CA Tax Website Accessibility & Compliance Updates: Important Info!

In a world grappling with increasingly complex financial landscapes, how can individuals and businesses navigate the intricacies of taxation with confidence and ease? The State of California provides a robust online infrastructure designed to streamline tax-related processes, promote transparency, and ensure accessibility for all residents and stakeholders.

As of June 13, 2023, the digital presence of the California State Board of Equalization, a pivotal component of the state's financial governance, is meticulously designed and maintained to comply with California Government Code sections 7405 and 11135. Furthermore, it adheres to the Web Content Accessibility Guidelines (WCAG) 2.1, achieving Level AA success criteria, as defined by the Web Accessibility Initiative. This commitment underscores California's dedication to ensuring that its online resources are accessible to all, including individuals with disabilities, fostering inclusivity and equal access to crucial information and services.

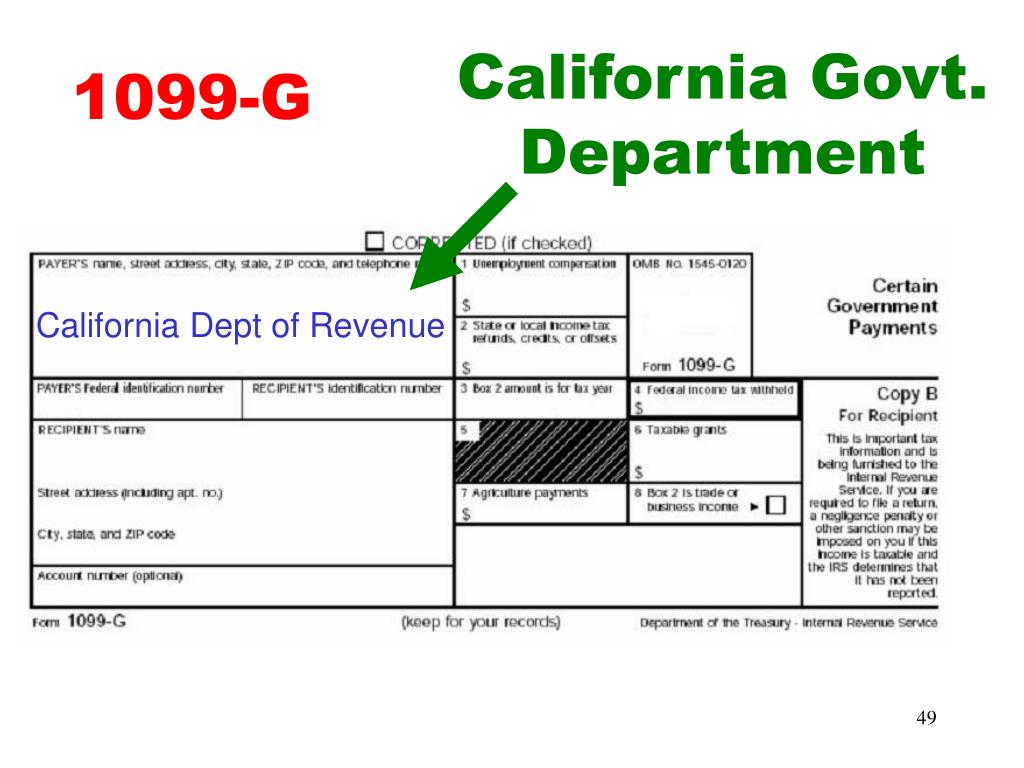

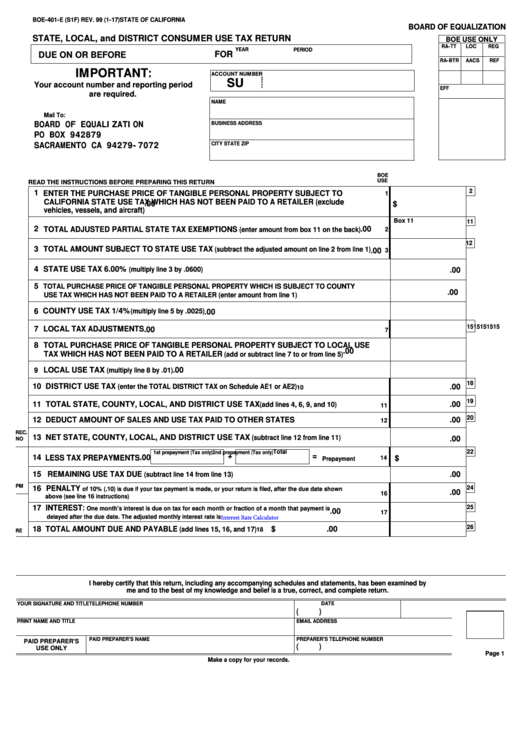

The Franchise Tax Board (FTB), a key partner agency in California's tax administration ecosystem, plays a central role in the state's financial operations. The FTB, in tandem with other essential partners such as the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service, collectively contribute to a cohesive and efficient tax system. This collaborative framework ensures that Californians have access to the resources and support they need to fulfill their tax obligations accurately and promptly.

- Modern Lines Haircut Trendsetting Styles And Techniques

- Revitalize Your Locks With Fresh Curls A Comprehensive Guide

| Agency | Franchise Tax Board (FTB) |

| Certification Date | July 1, 2023 |

| Accessibility Compliance | Designed, developed, and maintained to be accessible. Compliance is denoted by adherence to California Government Code sections 7405, 11135, and (where applicable) 11546.7. |

| Contact | Accessible Technology Program |

| Key Functions | Tax administration, including processing returns, managing payments, and issuing refunds. |

| Online Services | MyFTB account access, file a return, make a payment, check refund status, and access to forms and publications. |

| Partner Agencies | Board of Equalization, California Department of Tax and Fee Administration, Employment Development Department, and Internal Revenue Service. |

| Online Resources | MyFTB offers individuals, business representatives, and tax professionals online access to tax account information and services. |

| Additional Services | Disaster declaration tax payments information, free online tax filing, and a tax calculator. |

| Accessibility Features | Publications and tax form instructions are available in HTML format, offering translation capabilities. |

The FTB website, as of July 1, 2023, is meticulously designed, developed, and maintained with accessibility as a core principle. This commitment ensures compliance with California Government Code sections 7405, 11135, and, in specific instances, 11546.7. By adhering to these stringent standards, the FTB guarantees that its online platform is usable by all, irrespective of their abilities.

Accessing the FTB's online services is designed to be a straightforward process. The "MyFTB" account provides a secure portal for individuals, business representatives, and tax professionals alike to access their tax account information and a suite of online services. Whether it's filing a return, making a payment, or checking the status of a refund, the FTB offers user-friendly tools to manage tax-related responsibilities efficiently.

For those seeking to submit tax payments, the FTB provides clear guidance: separate payments should be submitted for different tax years to ensure accurate and timely processing. Detailed information on disaster declaration tax payments is readily available, catering to the needs of taxpayers affected by specific circumstances.

- Best Guide For Neti Pot Shoppers Tips And Insights For Optimal Results

- Quality Dental Care In Highlands Ranch Co Your Guide To Finding The Best Dentist

The FTB's commitment to user convenience extends to the availability of essential resources. Numerous publications and tax form instructions are available in HTML format, facilitating translation and ensuring accessibility for a diverse audience. The "Forms and Publications Search Tool" offers a comprehensive list of tax forms, instructions, and publications, along with their available formats.

In a bid to simplify the tax filing process, the FTB offers "File Online," enabling taxpayers to submit their state tax returns directly and free of charge. The website also features a "Tax Calculator" for the 2024 tax year, allowing users to quickly estimate their tax liability based on their filing status and income. This calculator is intended for the 2024 tax year only; users are advised not to use it for the 540 2EZ form or prior tax years.

Security is paramount. The FTB employs rigorous measures to protect user data. To access specific services, users are required to enter their Social Security number and last name, which must match the records on file. A warning is prominently displayed, cautioning users to be wary of text message and other scams during tax season.

The California State Board of Equalization plays a crucial role in overseeing the state's tax and fee programs. The Board's composition includes the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization, ensuring balanced oversight and accountability. The chief administrative official, the Executive Officer of the Franchise Tax Board, leads the day-to-day operations and strategic initiatives.

The FTB website, as of July 1, 2023, is meticulously designed, developed, and maintained with accessibility as a core principle. This commitment ensures compliance with California Government Code sections 7405, 11135, and, in specific instances, 11546.7. By adhering to these stringent standards, the FTB guarantees that its online platform is usable by all, irrespective of their abilities.

Accessing the FTB's online services is designed to be a straightforward process. The "MyFTB" account provides a secure portal for individuals, business representatives, and tax professionals alike to access their tax account information and a suite of online services. Whether it's filing a return, making a payment, or checking the status of a refund, the FTB offers user-friendly tools to manage tax-related responsibilities efficiently.

For those seeking to submit tax payments, the FTB provides clear guidance: separate payments should be submitted for different tax years to ensure accurate and timely processing. Detailed information on disaster declaration tax payments is readily available, catering to the needs of taxpayers affected by specific circumstances.

The FTB's commitment to user convenience extends to the availability of essential resources. Numerous publications and tax form instructions are available in HTML format, facilitating translation and ensuring accessibility for a diverse audience. The "Forms and Publications Search Tool" offers a comprehensive list of tax forms, instructions, and publications, along with their available formats.

In a bid to simplify the tax filing process, the FTB offers "File Online," enabling taxpayers to submit their state tax returns directly and free of charge. The website also features a "Tax Calculator" for the 2024 tax year, allowing users to quickly estimate their tax liability based on their filing status and income. This calculator is intended for the 2024 tax year only; users are advised not to use it for the 540 2EZ form or prior tax years.

Security is paramount. The FTB employs rigorous measures to protect user data. To access specific services, users are required to enter their Social Security number and last name, which must match the records on file. A warning is prominently displayed, cautioning users to be wary of text message and other scams during tax season.

The California State Board of Equalization plays a crucial role in overseeing the state's tax and fee programs. The Board's composition includes the California State Controller, the Director of the California Department of Finance, and the Chair of the California State Board of Equalization, ensuring balanced oversight and accountability. The chief administrative official, the Executive Officer of the Franchise Tax Board, leads the day-to-day operations and strategic initiatives.

The collaborative spirit among partner agencies, including the Board of Equalization, the California Department of Tax and Fee Administration, the Employment Development Department, and the Internal Revenue Service, is a cornerstone of California's tax system. This synergy ensures a coordinated approach to tax administration, providing taxpayers with consistent information and streamlined services. These agencies also provide valuable information about tax reporting and taxpayer rights.

As of July 1, 2023, the FTB reaffirms its commitment to accessibility. The agency's website has been designed, developed, and is maintained in accordance with accessibility standards. Compliance is affirmed by adherence to California Government Code sections 7405, 11135, and 11546.7. The "Accessible Technology Program" serves as the contact point for related inquiries.

The continuous pursuit of accessibility reflects a core value within the FTB and the State of California as a whole. This relentless effort aims to provide a seamless, equitable, and inclusive experience for every taxpayer, reinforcing the state's dedication to serving all its citizens.

In summary, California's tax landscape is a testament to the state's commitment to transparency, accessibility, and efficiency. Through its online platforms, collaborative partnerships, and unwavering dedication to meeting accessibility standards, California is setting a benchmark for how government agencies can effectively serve the public while ensuring inclusivity and equal access for all.

Article Recommendations

- The Intriguing Evolution Of Michael Jacksons Nose A Detailed Analysis

- Erykah Badus Tattoos Art Meaning And Influence

Detail Author:

- Name : Jonatan Douglas

- Username : jwyman

- Email : ron.mraz@yahoo.com

- Birthdate : 1995-03-23

- Address : 12792 O'Keefe Lodge Brekkestad, ME 72449

- Phone : (708) 367-8324

- Company : Nader, Powlowski and Smith

- Job : Metal Pourer and Caster

- Bio : Sunt laudantium omnis exercitationem officia vel ut fugit. Commodi facilis error enim repudiandae. Nemo cum quia atque eius eos. Quis nihil cupiditate sit doloribus.

Socials

linkedin:

- url : https://linkedin.com/in/janick_real

- username : janick_real

- bio : Doloremque provident non vel aut.

- followers : 260

- following : 1070

twitter:

- url : https://twitter.com/jsimonis

- username : jsimonis

- bio : Quibusdam ut delectus debitis quia facere. Ut repellat esse tempore fugiat illo quia. Rerum fuga quis impedit eaque odit.

- followers : 4928

- following : 628

instagram:

- url : https://instagram.com/janick_simonis

- username : janick_simonis

- bio : Est sunt excepturi et totam est. Delectus dolor sint quas minus nisi. Quis qui voluptas qui.

- followers : 148

- following : 258

tiktok:

- url : https://tiktok.com/@janick_id

- username : janick_id

- bio : Possimus qui distinctio dolor error earum nulla. Ipsam a aut error quisquam.

- followers : 1998

- following : 2821

facebook:

- url : https://facebook.com/jsimonis

- username : jsimonis

- bio : Voluptatum sint maiores voluptatem reprehenderit omnis.

- followers : 786

- following : 1611