Franchise Tax Board Info You Need To Know!

Are you navigating the complex landscape of California's franchise tax regulations? Understanding the intricacies of compliance, deadlines, and available resources is not just beneficial, it's essential for any business operating within the Golden State.

The California Franchise Tax Board (FTB) website, as of January 15, 2025, serves as a primary hub for information and online services. It provides a range of resources, from filing returns and making payments to accessing your MyFTB account. Navigating this digital space efficiently is key, and knowing where to find the right information can save valuable time and prevent potential issues. If you're looking to file a return, make a payment, or check your refund, the FTB website offers direct links for these common tasks. For those needing to access personalized account information, logging into your MyFTB account is the way to go. The site also directs users to popular topics and online services, aiming to streamline the user experience and provide quick access to relevant information.

| Topic | Details | Reference Link |

| Franchise Tax Board (FTB) Certification | As of July 1, 2023, the FTB website is designed to be accessible, in accordance with California Government Code sections 7405 and 11135. | California Franchise Tax Board Official Website |

| Accessibility Compliance | The FTB website adheres to accessibility standards, ensuring usability for all users, including those with disabilities. | FTB Accessibility Information |

| Online Services | Users can file returns, make payments, check refunds, and access their MyFTB accounts directly through the website. | FTB Online Services |

| Tax Calculation Tools | A tax calculator is available, but it does not figure tax for Form 540 2EZ. Users are directed to the 540 2EZ tax tables. | Tax Calculator |

| Income Tax Forms | Instructions and details on required fields for California taxable income, as entered on Form 540, line 19, or Form 540NR, are provided. | FTB Forms |

| Account Access | Accessing the FTB website often requires entering your Social Security Number and last name, ensuring the combination matches records. | FTB Account Access |

| Franchise Tax Account Status | The website provides a search function for checking your franchise tax account status. | FTB Account Search |

| Tax Payment Deadlines | Taxpayers are reminded to pay taxes by April 15 to avoid penalties. | FTB Payment Options |

| Estimated Tax Payments for Corporations | Corporations are generally required to make estimated tax payments equal to 100% of their current year tax to avoid penalties. | FTB Estimated Tax Payments |

| Delaware Corporations | Corporations incorporated in Delaware but not conducting business there are not subject to corporate income tax but still pay franchise tax. | Delaware Franchise Tax Information |

| API Access | API access to FTB data is available, with documentation provided for further information. | FTB API Documentation |

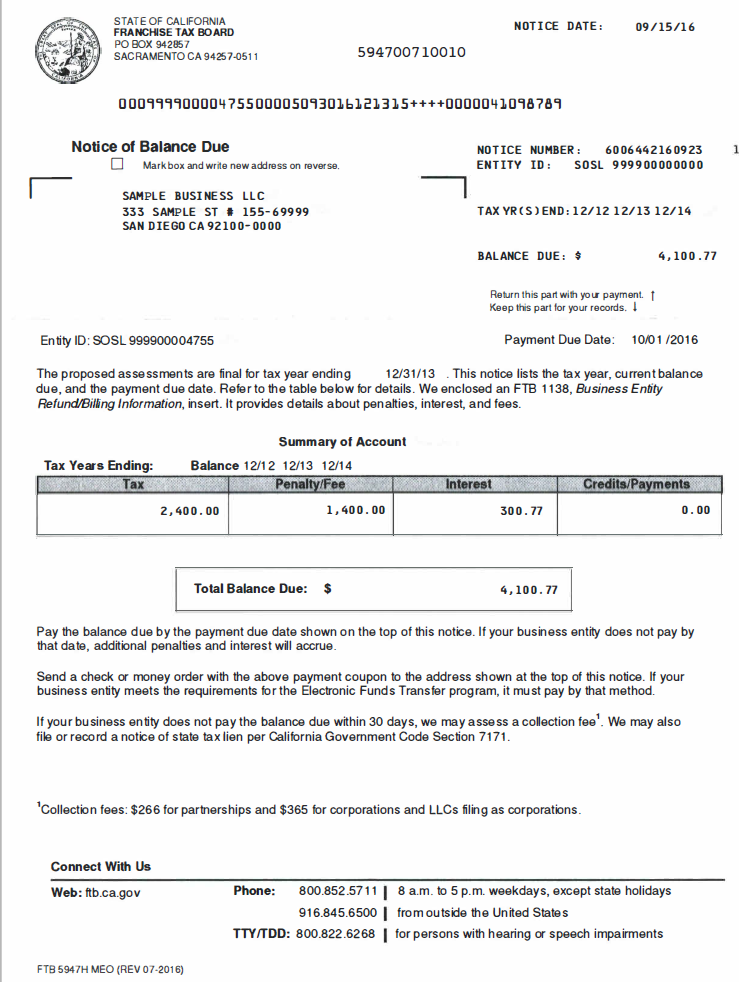

| Notice of Tax Filing or Payment Requirements | A notice may be issued for failure to meet franchise tax filing and/or payment requirements, with instructions on how to resolve the issue. | FTB Notices |

| Taxable Income Brackets | Users are directed to refer to the "if your taxable income is" column to find the applicable tax range for their income, using form 540, line 19 or 540NR line 19. | Tax Calculator with Brackets |

Article Recommendations

- Essential Tips For Tattoo Artists Mastering The Craft

- Guide To Using Snail Mucin Before Or After Moisturizer

Detail Author:

- Name : Dr. Rodrigo Dickinson MD

- Username : urban.rau

- Email : bell.mills@blick.biz

- Birthdate : 1982-02-27

- Address : 905 Maximus Road Schroederport, GA 46702

- Phone : +1 (909) 507-1995

- Company : Hane PLC

- Job : Anthropologist

- Bio : In cumque vitae in ipsam voluptatem. Velit ipsam et officia minus. Iste ab voluptatem dolorum.

Socials

facebook:

- url : https://facebook.com/milowisoky

- username : milowisoky

- bio : Distinctio deleniti beatae maiores vel.

- followers : 4078

- following : 2340

tiktok:

- url : https://tiktok.com/@milowisoky

- username : milowisoky

- bio : Et eveniet officiis sit et. Architecto sit ea modi sed ab quos voluptas.

- followers : 2189

- following : 759

instagram:

- url : https://instagram.com/milo.wisoky

- username : milo.wisoky

- bio : Doloribus occaecati voluptas non nisi explicabo. Laborum mollitia quis minus quia nam.

- followers : 3803

- following : 1840

twitter:

- url : https://twitter.com/milo9552

- username : milo9552

- bio : Eveniet ducimus rerum molestiae repellendus dolor a et. Repellat nihil quis exercitationem delectus doloremque ad eum.

- followers : 4096

- following : 2460

linkedin:

- url : https://linkedin.com/in/mwisoky

- username : mwisoky

- bio : Neque nobis at ipsam quia.

- followers : 749

- following : 1908