FTB Tax Info & Services: Your Guide To Filing & More!

Are you navigating the complexities of California taxes? Understanding the California Franchise Tax Board (FTB) is crucial for every individual and business operating within the Golden State.

The Franchise Tax Board (FTB) website offers a wealth of information. However, it's important to approach the resources with a discerning eye. The Google translation feature, for example, is provided for general informational purposes only. For official business, seeking the expertise of a professional translator is always recommended. The FTB's official stance is that the English web pages are the most accurate source for tax information and services.

Accessing taxpayer account information is a privilege afforded solely to individual taxpayers or their authorized representatives. Any unauthorized access to account information is strictly prohibited and unlawful, as explicitly stated in section 502 of the California Penal Code. The FTB takes data security seriously, and rightfully so.

- Transforming Your Look A Complete Guide To Layers In Wavy Hair

- Juggalo Face Paint Dive Into Its Vibrant Culture And Meanings

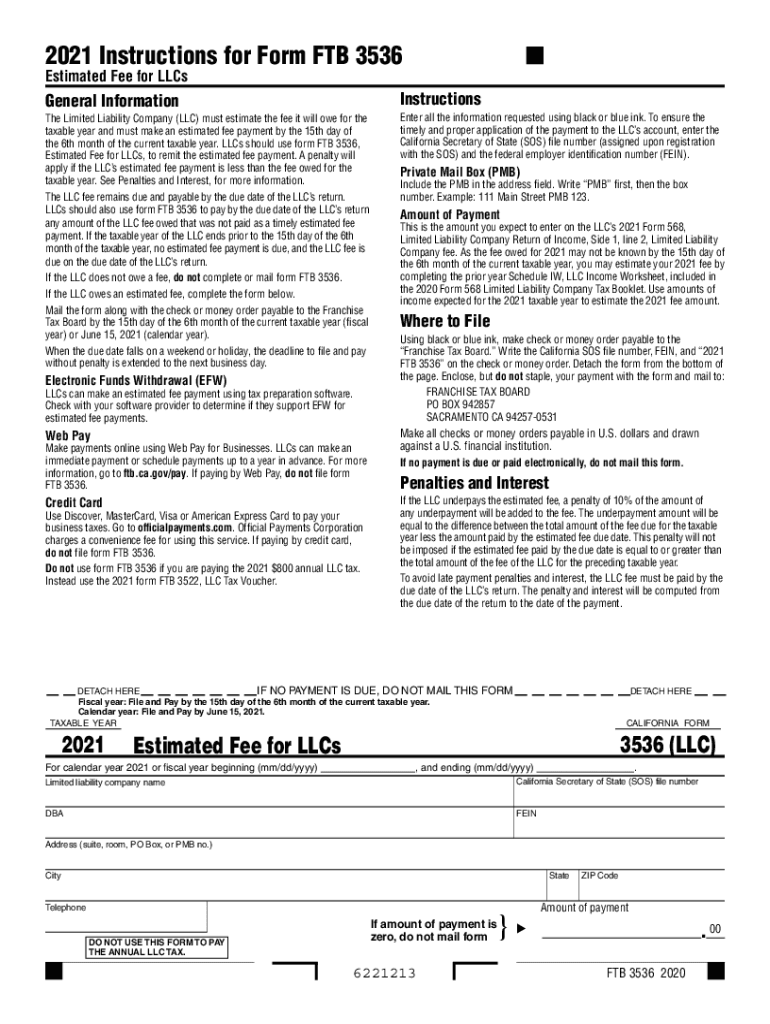

If you're unsure about the specific forms you need to file, the FTB website offers a search service, allowing you to locate tax forms and publications dating back to 2008 and up to the present. This is an invaluable tool for staying compliant with California tax law.

The FTBs website also offers several ways to interact with the board. For those seeking to conduct specific tasks, such as filing a return, making a payment, or checking a refund status, the "MyFTB" online portal is the gateway. It's a service tailored for individuals, businesses, and tax professionals alike, offering a streamlined way to access tax account information and manage various tax-related tasks.

The MyFTB account allows users to check refunds, review payment history, and view important notices. Creating an account is a straightforward process, and the benefits are significant. This digital access reduces the need for paper correspondence and provides a centralized hub for all your tax information.

- Huzzah Define The Exciting Definition And Its Impact

- Doctor Dubai Salary Understanding Earnings In The Medical Profession

The FTB provides several payment options. You can use the free "Web Pay" service for direct payments from your bank account. There are also options for online credit card payments, which are, of course, subject to associated fees. Moreover, the FTB offers payment plans for eligible taxpayers. It's always advisable to understand the terms and fees before committing to a payment plan.

For taxpayers who prefer traditional methods, the FTB also accepts form requests by mail or phone. If you have suggestions for improving the tax forms, you can even submit your feedback. The FTB is open to feedback, which is a good sign, as it indicates a willingness to improve and adapt.

The FTB provides various channels for assistance. You can find answers online, contact the Franchise Tax Board directly for help with filing, payments, refunds, and other tax-related inquiries. You can access support via chat, phone, fax, or by visiting office locations. Mailing addresses and processing times are also readily available. Such comprehensive support helps people to navigate the often-complex world of taxation.

For those claiming a refund on their 2024 California tax return, the FTB offers a straightforward process. Taxpayers are prompted to enter their Social Security number and last name. This information must match the FTBs records to access the service. This safeguard ensures the security and privacy of the information.

The "Entity Type" section of the FTB website is crucial for businesses. Youll be asked to select your entity type and enter your entity ID. The combination of these must match the FTB's records to access the service. This ensures that the right entity is accessing the correct information.

Businesses seeking an "Entity Status Letter" will find that corporations and limited liability companies are eligible for this service. It is an important feature for business owners.

When it comes to changes in entity names made through the Secretary of State, it's important to be patient. It can take up to 30 days for these changes to be reflected with the FTB. This lag time is something to keep in mind.

California's income tax structure for 2025 features a range from 1% to 13.3%. The FTB website provides the latest tax brackets and tax rates, alongside a California income tax calculator. Having access to this information is vital to correctly calculating your tax liability.

Income tax tables and other tax information are sourced directly from the California Franchise Tax Board, ensuring that the information is up-to-date and accurate. Accuracy is key to compliance.

If someone can claim you (or your spouse/RDP) as a dependent, youll need to check the appropriate box on Form 540, side 1. The FTB provides instructions for exemptions related to line 7, line 8, line 9, and line 10 in "instr6 exemptions". This detail may seem small, but can significantly impact your tax liability.

The MyFTB online portal offers individuals, business representatives, and tax professionals access to tax account information and services. This digital platform provides a secure environment for managing your tax obligations.

The official and most accurate source for tax information and services is the English language web pages on the FTB website. Be aware that any translations may not be binding on the FTB and have no legal effect for compliance or enforcement purposes. Therefore, always refer to the English version for official guidance.

For those using Schedule CA (540), its a crucial tool. This schedule is used to adjust federal adjusted gross income and federal itemized deductions to align with California law. Understanding and correctly filling out this schedule is vital for accuracy.

The FTB offers a variety of payment options, including direct pay from your bank account (free via Web Pay), online credit card payments (with fees), and payment plans for eligible taxpayers (with fees). It is essential to find the payment option that best suits your personal financial situation.

The FTB provides a comprehensive list of phone numbers for representatives, office locations with appointment information, and mailing addresses. These resources make it easier for taxpayers to connect with the FTB and obtain the assistance they need.

And best of all, access to the resources and information provided by the FTB is free. This includes access to the online portal, forms, and guidance.

When it comes to claiming a refund on your 2024 California tax return, the FTB simplifies the process. The amount you've claimed will be displayed on the form. It's essential to double-check all the information, especially the refund amount.

Before accessing certain services, you will be asked to provide your Social Security number. Remember, the Social Security number must consist of nine numbers with no spaces or dashes. This is a security measure to ensure that only authorized individuals can access their tax information.

Article Recommendations

- Stylish Icons Male Celebrities With Fringes

- The Real Deal On Eyebrow Tinting Cost What You Need To Know

Detail Author:

- Name : Ms. Bridget Koch

- Username : ghermiston

- Email : rlangosh@mueller.biz

- Birthdate : 1979-10-30

- Address : 3032 Mollie Centers Apt. 528 Medaburgh, HI 36929-2947

- Phone : 786-275-8549

- Company : Orn, McClure and Klein

- Job : Utility Meter Reader

- Bio : Fugit incidunt quod adipisci temporibus quos quis. Quo et aut eos accusamus enim provident. Earum molestiae architecto inventore quia et. Quis incidunt provident explicabo id fuga nesciunt.

Socials

tiktok:

- url : https://tiktok.com/@bhuel

- username : bhuel

- bio : Velit ut voluptatum quibusdam itaque ex tenetur aspernatur.

- followers : 6182

- following : 2851

instagram:

- url : https://instagram.com/brisa_official

- username : brisa_official

- bio : Totam saepe enim repudiandae magnam harum. Quia error ut officiis. Rerum ut in velit ut ut facilis.

- followers : 2564

- following : 1672

linkedin:

- url : https://linkedin.com/in/brisa7872

- username : brisa7872

- bio : Eos ipsa nihil sapiente in laboriosam laboriosam.

- followers : 2744

- following : 223