Chipotle (CMG) Stock: What Investors Need To Know Now

Is Chipotle Mexican Grill (CMG) poised for continued growth, and should investors be excited? The evidence strongly suggests that Chipotle's stock price has significant upside potential, offering a compelling investment opportunity in a dynamic market.

The trajectory of Chipotle Mexican Grill's (NYSE: CMG) stock has been nothing short of remarkable. Investors, always keen to gauge future performance, should find encouragement in the prevailing market conditions. The momentum behind CMG is palpable, fueled by a confluence of factors that suggest sustained growth. The company's performance has been particularly noteworthy, with the stock price experiencing substantial gains. A key event driving this momentum is the forthcoming stock split, which has been approved by shareholders. At the annual meeting of shareholders, held on June 6, 2024, the measure was ratified, setting the stage for increased accessibility and potentially further price appreciation. This strategic move is a significant milestone in the companys history and reflects the management's confidence in its future prospects.

The stock split, once completed, is expected to make shares more accessible to a wider range of investors. This increased accessibility can stimulate demand and contribute to a further rise in the stock price. This is a common strategy employed by successful companies to enhance shareholder value and improve market liquidity. The rationale behind a stock split is to lower the per-share price, making it easier for smaller investors to buy into the company and potentially increasing trading volume.

- Horoscope October 12 A Guide To Understanding Your Astrological Insights

- Secrets Of Undefined Curly Hair Tips Care And Styling

Let's delve deeper into the financial dynamics that underpin Chipotle's success. Understanding the revenue streams, expenditure, and profitability is essential for making informed investment decisions. The companys detailed quarterly and annual income statements provide a comprehensive picture of its financial health. By analyzing these statements, investors can gain insights into the efficiency of the company's operations, its ability to manage costs, and its overall financial performance. This detailed look into Chipotle's financial metrics reveals the company's resilience and ability to adapt to market changes.

Over the last few years, CMG stock has demonstrated extraordinary strength. From a base level of around $30 in early January 2021, the price has surged, currently trading near $66. This impressive surge reflects a growth of 115%. The stocks consistent performance relative to the broader market trends is a testament to its robust business model, strong brand, and effective management. The strong gains experienced in the last few years have been driven by factors such as same-store sales growth, new restaurant openings, and the expansion of digital ordering and delivery capabilities.

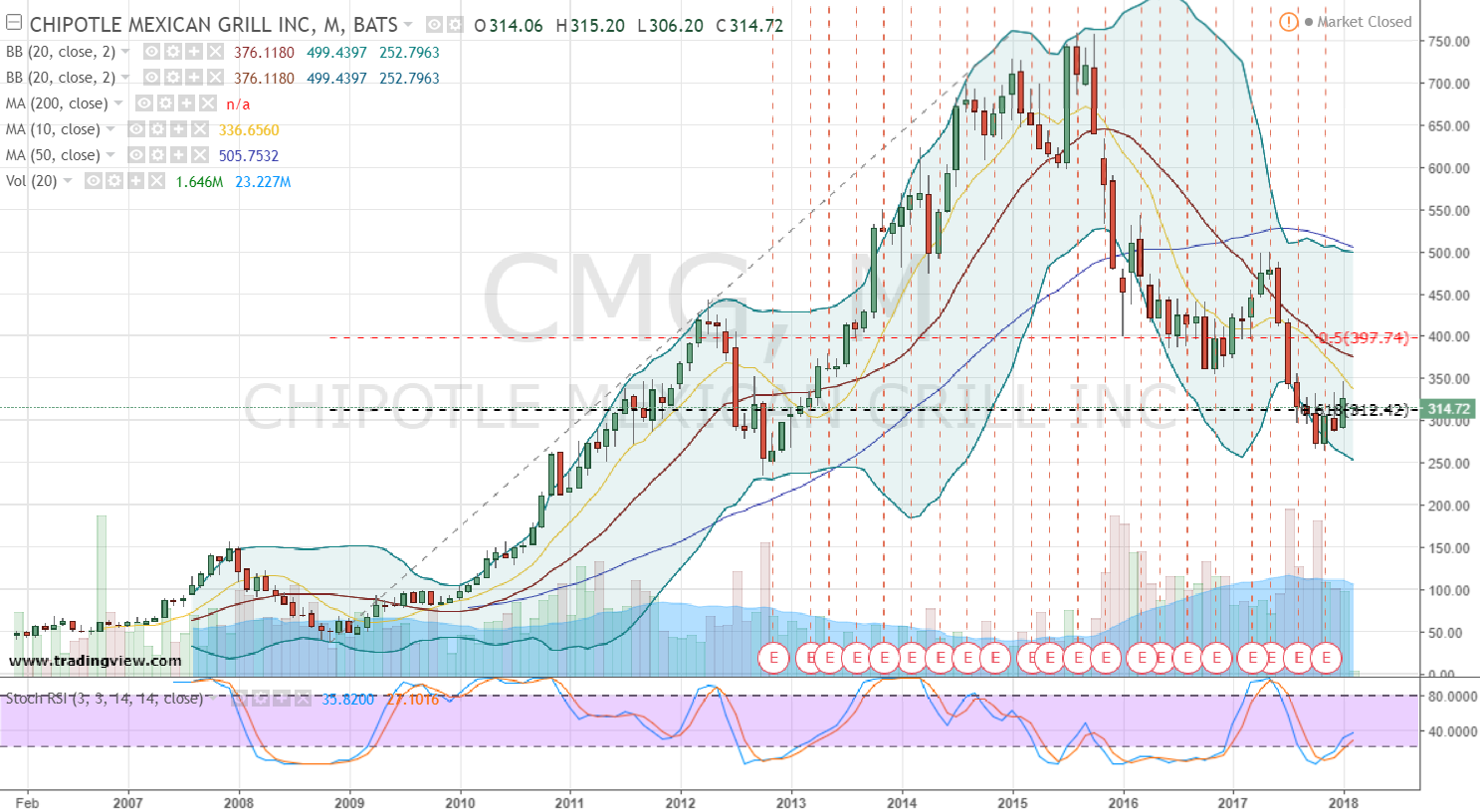

To understand the full scope of CMGs success, its crucial to examine its historical price performance. Platforms such as Yahoo Finance offer a comprehensive archive of historical prices, enabling investors to track the stock's journey over time. By examining the data in daily, weekly, or monthly formats, investors can identify trends, assess volatility, and make more informed decisions. These historical price charts provide valuable insights into market sentiment and the factors influencing the stock's price fluctuations.

- Astrology Signs Taurus Aries Compatibility And Characteristics

- Artistic Nail Designs With White Tips The Ultimate Guide

Chipotle's commitment to innovation, coupled with its robust financial performance, positions it favorably for the future. Its adoption of technology to streamline operations, enhance the customer experience, and expand its delivery capabilities highlights its proactive approach to addressing evolving consumer demands. These initiatives are key to driving future growth and enhancing the companys competitive position.

For those looking to delve into detailed analysis, interactive charts provide an indispensable tool. By using interactive charts, traders and investors can analyze data with a wide range of indicators. These indicators provide a comprehensive overview of the stock's performance, helping them make better informed decisions. Interactive charts can be customized to highlight specific trends, patterns, and key data points, allowing investors to conduct deep dives into market data.

Investors and traders need a continuous stream of information to make informed investment decisions. Staying abreast of the latest news and headlines related to Chipotle Mexican Grill (CMG) is crucial. This information includes company announcements, earnings reports, and market analysis, which help provide insights into the stock's performance and potential risks or opportunities. Financial news outlets and business publications provide valuable resources for keeping investors updated on the latest developments at Chipotle.

Chipotle's impressive performance has garnered attention from financial analysts. These analysts provide estimates, ratings, and price targets, which are valuable in guiding investment strategies. By reviewing analyst estimates for earnings and revenue, including EPS, upgrades, and downgrades, investors can gauge the sentiment surrounding the stock. This information is readily available through financial news websites and brokerage research reports. Analyst ratings often influence market sentiment and can provide insights into the potential risks and rewards associated with investing in Chipotle.

Accessing the latest stock quote, history, news, and vital information is essential for making informed decisions. The stock quote provides real-time pricing and trading data. By exploring the historical performance of the stock, investors can identify trends and make informed investment decisions. Financial news outlets provide valuable information about the company's performance, news, and market dynamics. All these factors are vital for investors who are looking to trade in Chipotle Mexican Grill (CMG).

Analyzing the financials, statistics, and forecasts related to CMG stock is imperative for informed investment choices. This data reveals critical insights into the company's financials, including revenue, earnings, and profitability. Additionally, it offers valuable predictions about future trends, which enable investors to anticipate market movements. Furthermore, this data gives key performance indicators, such as same-store sales growth, which reflect the company's performance. Charts provide investors with a visual representation of the stock's performance, allowing for trend identification and analysis.

The real-time market data is critical for investors and traders. Investors can analyze the latest trades, charts, and data from financial data providers such as NASDAQ. These platforms provide valuable information about stock prices, trading volumes, and market trends. These insights are important for making real-time investment decisions. NASDAQ is a premier source of financial and alternative datasets, which provides detailed information about financial and alternative datasets.

Market dips frequently provide opportunities for shrewd investors. Given Chipotle's solid fundamentals and growth trajectory, these dips can be especially attractive. Those who are already invested in CMG or considering entry should watch these downturns closely. Careful timing and due diligence can enhance potential returns over the long term. The companys strong performance and growth strategy make it an attractive investment choice.

The company's strong brand recognition and commitment to quality ingredients have made it a popular choice among consumers, which in turn has led to a continuous growth. Chipotles focus on providing a unique and customized dining experience, coupled with its tech-driven strategies, strengthens its competitive advantage. This, when combined with prudent financial management, makes the company an appealing option for many investors.

The forthcoming stock split is yet another positive development for investors. It is the latest signal that the company is confident in its future. This split will help to make the stock more accessible, likely boosting trading volume. This, in turn, could increase the value of CMG shares. Chipotles proactive approach demonstrates its commitment to enhancing shareholder value.

By examining the expert analyses of various financial professionals, investors can gain valuable insights and make informed decisions. These analyses include a wide range of data, such as upgrades, downgrades, and price targets. This information helps traders evaluate the stocks potential and make profitable investment choices. Financial analysts offer valuable perspectives on CMGs performance, growth prospects, and future value. They also provide recommendations and predictions that can assist investors in navigating the market.

Chipotle Mexican Grill's (CMG) current performance has garnered attention. The company is well-positioned in a competitive market. This success is not just a matter of chance, it's a testament to strategic vision, adaptability, and effective execution. Chipotle's innovative approach, coupled with its strong brand recognition, sets it apart. As Chipotle continues to evolve, so will its appeal to both consumers and investors.

As the company moves forward, investors are eagerly anticipating its upcoming events. From new product launches to strategic partnerships, the anticipation surrounding Chipotles next moves is palpable. These developments are closely watched as they can provide critical insights into the companys direction and growth prospects.

Investors interested in the companys detailed financial information should explore the complete Chipotle Mexican Grill Inc. reports. Detailed income statements reveal the key financials, giving insights into the company's performance. All these financial statements highlight its revenue streams, expenses, and profits. This gives investors a complete overview of the companys financial health.

In essence, the future looks promising for Chipotle Mexican Grill. With a proven track record, a strong market position, and a commitment to innovation, the company is well-placed for continued success. Investors who have been monitoring CMG are likely to be optimistic. Chipotle's strong fundamentals and positive outlook make it a compelling investment opportunity.

| Attribute | Details |

|---|---|

| Company Name | Chipotle Mexican Grill, Inc. |

| Ticker Symbol | CMG (NYSE) |

| Industry | Restaurants |

| Headquarters | Newport Beach, California |

| Founded | 1993 |

| CEO | Brian Niccol |

| Stock Split (Approved) | June 6, 2024 |

| Recent Stock Performance | Strong gains of 115% from around $30 (early Jan 2021) to around $66 (current) |

| Key Financials | Detailed quarterly/annual income statements available |

| Analyst Ratings | Available; includes earnings, revenue, EPS, upgrades, and downgrades |

| Website for Financial Data | Chipotle Investor Relations |

Article Recommendations

- Top Picks For Gentle Shampoo For Color Treated Hair Enhance Amp Protect

- The Secrets Of A Cancer Man In Relationships Love And Compatibility

Detail Author:

- Name : Dr. Annabell Grant

- Username : autumn.donnelly

- Email : cooper03@breitenberg.com

- Birthdate : 1970-04-21

- Address : 433 Gleichner Island Apt. 771 Unaborough, ID 92788-8777

- Phone : 239-473-5766

- Company : Russel Group

- Job : Commercial Diver

- Bio : Consequatur in qui qui beatae. Sit harum aut consequatur magnam. Laborum ea sed aut numquam eos unde culpa.

Socials

instagram:

- url : https://instagram.com/rstoltenberg

- username : rstoltenberg

- bio : Ullam est tempore et nobis. Quisquam veniam itaque consectetur provident et.

- followers : 1460

- following : 847

tiktok:

- url : https://tiktok.com/@reuben_official

- username : reuben_official

- bio : Consequuntur suscipit ducimus autem aut.

- followers : 1860

- following : 286

twitter:

- url : https://twitter.com/stoltenbergr

- username : stoltenbergr

- bio : Iure et natus voluptatem dolore minus non. Tempore aliquam iusto quis qui nihil est.

- followers : 5632

- following : 650

facebook:

- url : https://facebook.com/rstoltenberg

- username : rstoltenberg

- bio : Quo quia nostrum nihil velit quo aut sit velit.

- followers : 1371

- following : 2395

linkedin:

- url : https://linkedin.com/in/reuben_official

- username : reuben_official

- bio : Iste aut ad libero dolores blanditiis.

- followers : 3174

- following : 865