California FTB: File, Pay, Refund & More - Your Guide

Are you prepared to navigate the complexities of California taxes and secure your financial future? Understanding the intricacies of the California Franchise Tax Board (FTB) is not merely a matter of compliance; it's a crucial step toward financial empowerment and responsible citizenship.

The California Franchise Tax Board (FTB) serves as the primary entity responsible for the administration and collection of state personal income tax and corporate franchise and income tax. As part of the California Government Operations Agency, the FTB plays a pivotal role in funding essential state services. Whether you're a seasoned taxpayer or just starting out, grasping the fundamentals of California tax regulations is paramount. This includes knowing how to file your return, make payments, and even track your refund. The FTB provides a wealth of resources to assist you in fulfilling your tax obligations accurately and efficiently.

The FTB's online portal, "MyFTB," offers a comprehensive suite of services for individuals, businesses, and tax professionals alike. Through MyFTB, you can access your tax account information, check the status of your refunds, review your payment history, and stay informed about any notices you may have received. The platform is designed to streamline your interaction with the FTB, providing a secure and convenient way to manage your tax affairs. You can also learn how to make payments for your California state taxes online or by mail.

- Laboriously Meaning Decoding The Depth And Significance

- Why Do My Eyes Change Color From Blue To Green A Scientific Perspective

The FTB's website, which is regularly updated, provides official and accurate tax information and services. For those seeking assistance with filing or understanding California's tax laws, the FTB's website is a great resource.

Lets delve deeper into the specifics of what the FTB provides, what services they provide and how you can take advantage of their resources.

Below is a comprehensive guide that helps you navigate the various aspects of interacting with the FTB, from filing returns and making payments to accessing online services and understanding important legal and technical considerations.

- Discover Your Astrological Moon Sign What Is Your Moon Sign

- How To Know Signs A Man In Love With You Simplified

In this guide, we'll break down each component, giving you a clearer picture of how the FTB operates and how you can utilize its resources.

Key Services and Resources Provided by the California Franchise Tax Board (FTB)

The California Franchise Tax Board (FTB) offers a comprehensive suite of services designed to assist taxpayers with their state tax obligations. From online portals to detailed informational publications, the FTB provides the resources necessary for individuals and businesses to manage their taxes effectively.

1. Online Services (MyFTB)

- MyFTB Account: A secure online portal for individuals, businesses, and tax professionals to access tax account information and services.

- Features: Check refunds, view payment history, review notices, and manage account details.

- Access: Log in or create an account to access these services.

2. Filing Returns

- Online Filing: The FTB facilitates the filing of returns online, often offering faster processing and confirmation.

- Paper Filing: Traditional paper filing options are also available, providing flexibility for different taxpayer preferences.

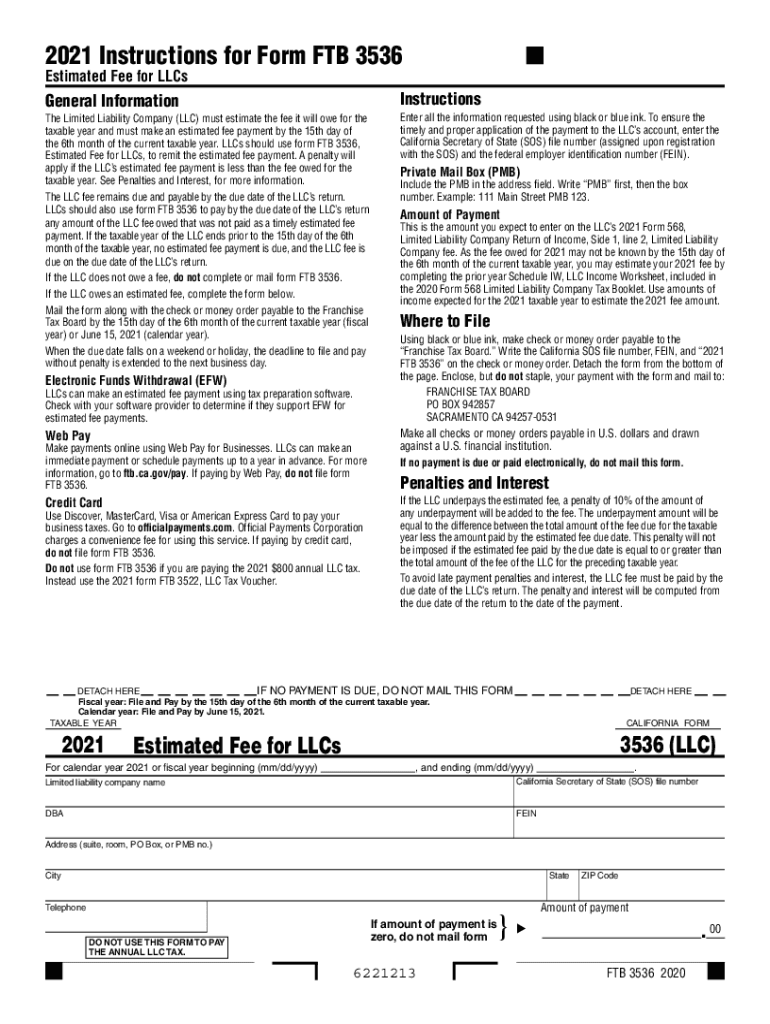

- Forms and Instructions: Access to necessary forms and detailed instructions, including Schedule CA (540) for adjusting federal adjusted gross income and itemized deductions.

3. Making Payments

- Payment Options: A variety of payment methods are offered, including:

- Direct Pay from your bank account (free).

- Online credit card payments (subject to fees).

- Payment plans for eligible taxpayers (subject to fees).

- Online Payment Service: Access online payment services by entering your Social Security number and last name.

- Payment Methods: Web Pay (no paper voucher needed).

4. Checking Refunds

- Refund Status: Check the status of your refund through your MyFTB account or using the online refund tracker.

- Claiming Refunds: The refund amount claimed on your California tax return.

5. Information and Assistance

- Popular Topics and Online Services: Easy access to frequently used resources and information.

- Publications: Detailed information about California tax laws, including FTB Pubs.

- Help Resources: Access to contact information and support for questions and assistance.

6. Compliance and Regulations

- Official Source: The official and accurate source for tax information and services is the FTB websites English web pages.

- Accessibility: The FTB is committed to accessibility, as evidenced by their websites certification dates and compliance with California government codes.

- Translation Disclaimer: Translations of web content are not legally binding and do not supersede the English versions.

Navigating MyFTB and Online Services

MyFTB is designed to be the central hub for managing your California tax affairs. To access the MyFTB portal, you will need to log in or create an account. The platform allows you to:

- Access Account Information: Review your tax account details, including prior filings and payments.

- Check Refund Status: Track the progress of your refund.

- Review Payment History: View past payments and their statuses.

- Manage Notices: Access and respond to any notices received from the FTB.

- Update Contact Information: Keep your contact details current.

Creating an account is straightforward. Youll typically need to provide personal information and verify your identity. The FTB uses robust security measures to protect your data, ensuring a secure environment for all your tax-related activities.

Understanding Filing and Payment Processes

The FTB offers a range of options for filing your tax returns and making payments. This provides flexibility to meet the needs of different taxpayers.

Filing

You can file your return either online or by mail.

- Online Filing: Provides a streamlined process. Offers faster processing and confirmation of filing.

- Paper Filing: For those who prefer or need it, traditional paper filing options are available. You can access forms and instructions on the FTB website.

Payments

The FTB offers several payment methods to make it convenient for taxpayers to fulfill their obligations.

- Direct Pay: You can make a direct payment from your bank account through the web pay service, which is free of charge.

- Credit Card Payments: The FTB accepts online credit card payments, which is subject to fees.

- Payment Plans: If you need additional time to pay, the FTB offers payment plans for eligible taxpayers, which are also subject to fees.

When filing and making payments, remember to use the correct forms and schedules, such as Schedule CA (540), to adjust federal adjusted gross income and itemized deductions in accordance with California law.

Key Requirements and Considerations

When engaging with the FTB, it's essential to be aware of specific requirements and factors that can affect your interaction with the agency.

- Accuracy of Information: Ensure all information entered is accurate.

- Social Security Number: This is a required field for accessing services.

- Refund Amount: Enter the amount in whole dollars without special characters.

- Entity Type and ID: For businesses, select your entity type and enter your entity ID.

Please note that the web pages currently in English on the FTB website are the official and accurate source for tax information and services. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes.

California Franchise Tax Board

The California Franchise Tax Board (FTB) is committed to ensuring that its digital resources are accessible to all users. This commitment is demonstrated through their adherence to accessibility standards and continuous efforts to improve usability across their website and online services.

Accessibility Standards

- Compliance: The FTBs website is designed, developed, and maintained to be accessible.

- Certifications: The FTB regularly certifies its compliance with accessibility standards. For instance, certifications dating back to July 1, 2023, show ongoing efforts to meet these requirements.

- Government Codes: The FTBs commitment to accessibility denotes compliance with California Government Code sections 7405 and 11135.

Accessible Technology Program

To ensure accessibility, the FTB partners with an Accessible Technology Program. This programs contact information is usually provided within the certification details, emphasizing their commitment to address any accessibility concerns and continuously improve user experience.

The FTB's commitment to accessibility ensures that everyone, regardless of ability, can use their resources.

Contacting the FTB and Additional Information

Should you have any questions or need assistance, the FTB provides various channels for support. Contact information is available on the FTB website and in its publications. The California tax service center is also an excellent resource for assistance. Whether you're seeking help with a specific tax issue, need to understand a notice, or want to learn more about California tax law, these resources are there to support you.

Contact Information

The FTB provides a variety of ways to get in touch, including phone numbers, addresses, and online contact forms. It is recommended to visit the FTB website for the most current contact information, as it may change.

Publications

Additional information can be found in FTB publications, which provide detailed explanations of California tax laws and regulations. These publications are an invaluable resource for both individuals and businesses.

Quarterly Estimated Taxes and Withholding

If you anticipate owing taxes at the end of the year, the FTB advises that you may need to pay quarterly estimated taxes. Alternatively, you might consider increasing the amount withheld from your paycheck. This proactive approach can help avoid potential penalties and ensure compliance.

The FTB works with several other tax agencies to provide a comprehensive tax service center. These include:

- The Internal Revenue Service (IRS)

- The California Department of Tax and Fee Administration (CDTFA)

- The Employment Development Department (EDD)

| Aspect | Details |

|---|---|

| Name of Agency | California Franchise Tax Board (FTB) |

| Primary Function | Administers and collects state personal income tax and corporate franchise and income tax of California. |

| Part of | California Government Operations Agency |

| Key Services | Filing returns, making payments, checking refunds, accessing online account information via MyFTB. |

| Online Portal | MyFTB (for individuals, businesses, and tax professionals) |

| Payment Options | Direct pay from bank account (free), online credit card payments (subject to fees), payment plans (subject to fees). |

| Accessibility Commitment | Designed, developed, and maintained to be accessible, compliant with California Government Code sections 7405, 11135. |

| Certification Date | July 1, 2023 (and prior certifications) |

| Primary Resource for Taxpayers | FTB Website, especially the English web pages. |

| Official Source | The FTB Website in English (official and accurate). |

| Additional Information Source | FTB Publications |

| Website Link | California Franchise Tax Board Official Website |

The California Franchise Tax Board (FTB) provides comprehensive resources and services to assist taxpayers with their state tax obligations.

By thoroughly understanding these processes and utilizing the resources the FTB provides, taxpayers can navigate the complexities of California state taxes with confidence and ensure compliance. Whether it's filing your return, making a payment, or accessing online services, the FTB is committed to providing a user-friendly experience that supports taxpayers in meeting their financial obligations effectively. Remember, accurate information, and a proactive approach are key to a smooth tax experience.

Article Recommendations

- Benefits And Usage Of Tea Tree Cream For Eczema Relief

- May 24 Zodiac Sign Traits Compatibility And More

Detail Author:

- Name : Raquel Muller

- Username : haag.leanna

- Email : sklocko@hotmail.com

- Birthdate : 2006-05-24

- Address : 57136 Nikolaus Mews Carrollborough, AK 92279-9517

- Phone : +1-561-418-7119

- Company : Purdy Group

- Job : Printing Machine Operator

- Bio : Dolores eum commodi id sed voluptates sed. Vitae repellat id qui. Debitis quas sunt deserunt eaque error laborum.

Socials

facebook:

- url : https://facebook.com/ashlynn_mckenzie

- username : ashlynn_mckenzie

- bio : Non adipisci et qui eius beatae. Pariatur doloremque non et.

- followers : 989

- following : 394

instagram:

- url : https://instagram.com/ashlynn.mckenzie

- username : ashlynn.mckenzie

- bio : Aperiam quod quod ea amet voluptate nihil est. Rerum nulla occaecati ut ea eligendi impedit.

- followers : 6146

- following : 2999

linkedin:

- url : https://linkedin.com/in/ashlynn_mckenzie

- username : ashlynn_mckenzie

- bio : Sit facere omnis odit dolor quia et id.

- followers : 2495

- following : 2577

twitter:

- url : https://twitter.com/ashlynn.mckenzie

- username : ashlynn.mckenzie

- bio : Tenetur fuga provident aut a inventore enim. Provident id non nisi eaque animi et. Sed quia omnis aut ea. Nam est accusamus atque fuga.

- followers : 1128

- following : 883

tiktok:

- url : https://tiktok.com/@ashlynn2280

- username : ashlynn2280

- bio : Asperiores quam esse magnam. Id enim fugiat dolorem dolores odit.

- followers : 1105

- following : 1111