Understanding Florida Tax Data: Your Guide To [Key Information]

Are you aware of the intricate web of financial transactions and legal frameworks that govern the Sunshine State? Florida's Department of Revenue (DOR) plays a pivotal role in this complex landscape, managing billions of dollars and ensuring compliance with a multitude of tax laws and regulations.

The DOR's activities are far-reaching, impacting individuals, businesses, and the state's overall economic health. Its responsibilities extend beyond mere tax collection; it's also tasked with enforcing child support laws and overseeing property tax administration, making it a central player in Florida's governmental operations.

The DOR's operations are multifaceted. It's not just about collecting taxes; it's about managing the flow of funds, ensuring fairness, and upholding the law. This includes a wide array of duties, from processing tax filings to investigating fraud. The department works diligently to keep things running smoothly, making sure that funds are collected, distributed, and used properly.

- Perfecting Your Look Haircuts For A Heart Shaped Face

- Are Ascendent And Rising Signs Identical Astrology Insights

The scope of the DOR's work is massive. Consider the sheer volume of transactions it handles annually. The DOR manages 36 different types of taxes and fees, processing a staggering $37.5 billion and more than 10 million tax filings each year. This financial throughput underscores the department's importance in maintaining the state's economic stability. The department also handles child support enforcement. The DOR oversees property tax administration, a critical function that ensures the fair assessment of property values.

The data the department processes and reviews is governed by specific sections of the Florida Statutes, including 193.114 and 193.1142. It's important to note that the DOR's data requirements are subject to change annually. This means that businesses and individuals must stay informed about the latest standards and regulations to ensure compliance. The DOR regularly updates its processes and the information it requires, to meet changing needs and situations.

The department actively fights against fraud and misuse of information. Unauthorized access to information on the DOR site is a violation of Florida law and can lead to criminal prosecution. Furthermore, the fraudulent use of personal identification information is a serious offense, classified as a third-degree felony under section 817.568 of the Florida Statutes, carrying penalties including fines of up to $5,000 and potential imprisonment of up to five years.

- July 11 Zodiac Sign Traits Compatibility And Astrological Insights

- January 20 Zodiac Traits And Characteristics

The DOR also provides a range of online services to facilitate tax-related activities. These services include access to taxes, fees, remittances, resale certificates, and child support information. The agency's website serves as a central hub for finding tax data, publications, forms, contact information, and the latest news from the department. You can also pay various taxes, fees, and remittances online through the Florida Department of Revenue website. This digital accessibility streamlines the tax process, making it more convenient for taxpayers and businesses.

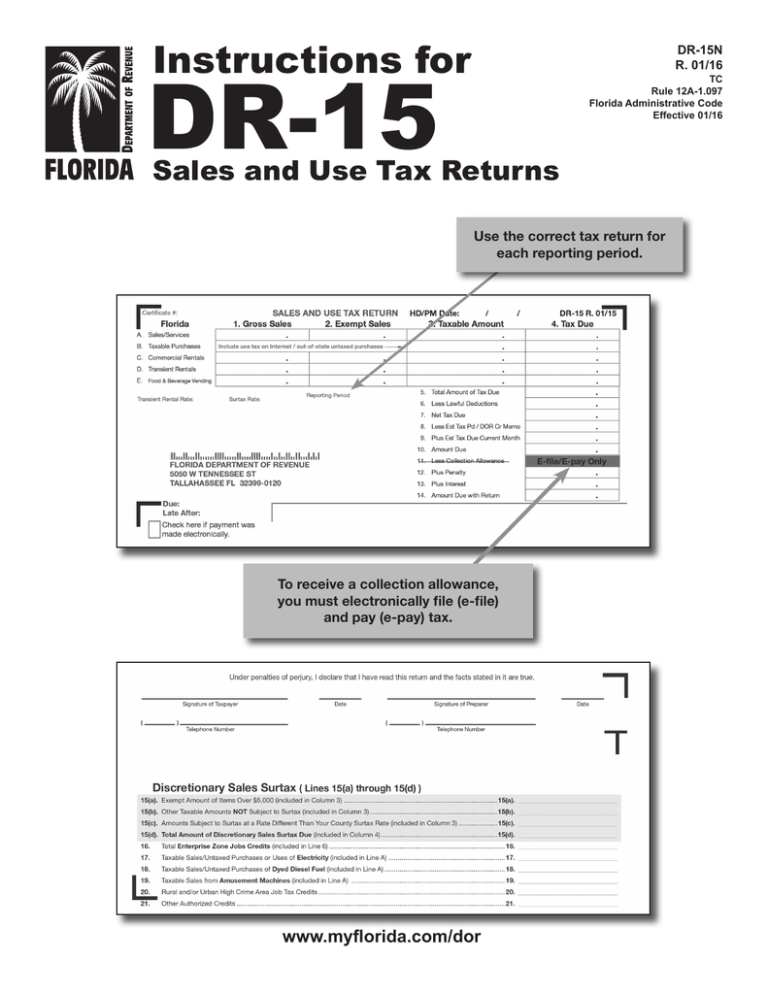

The online platform is well organized, enabling users to navigate through various tax types, such as communications services tax, fuel tax, sales and use tax, and many others. You can learn about the state and local taxes on sales, use, rentals, and admissions in Florida. The website guides users on how to register, file, pay, and report taxes online or by mail. For businesses, the department provides an online application to register for Florida business taxes, requiring a username and password for access. Additionally, there's an online application to file and pay sales and use tax, the prepaid wireless E911 fee, and solid waste tax, fees, and surcharges, which requires user ID, password, or certificate number, along with the business partner number for entry.

The DOR is also responsible for the "Property Tax Oversight Program," which ensures the fair and consistent administration of property taxes across the state. This involves setting standards, providing guidance, and monitoring the activities of local property appraisers and tax collectors. The program aims to ensure that property values are assessed fairly and that taxes are collected in accordance with the law.

The DOR's website is an essential resource for taxpayers, businesses, and anyone seeking information about Florida's tax system. From finding forms to paying taxes online, the website simplifies the complexities of tax compliance. Staying informed about changes in tax laws and regulations is crucial. By utilizing the resources provided by the DOR, individuals and businesses can fulfill their tax obligations efficiently and stay compliant with Floridas laws.

| Category | Details |

|---|---|

| Mission | To administer tax laws fairly and efficiently, and to collect revenue to fund state services. |

| Key Functions |

|

| Taxes and Fees Administered | 36 different taxes and fees, including sales tax, corporate income tax, and fuel tax. |

| Financial Impact (Annually) |

|

| Tax Filings (Annually) | More than 10 million tax filings. |

| Child Support Enforcement |

|

| Property Tax Oversight | Involves overseeing the administration of property taxes across Florida. |

| Online Services |

|

| Legal and Security |

|

| Resources | Tax data, publications, forms, contact information, and news. |

| Forms | Available to order through the online system. |

| Reporting |

|

For further details and access to resources, please visit the official Florida Department of Revenue website: https://floridarevenue.com/.

Article Recommendations

- The Art And Evolution Of Dots Nail Gn A Trendy Manicure Style

- Does Neptune Have An Atmosphere Facts And Details Revealed

Detail Author:

- Name : Lavonne Bogan

- Username : ldamore

- Email : freddie.ward@gmail.com

- Birthdate : 1978-01-06

- Address : 1273 Turcotte Dam New Elwynville, ND 32742-1329

- Phone : 1-610-460-8818

- Company : VonRueden, Franecki and Reinger

- Job : Packer and Packager

- Bio : Deleniti et quae molestiae saepe. Molestiae pariatur et nostrum officiis dolorem cupiditate. Voluptatem necessitatibus autem unde libero sunt quam laboriosam. Laboriosam veritatis et nostrum aut.

Socials

instagram:

- url : https://instagram.com/mschmitt

- username : mschmitt

- bio : Et illum quis consequatur qui alias. Sint eos quae autem sit.

- followers : 3803

- following : 2561

twitter:

- url : https://twitter.com/markschmitt

- username : markschmitt

- bio : Voluptas deserunt repellat est deleniti et fugiat. Dolor impedit ad ullam quo officiis magni. Consequatur ad amet reprehenderit reprehenderit.

- followers : 6712

- following : 2407