Drake Tax 2019 Guide: Your Essential Tax Software Resource

Are you a tax professional navigating the ever-changing landscape of tax preparation? Then you understand the critical importance of efficient, reliable, and comprehensive tax software, and Drake Tax is designed to meet those needs.

In the realm of tax preparation, the right software can be the difference between a stressful, time-consuming process and a streamlined, efficient workflow. Drake Tax, a name that resonates with many tax professionals, aims to provide just that. With a comprehensive suite of features, it positions itself as a central hub for tax practices of all sizes. This article delves into the capabilities of Drake Tax, exploring its features, benefits, and how it can assist in navigating the complexities of tax season. The following analysis is based on publicly available information and aims to provide an objective overview of the software's functionality and its place in the tax preparation ecosystem.

To better understand the software and its application, it's helpful to explore the core features that make it a popular choice for tax professionals. Drake Tax online tm provides full tax compliance like drake zero and web1040, with the added capability to file business tax returns. The software is designed to handle a wide array of tax situations, from personal income tax returns to complex business filings. This versatility makes it a suitable option for practices that cater to a diverse clientele. Beyond the core tax preparation functions, Drake Tax also offers a range of additional features designed to enhance the user experience and streamline the tax preparation process. Drake tax offers tax compliance, workflow, office management, and integration solutions for tax pros.

- Cardi B New Look A Transformational Style Statement

- Achievements Of Halle Berry A Trailblazing Career In Hollywood

Let's consider the specific capabilities and attributes that define Drake Tax, looking closely at how these features contribute to its overall value proposition.

Drake tax\u00ae serves as the hub of your practice, streamlining tax return preparation and enabling you to delight your customers. Drake tax is complete, professional, and comprehensive tax software, allowing you to prepare any tax return, personal or business, federal or state. At its core, Drake Tax is designed for comprehensive tax compliance. Drake Tax includes all federal tax packages. The software is updated regularly to incorporate the latest tax laws and regulations, ensuring accuracy and compliance. Integrated new online help features inside drake tax to take users directly to program help information online and knowledge base articles. This focus on compliance is critical for tax professionals, who must ensure that their clients' tax returns are accurate and compliant with all relevant laws. The software's ability to handle both personal and business tax returns further enhances its appeal, making it a versatile tool for tax practices of varying sizes and specializations.

Drake Tax integrates new online help features to take users directly to program help information online and knowledge base articles. This integration is essential for keeping users informed and updated about changes in tax laws. To minimize the impact of these updates, the software developers release a pre-season version in December, which allows users to set up and install the software, get familiar with the new features, and make any necessary adjustments to their workflows before the full tax season begins. This proactive approach demonstrates a commitment to supporting tax professionals during the high-pressure period of tax season.

- Fortnite Hime Skin A Complete Guide To Mastering The Aesthetic

- Ultimate Guide To Yellow Curly Hair Product Tips Benefits And Choices

The Drake Tax Planner is designed to help you assist your clients in planning for the future. By comparing a client\u2019s current tax situation to different scenarios that could occursuch as marriage, the birth of a child, buying or selling a house, or change in incomeyou can see how these changes may affect their finances and tax liability. The Drake Tax Planner helps tax professionals advise clients. This feature allows tax professionals to analyze different financial scenarios for clients, providing valuable insights into potential tax liabilities and opportunities for tax planning.

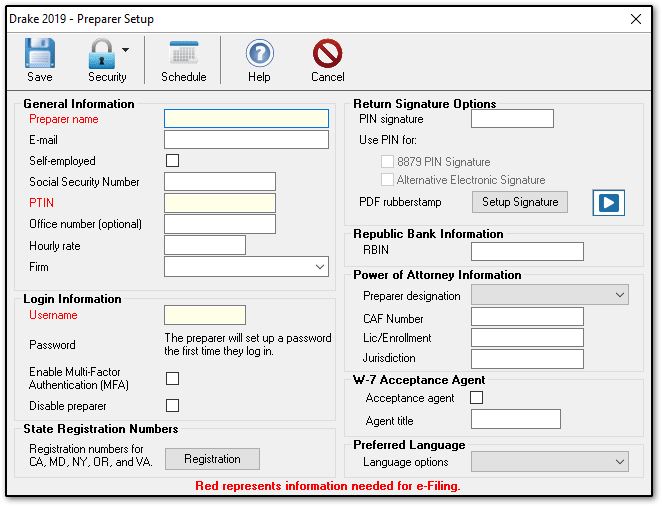

The system is designed to facilitate ease of use, offering features such as integrated online help and knowledge base articles to guide users through the software. Moreover, Drake portals are integrated to import client data, which reduces the need for manual data entry. This, in turn, helps prevent data entry errors, saving time and increasing efficiency. Set up different user levels to suit your workflow and security needs. The software also supports different user levels, which enhances workflow management and security. Prevent loss of data using drake tax\u2019s backup and restore tools. Additionally, the backup and restore tools help safeguard against data loss. Digital rubber stamp the rubber stamp feature in drake allows you to apply the preparer\u2019s signature to all signature documents with just a few clicks. The "digital rubber stamp" feature streamlines document signing. These features collectively aim to create a more efficient and secure tax preparation process.

Drake Tax provides a variety of resources to assist users in learning and understanding its features. Learn the basics of preparing tax returns in drake tax. Learn the basics of drake tax with these short instructional videos. Content with closed caption [cc] enabled is available by clicking [cc] in the video or its summary. To learn about drake software products in a classroom setting, join us for classroom training or a live webcast. Click here for more information. These resources include short instructional videos that cover the basics of using the software. Moreover, the software's trial mode allows users to test its functionality. Learn how to test drake tax program on your computer with trial mode and convert from another software. See the functions available in trial mode, how to install states, change trial to full, and uninstall the program. Drake software customers can download and install available versions of drake tax (federal and state programs) through the drake download center. The Drake tax trial allows you to test the ease and functionality of the drake tax program on your own computer. You can use the trial software to test functionality and even convert from another program. These resources make it easier for users to get started and become proficient with the software. To learn about drake software products in a classroom setting, join us for classroom training or a live webcast.

Drake Tax also offers a variety of support options. The drake software seminar tour travels nationwide throughout the spring and summer. Our free demonstrations will introduce you to tax software features that can help increase your productivity, streamline your workflow, and improve the bottom line for your business. Join a live webinar for an introduction to drake tax. Stay current and earn continuing education by taking courses on drake cpe. Drake is an approved ce provider with nasba, ctec, and the irs, and is an approved irs annual federal tax refresher. The company provides free demonstrations and live webinars. The availability of training and customer support ensures that users have access to the assistance they need.

Drake Tax is available for purchase on April 17th! If you are a current drake customer, please log in to your account to renew your software. The software also offers integration capabilities, such as importing client data through Drake portals, and allows users to set up different user levels to accommodate various workflows and security needs. The version you choose depends on the number of users in your firm. Watch the video single user vs. Drake documents and drake portals; And many more to choose from; These features, along with the ability to generate digital signatures, streamline the tax preparation process and make it more efficient. From initial setup to the final filing, Drake Tax aims to provide a comprehensive solution. Drake provides the tools and support tax professionals need to build their businesses and attract new clients. Our customers know they can rely on drake for comprehensive product excellence and value.

Considering the available evidence and the information, Drake Tax has the potential to serve as a significant asset for tax professionals, contributing to increased productivity, efficiency, and client satisfaction. However, the ultimate effectiveness of the software depends on the specific needs and workflows of the individual tax practice. The software's various features and functionalities, from compliance to training and support, collectively contribute to its appeal as a central hub for tax preparation.

Article Recommendations

- The Secrets Of June 21 Zodiac Sign Everything You Need To Know

- Ingredients Of Nail Polish Essential Components And Their Impact

Detail Author:

- Name : Prof. Trent Parisian III

- Username : ojenkins

- Email : ohara.bryce@corwin.org

- Birthdate : 2007-02-04

- Address : 670 VonRueden Heights Suite 047 Zemlakshire, HI 80166

- Phone : 423.510.0381

- Company : Kirlin, Schinner and Funk

- Job : Legal Secretary

- Bio : Aliquid et perferendis optio. Voluptatem vitae officiis et ut voluptas. Dolorem atque quasi in rerum dignissimos non saepe.

Socials

facebook:

- url : https://facebook.com/waltere

- username : waltere

- bio : Qui consectetur placeat qui temporibus.

- followers : 2039

- following : 316

twitter:

- url : https://twitter.com/ericwalter

- username : ericwalter

- bio : Esse in voluptatem sunt reprehenderit. Et at officiis quasi. Aut fugit et ullam impedit.

- followers : 116

- following : 484

tiktok:

- url : https://tiktok.com/@eric3346

- username : eric3346

- bio : Et deleniti et et consectetur. Et animi velit impedit reprehenderit.

- followers : 2491

- following : 2236