NY Income Tax Filing Guide: Your Complete 2025 Overview

Are you prepared to navigate the complexities of income tax season? Understanding your tax obligations is crucial, and knowing the nuances of filing, from eligibility to deadlines, can save you time, money, and stress.

The world of income tax can seem daunting, but it doesn't have to be. This article provides a comprehensive guide to the essentials of filing your income tax return, specifically focusing on the guidelines set forth by the New York State Department of Taxation and Finance. Whether you're a resident, a nonresident with New York source income, or simply trying to understand your obligations, this information aims to clarify the process and empower you to fulfill your tax responsibilities with confidence.

Let's delve into the specifics of how to navigate the tax landscape, ensuring you're well-informed and equipped to handle your tax responsibilities effectively. Learn about the who, how, and when of filing an income tax return. Discover whether you need to file a New York State personal income tax return, considering factors such as residency and income thresholds. Explore the benefits of direct file and free file options, streamlining the process for greater ease and accessibility. Gain insights into essential topics such as joint filing information, standard deductions, and itemized deductions, as well as the pension and annuity income exclusion.

- Fortnite Hime Skin A Complete Guide To Mastering The Aesthetic

- Essential Tips For Tattoo Artists Mastering The Craft

The official website of the New York State Department of Taxation and Finance ([https://www.tax.ny.gov/](https://www.tax.ny.gov/)) offers a wealth of resources to assist taxpayers. You can visit the website to learn about your tax responsibilities, check your refund status, and utilize online services anytime, anywhere. The department provides information about tax rates and tax tables for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax (MCTMT) by year.

For nonresidents, it's important to note that a New York State personal income tax return is required if you have income from New York sources and your New York adjusted gross income (determined as if you were a resident) exceeds the New York State standard deduction allowed. Get ready to file your income tax return by reviewing your tax account balance and exploring options for direct deposit of your income tax refund. Taxpayers can also review driver license requirements, find their school district code, and visit the individuals homepage for additional help. The MCTMT sales tax and property tax information are readily available as well.

Eligible New York taxpayers can utilize IRS Direct File to file their federal return and then seamlessly export their information into New York State Direct File to complete their state return. This integrated approach offers convenience, and you can access these services from your smartphone, laptop, tablet, or desktop computer. Keep an eye out for the upcoming availability of direct file.

Its worth noting that while New York State's top marginal income tax rate is 10.9%, one of the highest in the nation, this rate applies to a relatively small number of high-income earners. The state's tax system, like the federal system, is progressive, meaning higher earners pay higher tax rates. For your 2024 taxes, which you will file in early 2025, the rates and thresholds are available.

The New York State tax calculator (NYS Tax Calculator) is a valuable tool, using the latest federal and state tax tables for 2025/26 to help you estimate your tax return for the 2025/26 tax year. Please select the 2025 tax year to utilize this tool.

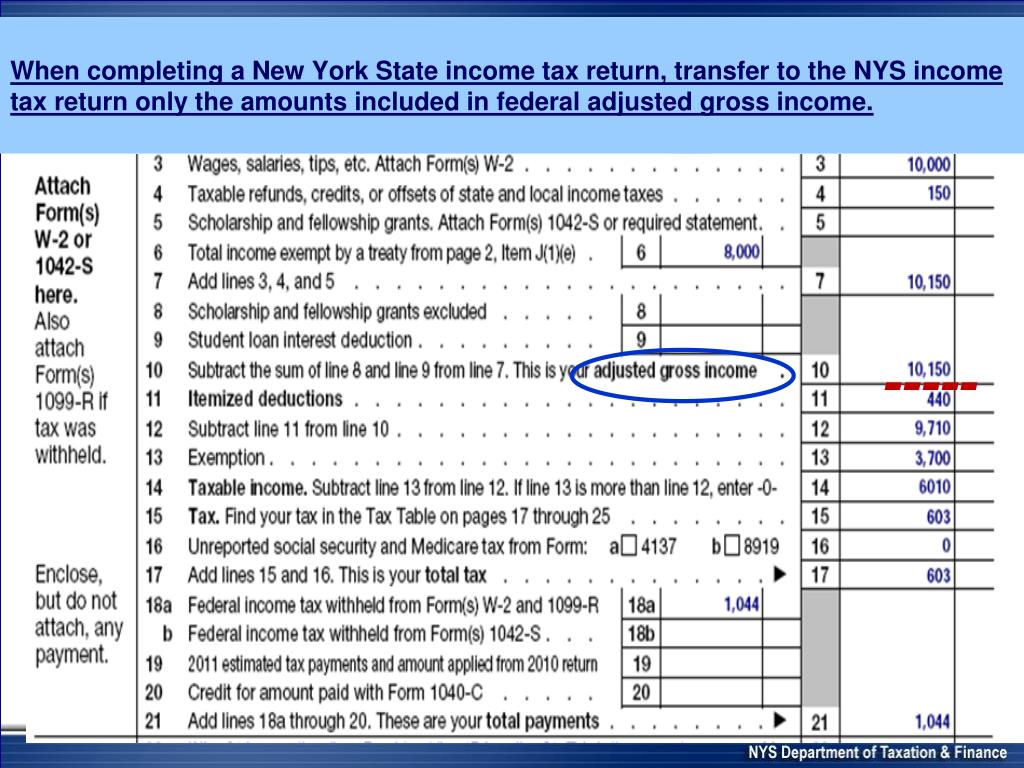

Beginning with the tax year 2018, the tax law in New York allows you to itemize your deductions for state income tax purposes, regardless of whether you itemized on your federal return. Additionally, the new york itemized deduction limitation for taxpayers whose new york adjusted gross income is over $10 million has been extended through tax year 2029.

The state's income tax ranges from 4% to 10.9%. Income tax tables and other tax information come directly from the New York Department of Taxation and Finance. Those with NYS adjusted gross income of $107,650 or less (line 33) or NYS taxable income less than $65,000 (line 38) have specific considerations. For those with NYS taxable income of $65,000 or more (line 38), different tax brackets apply. The 2025 tax rates and thresholds for both the state and federal tax tables are fully integrated into the New York Tax Calculator for 2025.

Regarding pension income, income from pension plans described in section 114 of title 4 of the U.S. Code received while you are a nonresident of New York State is not taxable to New York. However, if your pension is taxable to New York and you are over the age of 59 or turn 59 during the tax year, you may qualify for a pension and annuity exclusion of up to a specific amount, depending on your income.

For those interested in potential tax credits, it's worth noting that barns may qualify for an income tax credit for rehabilitating the property.

Below is a table summarizing key aspects of New York State Income Tax filing:

| Topic | Details |

|---|---|

| Filing Requirements | Generally, you must file a New York State resident income tax return if you are a New York State resident and meet certain income thresholds. A nonresident must file if they have any income from New York sources and their New York adjusted gross income exceeds the state standard deduction. |

| Filing Methods | New York offers Direct File and Free File options for personal income tax returns, making filing easier. IRS Direct File is available for federal returns, with seamless export to New York State Direct File. |

| Tax Rates | New York's 2025 income tax rates range from 4% to 10.9%, applied progressively. |

| Standard Deductions and Itemized Deductions | Information is available on joint filing, standard deductions, and itemized deductions. As of 2018, you can itemize your New York deductions regardless of whether you itemized on your federal return. There is also an itemized deduction limitation for high-income earners (over $10 million in NY AGI) through tax year 2029. |

| Pension and Annuity Exclusion | If your pension is taxable to New York, you may qualify for an exclusion if you are over 59 . Income from certain pension plans received while a nonresident is not taxable to New York. |

| Resources | The official website of the New York State Department of Taxation and Finance ([https://www.tax.ny.gov/](https://www.tax.ny.gov/)) offers detailed information. |

| Tax Calculator | The New York State Tax Calculator uses the latest federal and state tax tables to help estimate your return. |

Article Recommendations

- Ingredients Of Nail Polish Essential Components And Their Impact

- Empowering Resilience Terry Crews And Ual Harassment

Detail Author:

- Name : Stuart Wintheiser MD

- Username : damon.schuppe

- Email : ifeil@hotmail.com

- Birthdate : 1998-02-19

- Address : 2383 Kiara Spring Kuvalisland, ID 88069-8399

- Phone : (612) 326-0889

- Company : Hahn-Powlowski

- Job : Natural Sciences Manager

- Bio : Cum odio commodi non soluta quas officia. Tempore deleniti quia rerum et quis aliquid reprehenderit.

Socials

facebook:

- url : https://facebook.com/lon_id

- username : lon_id

- bio : Rerum eius consequatur incidunt autem molestias accusamus.

- followers : 393

- following : 2469

linkedin:

- url : https://linkedin.com/in/homenick1986

- username : homenick1986

- bio : Omnis cum consectetur tenetur excepturi qui.

- followers : 5542

- following : 1096