SERS Retirement Info: Access & Plan Your Future Today!

Are you ready to navigate the complex world of retirement planning and secure your financial future? Understanding your retirement benefits, especially through systems like the Pennsylvania State Employees' Retirement System (SERS) and the School Employees Retirement System of Ohio, is crucial for a comfortable and worry-free retirement.

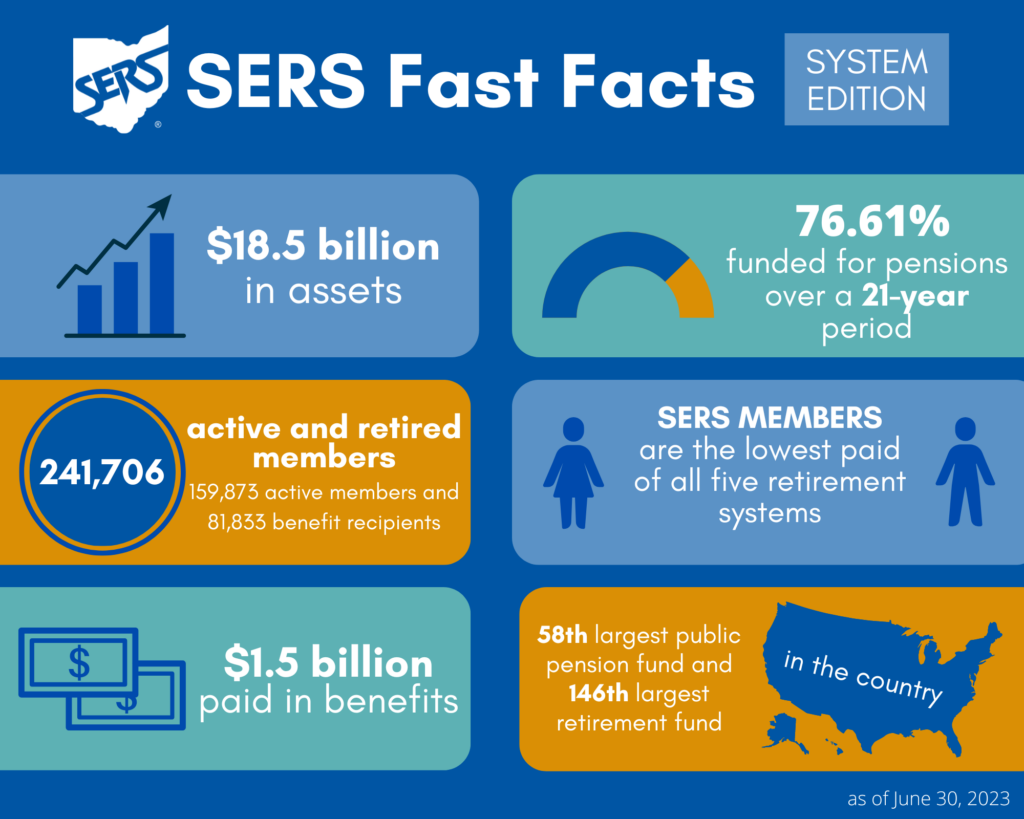

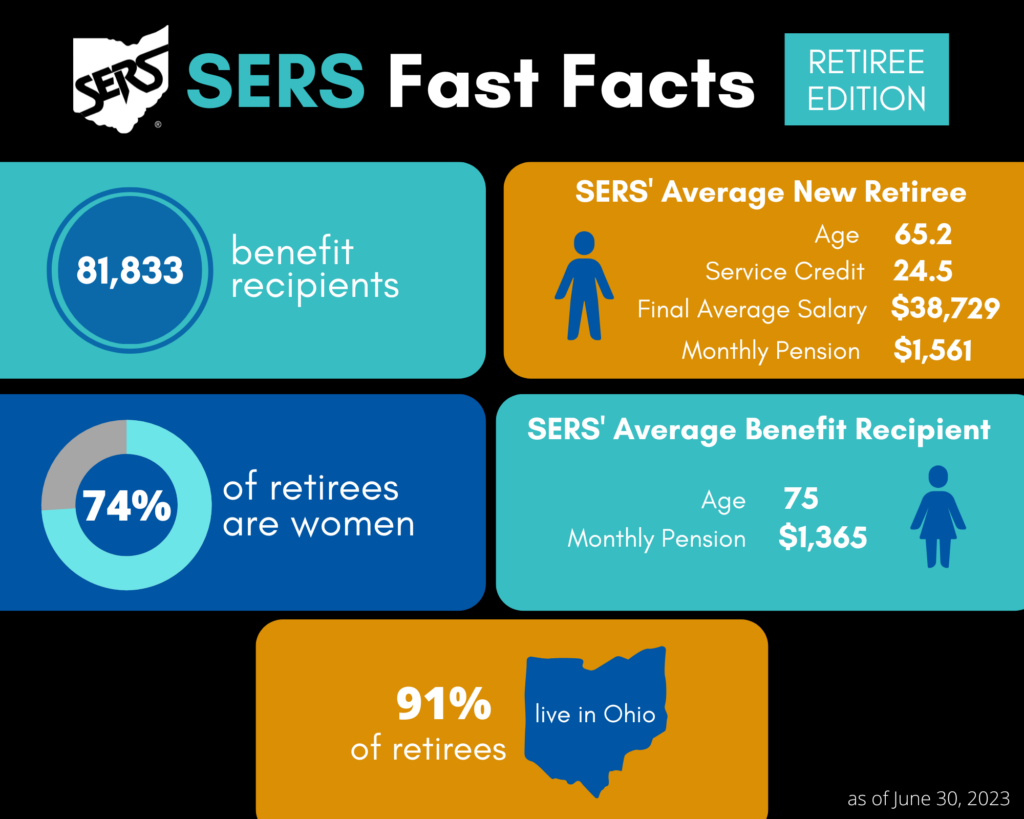

Established in 1923, the Pennsylvania State Employees' Retirement System (SERS) stands as a cornerstone of financial security for public employees in the state, one of the nation's oldest and largest statewide retirement plans. If you're among the over 79,000 retired members of the Ohio SERS, you'll discover a wealth of resources designed to optimize your retirement experience. These resources encompass a wide range of essential information, including guidance on reemployment opportunities and details related to Social Security benefits. Similarly, the School Employees Retirement System of Ohio caters to more than 157,000 active members, offering a comprehensive suite of information to facilitate effective retirement planning.

As you approach retirement, a multitude of decisions will require your attention concerning your SERS retirement benefits. These pivotal choices will be documented through a retirement estimate request, ensuring that your preferences are accurately reflected in your future financial arrangements. Information on state retirement systems can be found at srs.illinois.gov, while details regarding the State Universities Retirement System are available at surs.org. The Office of Retirement Services (ORS) websites provide retirement plan information that summarizes the essential provisions of public acts 300 of 1980, 240 of 1942, 182 of 1986, and 234 of 1992, as amended. A dedicated Member Services Account provides access to view your SERS benefit information and, for active members, estimate future retirement benefits, offering a valuable tool for long-term financial planning.

- Ingredients Of Nail Polish Essential Components And Their Impact

- The Real Deal On Eyebrow Tinting Cost What You Need To Know

| Category | Details |

|---|---|

| Retirement System Name | Pennsylvania State Employees' Retirement System (SERS) |

| Year Established | 1923 |

| Location | Pennsylvania |

| Purpose | Provide retirement benefits for public employees. |

| Key Features |

|

| Key Benefits |

|

| Contact Information |

|

| Important Alerts |

|

| Other Services |

|

| Reference Website | School Employees Retirement System of Ohio |

The financial payments in the event of your death, if any, could amount to a significant sum of money, underscoring the importance of comprehensive planning. For those nearing or already in retirement, the ability to access online services, update personal information, and receive newsletters and alerts from SERS streamlines the process. Furthermore, the pension estimate calculator, now available through your member services account, provides a valuable tool for projecting your retirement benefits. Training videos are available to help you navigate the calculator. All SERS benefit applications can now be found in your account, simplifying the application process.

It is vital to be aware of potential fraud attempts. SERS members have recently been targeted by various phishing scams, encompassing emails, phone calls, and text messages that impersonate or imply affiliation with SERS. Always verify the authenticity of any communication claiming to be from SERS before providing personal information. Understanding your retirement benefit is crucial even if you are not planning to retire soon. This knowledge allows you to make informed decisions and plan for your future. Additionally, if you're a new SERS member, you have a 45-day window to select from three retirement plan options, with a calculator to estimate the benefits of each plan.

The mission of SERS is to prepare members and participants to achieve financial success and security in retirement. Consider the potential impact on your SERS account when you're a new employee, as well as when you leave state service or approach retirement. The Ohio SERS provides comprehensive information to help guide your retirement planning for over 157,000 active members of the school employees retirement system.

- Best Guide For Neti Pot Shoppers Tips And Insights For Optimal Results

- Paraffin Wax At Walmart Your Complete Guide And More

Due to an internal processing error, federal taxes were under withheld or not withheld from many January 2023 benefit checks. This is something to bear in mind when planning your finances. With an online member services account, you can easily view your benefit information and estimate your future retirement benefit. Additionally, a member statement is sent every spring to allow you to verify information and incorporate SERS projections into your overall retirement planning.

SERS offers two types of service retirement: unreduced service retirement and early service retirement with reduced benefits. For the unreduced option, you will receive the maximum pension amount based on your service credit and final average salary. The pension estimate calculator is a useful tool to understand your options, and SERS is dedicated to preparing its members for financial success and security during retirement. It's also worth noting that the SERS website is updated frequently, and you can expect important information regarding fraud attempts.

Remember, a deep understanding of your retirement benefits is key to a successful and secure future. By utilizing the resources provided by SERS and other state retirement systems, you can navigate the complexities of retirement planning with confidence and achieve your financial goals.

Article Recommendations

- Does Neptune Have An Atmosphere Facts And Details Revealed

- Uncovering Ushers Health Journey What Std Did Usher Have

Detail Author:

- Name : Raquel Muller

- Username : haag.leanna

- Email : sklocko@hotmail.com

- Birthdate : 2006-05-24

- Address : 57136 Nikolaus Mews Carrollborough, AK 92279-9517

- Phone : +1-561-418-7119

- Company : Purdy Group

- Job : Printing Machine Operator

- Bio : Dolores eum commodi id sed voluptates sed. Vitae repellat id qui. Debitis quas sunt deserunt eaque error laborum.

Socials

facebook:

- url : https://facebook.com/ashlynn_mckenzie

- username : ashlynn_mckenzie

- bio : Non adipisci et qui eius beatae. Pariatur doloremque non et.

- followers : 989

- following : 394

instagram:

- url : https://instagram.com/ashlynn.mckenzie

- username : ashlynn.mckenzie

- bio : Aperiam quod quod ea amet voluptate nihil est. Rerum nulla occaecati ut ea eligendi impedit.

- followers : 6146

- following : 2999

linkedin:

- url : https://linkedin.com/in/ashlynn_mckenzie

- username : ashlynn_mckenzie

- bio : Sit facere omnis odit dolor quia et id.

- followers : 2495

- following : 2577

twitter:

- url : https://twitter.com/ashlynn.mckenzie

- username : ashlynn.mckenzie

- bio : Tenetur fuga provident aut a inventore enim. Provident id non nisi eaque animi et. Sed quia omnis aut ea. Nam est accusamus atque fuga.

- followers : 1128

- following : 883

tiktok:

- url : https://tiktok.com/@ashlynn2280

- username : ashlynn2280

- bio : Asperiores quam esse magnam. Id enim fugiat dolorem dolores odit.

- followers : 1105

- following : 1111