Georgia Taxes 2024/2025: Rates, Brackets & Filing Guide

Are you prepared for the complexities of filing your Georgia state income tax return? Understanding the intricacies of Georgia's tax system, from its progressive structure to the latest updates, is crucial for every taxpayer in the Peach State.

Navigating the world of state taxes can feel like traversing a maze. With the constant evolution of tax laws and regulations, staying informed is not just a recommendation; it's a necessity. This article serves as your guide to the essential information you need to successfully file your Georgia individual income tax return, avoid potential pitfalls, and understand the specific nuances that apply to your financial situation. We'll explore everything from filing deadlines and eligibility requirements to the specific tax rates and changes you need to be aware of in 2024 and beyond.

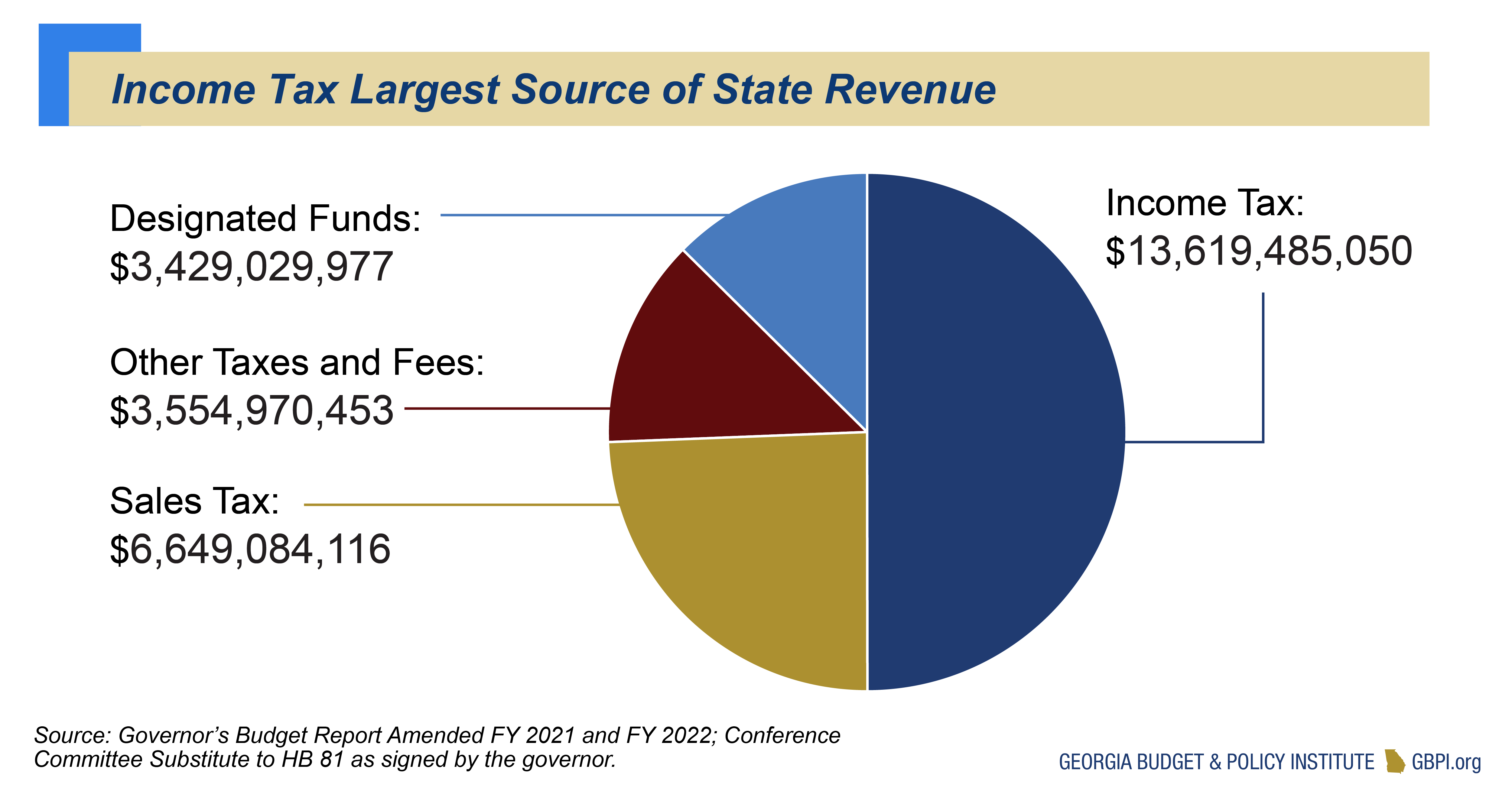

Let's begin with a comprehensive overview of the Georgia income tax system, which, like many states, operates under a progressive structure. This means that the tax rate increases as your income rises. As of 2024, Georgia's income tax rates span from 1% for those earning up to $750 to a top rate of 5.75% for incomes exceeding $7,000. This system aims to distribute the tax burden equitably, ensuring that those with higher incomes contribute a larger percentage. It's important to note that the maximum marginal income tax is set at 5.750% as of 2025. Detailed information regarding state income tax rates and brackets can be found on dedicated resources, which we'll explore further.

- Pin Up Hair Styles Timeless Elegance And Modern Flair

- May 24th Zodiac Insights Into Gemini Traits And Characteristics

| Category | Details |

|---|---|

| Tax System | Progressive |

| 2024 Tax Rates | 1% (up to $750) to 5.75% (over $7,000) |

| 2025 Maximum Marginal Tax Rate | 5.750% |

| Tax Brackets | Six |

| Standard Deduction (Married Filing Jointly) | $24,000 (effective January 1, 2024) |

| Alcoholic Beverage Tax | High |

| Distilled Spirits Tax | $3.79 per gallon |

| Beer Tax | $0.48 per gallon |

| Gasoline Tax | 33.05 cents per gallon |

| Combined State and Local Tax Rate | 7.42% (19th highest in the country) |

| Sales Tax Rate Charts | Georgia Department of Revenue |

As you prepare your Georgia income tax return, it's imperative to consider the filing requirements. You are generally required to file a state tax return if you are a resident of Georgia or if you have earned income within the state. This encompasses a broad range of individuals, including those who live and work in Georgia, as well as non-residents who have income sourced from within the state. Furthermore, the determination of whether you need to file often hinges on whether you are also required to file a federal income tax return.

When it comes to filing deadlines, keep in mind that Georgia state tax returns usually align with the federal tax deadline, which is typically April 15th of the following year. However, if you find that you need more time to gather your documents or complete your return, extensions are available. You can request an extension to file your Georgia return until October 15th. It's important to note that an extension grants you additional time to file, but it doesn't extend the deadline for paying any taxes owed. Any estimated tax payments should still be made by the original due date to avoid potential penalties and interest.

The Georgia Department of Revenue provides various resources to assist taxpayers. Often, they offer detailed guidance on tax forms, filing instructions, and frequently asked questions (FAQs). These resources are invaluable, especially if you have questions about specific deductions, credits, or changes in tax law. Moreover, the Department's website may provide links to selected income tax return forms. If you're looking to compare state tax rates, you can also visit external resources that compile this information for easy comparison.

- Stylish Icons Male Celebrities With Fringes

- Ultimate Guide To Yellow Curly Hair Products Enhance Your Natural Curls

Navigating the digital landscape of tax preparation can be both convenient and potentially risky. Remember that local, state, and federal government websites often have a ".gov" domain, ensuring you are on an official and secure site. Georgia state government websites and email systems will use either "georgia.gov" or "ga.gov" at the end of the address. To protect your sensitive personal and financial information, it is crucial to verify that you are on a legitimate government website before entering any data.

The Georgia state tax calculator is regularly updated to reflect the latest changes in both federal and state tax laws. This calculator incorporates the most current federal tax rates, as published by the IRS, and state tax rates. It will also be updated as new state tax tables are published to cover the 2026/2027 tax year. This ensures that taxpayers have access to the most accurate tools for estimating their tax liability.

Taxpayers who meet specific criteria can prepare and file both their federal and Georgia individual income tax returns electronically. This can often be done using approved software that is available either at a reduced cost or free of charge. While these programs offer a convenient and often cost-effective way to file, be aware that using sites which promote a free federal return may not guarantee your ability to also file your Georgia return for free. Always verify that any software you choose supports the filing of both federal and state taxes, and that it is approved by the Georgia Department of Revenue.

There have been significant developments in Georgia tax laws that are effective from January 1, 2024. Notably, the standard deductions for taxpayers filing jointly have increased to $24,000. This adjustment offers a welcome tax break for many families in the state. Also, it's important to note that a decrease in the state income tax rate, from 5.39% to 5.19%, was retroactively applied from January 1. This reduction will provide some relief to Georgia taxpayers.

While exploring Georgia tax information, remember to complete your federal return before starting your state return, as your Georgia individual income tax is based on your federal adjusted gross income, adjustments required by Georgia law, and your filing requirements. You will need to consider your federal adjusted gross income (your income before taxes), adjustments made in accordance with Georgia law, and your individual filing requirements. This structured approach is vital for accurate tax filing.

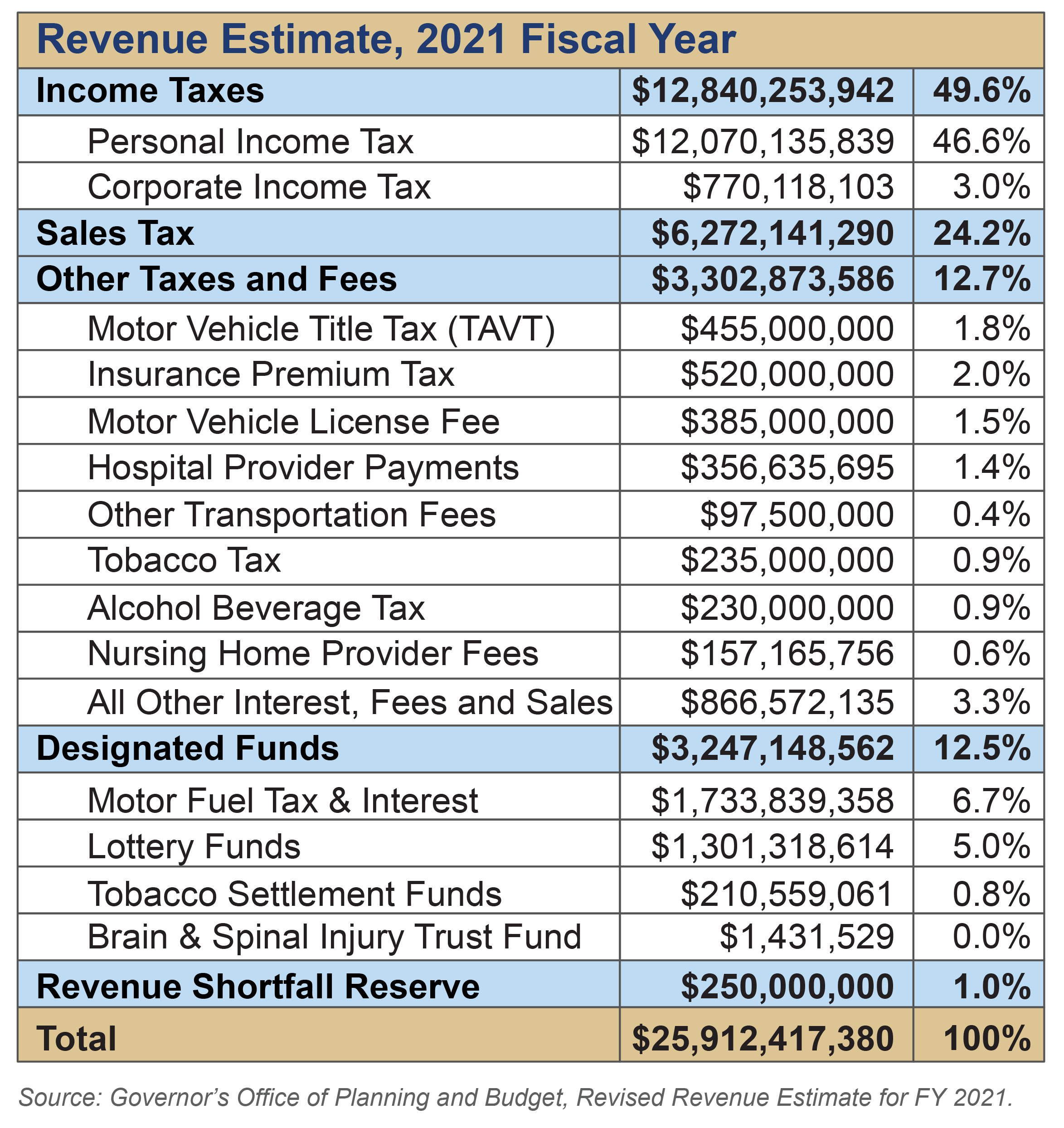

Georgia levies taxes on specific items. For instance, Georgia has among the highest taxes on alcoholic beverages in the country. A tax of $3.79 per gallon is charged on distilled spirits and a tax of $0.48 per gallon of beer is charged. Moreover, Georgia charges a tax of 33.05 cents per gallon of gasoline. It's important to factor in these excise taxes in addition to income tax if you are running a business that sells these items.

Article Recommendations

- Elegant Wedding Updos For Black Hair Timeless Styles For Your Special Day

- Expert Guide Efficiently Removing Shower Knobs With Ease

Detail Author:

- Name : Ardith Ziemann

- Username : pfannerstill.cullen

- Email : qpollich@hotmail.com

- Birthdate : 1976-09-10

- Address : 556 Renner Ridge Apt. 001 Tomaschester, MI 68369

- Phone : +1-307-627-7094

- Company : Mayer LLC

- Job : Command Control Center Specialist

- Bio : Consequuntur eius maxime voluptas. Accusantium culpa nostrum sunt. Tempora ea non quibusdam aspernatur.

Socials

linkedin:

- url : https://linkedin.com/in/brock_harber

- username : brock_harber

- bio : Debitis quos voluptas beatae corporis.

- followers : 3960

- following : 2656

facebook:

- url : https://facebook.com/harberb

- username : harberb

- bio : Eaque inventore consequatur ea voluptates quia voluptatem consequatur.

- followers : 6885

- following : 94