Simplify Nanny Payroll With Poppins Payroll: Easy & Affordable!

Is managing household payroll a source of stress and confusion? Discover how Poppins Payroll offers a simple, affordable, and compliant solution, transforming the complexities of nanny taxes into a manageable task.

In today's world, many families rely on nannies, housekeepers, and senior caregivers. However, navigating the legal and financial requirements of employing household staff can be daunting. From understanding tax obligations to ensuring accurate payments, the process can be time-consuming and prone to errors. Poppins Payroll steps in to alleviate this burden, offering a comprehensive service designed to simplify the entire process. Their platform simplifies the complex process with a user-friendly interface that provides complete transparency in pricing and services. For families in Colorado, Poppins Payroll is the trusted, easy, and affordable solution.

Poppins Payroll addresses a crucial need for families employing household staff. The service handles all aspects of payroll and taxes, including calculating wages, withholding and remitting taxes, and generating pay stubs. The service also handles tax filings and payments and will cover any penalties and interest they cause, standing behind their work. The monthly fee includes all services, eliminating the need for additional charges for features that other services may charge extra for. This makes it an attractive option for families seeking an all-inclusive payroll solution.

- 920 Angel Number A Guide To Understanding Its Meaning And Significance

- Discover Your Astrological Moon Sign What Is Your Moon Sign

Poppins Payroll operates with a commitment to compliance. For families unsure of the legal requirements for employing household staff, the platform provides guidance and ensures adherence to all applicable federal and state regulations. This reduces the risk of penalties and ensures that both the employer and employee are protected.

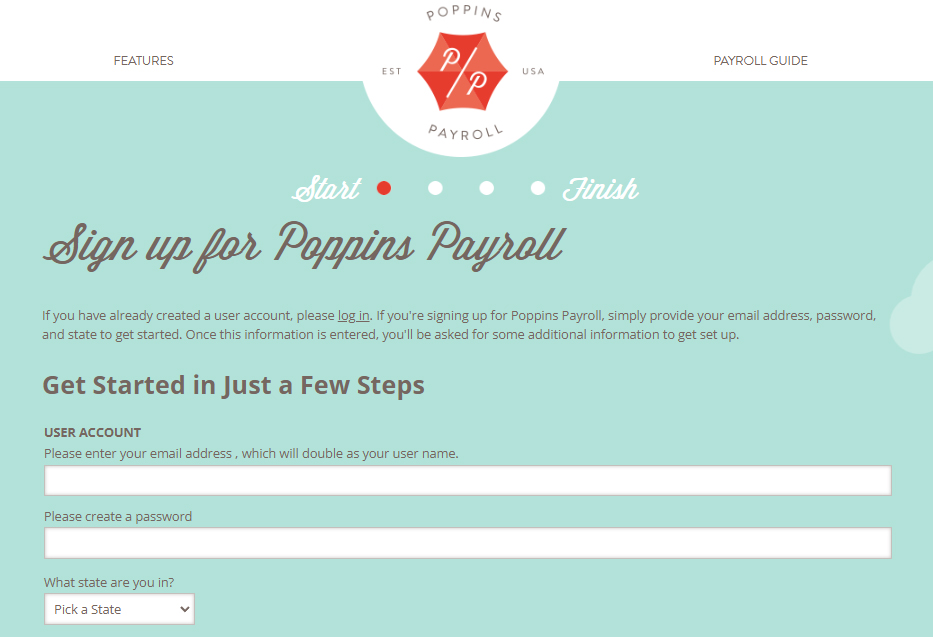

The services features extend beyond basic payroll processing. The system offers automatic calculations, direct deposit, and electronic filing, streamlining the workflow. It also supports integration with existing systems, making the transition seamless. The platform is also easy to use. The user interface is colorful and enjoyable, listing its services and fees with complete transparency, providing a clear understanding of costs and services.

For many families, the fear of making a mistake in payroll or tax calculations is a major deterrent to hiring household help. Poppins Payroll addresses this concern by offering a guarantee of accuracy and compliance. This promise of reliability instills confidence in the service, making it a trustworthy partner for household payroll management.

The financial benefits of using Poppins Payroll are substantial. The service eliminates the need for expensive accounting software or hiring a professional payroll service. Furthermore, by ensuring compliance, Poppins Payroll reduces the risk of costly penalties and audits, saving families both money and time.

The user experience with Poppins Payroll is designed to be intuitive and efficient. The sign-up process is straightforward, requiring users to enter employer and employee information only once. The platform provides an easy and affordable way to manage payroll, offering a simple and affordable way to handle taxes and payroll for nannies, housekeepers, senior caregivers, and more.

Poppins Payroll presents an easier way to handle taxes and payroll for nannies, housekeepers, senior caregivers, and anyone else you employ in your home. The platform streamlines the often-complex tasks associated with managing household employees, allowing families to focus on what matters most. With services that range from depositing payments to employee accounts and remitting payroll taxes to electronically filing tax forms, families can manage payroll, view tax filings and payments, and update account details.

The impact of Poppins Payroll extends beyond its direct users. By making it easier to manage household payroll, Poppins Payroll helps to create a more stable and compliant environment for domestic workers. The platform facilitates fair compensation and ensures that employees receive the benefits they are entitled to, promoting a more equitable workplace.

The service's commitment to user satisfaction is evident in its approach. Poppins Payroll handles all aspects of nanny and household payroll and taxes at an affordable price. The service offers smart, simple, and compliant payroll for busy families. Families can compare the service to others, noting Poppins Payroll as the only trusted, easy, and affordable tax and payroll service serving Colorado. It also offers 100% compliance, relieving clients from stress.

Families in Virginia will be pleased to know that the state's minimum wage is $13.50 per hour. It will increase to $15 on January 1, 2026. Household employers in Virginia must pay overtime at 1.5 times the regular rate of pay after 40 hours of work in a calendar week.

Poppins Payroll is transforming nanny taxes into childs play by taking care of everything needed to stay 100% compliant. By making the process easy to use, and easy to navigate, the company has saved its users time and worry. When considering signing up for the nanny tax payroll services, you simply enter the employer information (thats you) and employee information (thats who youre paying) once and only once.

Poppins Payroll is a service that helps you pay your nanny or household employee legally and easily. If a family is in need of a nanny or household employee, Poppins Payroll has all the tools to make the process easy.

Heres a closer look at Poppins Payroll's key aspects and how it stands out in the market:

Core Services:

- Payroll Processing: Calculating wages, managing deductions, and generating pay stubs.

- Tax Management: Withholding, remitting, and filing federal, state, and local taxes.

- Direct Deposit: Facilitating secure and timely payments to employees' bank accounts.

- Compliance: Ensuring adherence to all relevant tax laws and regulations.

Key Features and Benefits:

- User-Friendly Interface: Easy-to-navigate platform for both employers and employees.

- Affordable Pricing: Cost-effective solutions tailored to various household payroll needs.

- Time Savings: Automating tasks to reduce administrative burden.

- Accuracy Guarantee: Minimizing the risk of errors and penalties.

- Customer Support: Providing assistance and guidance when needed.

Competitive Advantages:

- Comprehensive Service: Handling all aspects of household payroll.

- Transparent Pricing: No hidden fees or extra charges for essential services.

- Reliability: A reputation for accuracy and dependability.

- Compliance Expertise: Ensuring adherence to evolving tax regulations.

How It Works:

- Sign Up: Register on the Poppins Payroll platform.

- Enter Information: Provide details about your household employees and their compensation.

- Payroll Processing: Poppins Payroll calculates wages, taxes, and deductions.

- Payments: Employees receive payments via direct deposit.

- Tax Filing: Poppins Payroll handles tax filings and payments on your behalf.

Poppins Payroll offers an easy and affordable way to manage payroll for nannies, senior caregivers, housekeepers, and other household staff. Priced at $49 monthly for one worker, it handles all nanny payroll and tax processes.

Poppins Payroll has proven to be a reliable solution for countless families. For the past 5 years, the service has made managing nanny hours easy to update. The company takes care of everything and is so reliable.

For those considering using Poppins Payroll, here's a simple breakdown of the process:

- Sign Up: Create an account on the Poppins Payroll website. This is the first step.

- Provide Information: Enter your details as the employer, along with your employee's information. Include details on pay rates, hours worked, and any deductions.

- Set Up Payroll: Configure your payroll schedule (weekly, bi-weekly, etc.). You also indicate the payment method, usually direct deposit.

- Run Payroll: Each pay period, log in and review or enter the hours your employee has worked. Poppins Payroll calculates wages, withholds taxes, and handles other deductions.

- Make Payments: Approve the payroll, and Poppins Payroll will deposit the net pay directly into your employee's account.

- Tax Filing: Poppins Payroll handles the filing of all necessary tax forms (W-2, 941, etc.) and remittances to the IRS and state tax agencies.

- Access Records: You and your employee can access pay stubs, tax forms, and payroll reports through the online portal.

Nine Required Steps to Pay a Nanny Legally

- Create a Clear Nanny Contract

- Classify Your Nanny as an Employee

- Obtain an Employer Identification Number (EIN)

- Register for State Tax Accounts

- Determine the Payment Method

- Establish a Payroll Schedule

- Calculate and Withhold Taxes

- File Taxes

- Maintain Accurate Records

Poppins Payrolls success is a testament to its ability to simplify a complex process. It streamlines the often-complicated task of managing household employees, enabling families to focus on their priorities. From its user-friendly interface to its commitment to 100% compliance, Poppins Payroll proves its value, making the challenges of household payroll management a thing of the past.

Poppins Payroll is more than just a service; it's a partner in simplifying the responsibilities of being a household employer, ensuring compliance, and freeing up valuable time and resources. It offers a complete solution for families, simplifying the process with its easy-to-use interface and making taxes merry. Poppins Payroll stands out as a trusted, easy, and affordable solution for managing nanny and household payroll.

Article Recommendations

- Achievements Of Halle Berry A Trailblazing Career In Hollywood

- Elegance And Style Hime Cut Bangs For Modern Fashion

Detail Author:

- Name : Eugene Effertz

- Username : marianne.yundt

- Email : joyce66@lemke.org

- Birthdate : 1973-04-03

- Address : 79691 Nolan Ports Suite 668 Sierrachester, NE 52978-6606

- Phone : 910.202.8617

- Company : Hayes, Koelpin and Mohr

- Job : Vice President Of Human Resources

- Bio : Consequatur eligendi dolores qui molestias. Rerum voluptatibus iusto ut id ea. Ratione quidem sequi similique nihil est ea quod voluptates.

Socials

linkedin:

- url : https://linkedin.com/in/lnolan

- username : lnolan

- bio : Necessitatibus consequatur cum et et occaecati.

- followers : 2253

- following : 1579

twitter:

- url : https://twitter.com/lula_real

- username : lula_real

- bio : Sed expedita maiores quia quia praesentium. Consequatur perferendis facere veritatis a rerum. Sit velit ullam illum dolorem distinctio quo voluptatem.

- followers : 5359

- following : 712

instagram:

- url : https://instagram.com/lula.nolan

- username : lula.nolan

- bio : Sunt suscipit quia veniam. Et et voluptatem vel nam est repellat.

- followers : 1275

- following : 2101

facebook:

- url : https://facebook.com/nolanl

- username : nolanl

- bio : Voluptas quia ut delectus beatae dolores mollitia. Sit quaerat culpa libero.

- followers : 4092

- following : 2436

tiktok:

- url : https://tiktok.com/@lula.nolan

- username : lula.nolan

- bio : Aut esse deserunt qui magni consequatur animi illum.

- followers : 273

- following : 1840