks, it also creates opportunities for traders who can anticipate price movements. Effective risk management strategies, such as setting stop-loss orders and diversifying portfolios, are crucial for mitigating the risks associated with Bitcoin trading.

Bitcoin's global accessibility is a significant advantage. It can be bought and sold across numerous cryptocurrency exchanges worldwide. The choice of an exchange is critical, and factors like trading volume, security measures, and user trust scores should be considered when selecting a platform. Active exchanges, such as Bitget and OKX, offer high liquidity and a wide range of trading pairs.

Converting Bitcoin to US dollars (BTC to USD) is a fundamental aspect of the cryptocurrency ecosystem. The exchange rate between Bitcoin and the USD fluctuates constantly, reflecting market dynamics. Several online converters provide real-time exchange rates, allowing users to determine the USD value of their Bitcoin holdings. This conversion process is essential for realizing profits, paying for goods and services, and managing financial assets.

Centralized exchanges (CEXs) provide a convenient option for buying and selling Bitcoin using USD. These exchanges act as intermediaries, connecting buyers and sellers and facilitating transactions. When choosing a CEX, factors such as fee structures, security protocols, and the availability of various assets should be carefully evaluated.

Bitcoin is the most traded cryptocurrency globally, commanding a substantial share of the cryptocurrency market. Its pioneering status and first-mover advantage have cemented its position as the most recognized and widely adopted cryptocurrency. The other cryptocurrencies have followed in Bitcoins footsteps.

The current market capitalization of Bitcoin is substantial, reflecting its dominance in the digital asset space. This market capitalization represents the total value of all Bitcoin in circulation. The actual, current value of one Bitcoin is subject to constant adjustment, changing with the market's minute-by-minute activities.

The value of Bitcoin, like any cryptocurrency, is shaped by several components, like market sentiment, its practical applications, the rate of its acceptance, changes in regulations, and rivalry from other digital currencies. The value of a single Bitcoin in US dollars can be determined today. The charts and tables illustrate the movement of the exchange rate across a week, a month, or a year.

In the financial landscape, the Bitcoin to USD conversion is vital. This process is not only about calculating the current value but also about understanding the dynamics of the market. The conversion provides the immediate valuation, enabling investors to make decisions.

Bitcoin's market has a global reach, where it can be traded on 591 cryptocurrency exchanges. The accessibility enables a variety of trading and investment strategies. The most active exchanges, based on trading volume and trust, include Bitget and OKX.

Bitcoins performance in the last 24 hours has seen a fall. It is crucial to follow the price chart to see the dynamics of the change.

The rapid fluctuations in cryptocurrency prices, including Bitcoin, are a reality of the market. These sudden swings are caused by factors like market sentiment and external developments. This volatility requires a careful approach, necessitating strong risk management and understanding of market trends.

Understanding the Bitcoin to USD conversion is key for Bitcoin users. There are several resources available online that enable converting BTC to USD and assessing the value of Bitcoin in USD. These converters use real-time data to give users accurate assessments of their holdings.

Technical analysis tools offer traders a way to understand the Bitcoin market. These instruments allow individuals to analyze price charts, track data, and discover patterns to predict the future price movements. The analysis allows making informed choices on entry and exit points.

In conclusion, Bitcoin remains a dynamic and intriguing asset within the financial landscape. Its journey, from its origins to its current status, has been marked by volatility, innovation, and debate. Continuous monitoring of market movements, technical analysis, and an awareness of outside influencers are all crucial to navigating the Bitcoin market. For those who study the market carefully, Bitcoin provides chances for growth.

Stay informed about Bitcoin's live price, trading volume, chart history, and more.

| Feature | Details |

|---|---|

| Live Price | The real-time price of Bitcoin in USD, constantly updated. |

| Trading Volume | The total amount of Bitcoin traded within a 24-hour period, indicating market activity. |

| Historical Charts | Visual representations of Bitcoin's price movements over time, allowing for trend analysis. |

| Technical Analysis | Tools and indicators used to predict future price movements, such as moving averages and RSI. |

| Market Capitalization | The total value of all Bitcoin in circulation, reflecting the overall market size. |

| Exchanges | Platforms where Bitcoin can be bought, sold, and traded. |

| Volatility | The degree of price fluctuation, which can be significant in the Bitcoin market. |

| Bitcoin Technical Analysis | A process of analyzing the charts and understanding Bitcoin price movements. |

| Bitcoin Predictions | Forecasts of future Bitcoin prices based on market data and analysis. |

| Bitcoin/Dollar Chart | A visual display of Bitcoin's price relative to the US dollar. |

| BTC/USD Prices | The price of Bitcoin in relation to the US dollar. |

| BTC Price History | A record of Bitcoin's past prices over a period of time. |

| CEX | Centralized exchanges, a convenient way to buy and sell bitcoin. |

| Market Sentiment | General feeling or attitude of investors or participants in the market. |

For Further Reading:

Bitcoin.org

Article Recommendations

- Guide To Using Snail Mucin Before Or After Moisturizer

- 920 Angel Number A Guide To Understanding Its Meaning And Significance

Detail Author:

- Name : Ms. Kristy Padberg

- Username : von.kylee

- Email : lwalter@gmail.com

- Birthdate : 2006-07-27

- Address : 30590 Laura Rapid Suite 605 Luciusmouth, IN 40925

- Phone : 234.301.8820

- Company : Purdy-Jones

- Job : Tile Setter OR Marble Setter

- Bio : Et rerum maxime aut sunt. Voluptates eos est quod et. Expedita ut eius adipisci enim. Vitae eum voluptate eaque laboriosam ea.

Socials

twitter:

- url : https://twitter.com/prestondavis

- username : prestondavis

- bio : Iste voluptate asperiores minima. Ipsa aliquid voluptatem dolorem totam. Est vel excepturi aut sunt accusantium reprehenderit numquam.

- followers : 2379

- following : 2065

instagram:

- url : https://instagram.com/prestondavis

- username : prestondavis

- bio : Qui neque rerum placeat et. Dolore enim dicta corrupti et rerum optio.

- followers : 2430

- following : 1126

facebook:

- url : https://facebook.com/davisp

- username : davisp

- bio : Quasi iure dolor voluptates. Voluptates sit aliquam quam.

- followers : 2261

- following : 2417

tiktok:

- url : https://tiktok.com/@davisp

- username : davisp

- bio : Totam doloribus voluptatum asperiores ut. Aut ea omnis beatae.

- followers : 6534

- following : 175