NYS Taxes: Filing, Rates, & Calculator [2024]

Are you prepared for the complexities of tax season in New York? Navigating the financial landscape of the Empire State requires a thorough understanding of its unique tax regulations, from income tax rates to available credits and deductions the details are critical to successfully managing your finances.

New York's tax system can seem daunting, especially with the various components at play. From the intricacies of state and local income taxes to the nuances of sales tax and withholding, understanding these elements is crucial for every taxpayer. This comprehensive guide will delve into the specifics, offering clarity and actionable insights to help you navigate the tax season effectively.

New York State, New York City, and other locales within the state employ distinct tax structures, each with its own set of regulations and rates. Staying informed on these specifics is key to responsible financial management. Additionally, taxpayers must be aware of various services provided by the New York State Department of Taxation and Finance, including online filing options, payment methods, and assistance programs.

- The Ultimate Guide To Cool Blonde Hair Color Styles Tips And More

- Understanding Retinol Shelf Life Does Retinol Expire And How To Maximize Its Efficacy

To provide a clearer understanding, let's break down the key components of the New York State tax system.

| Tax Component | Description | Key Considerations |

|---|---|---|

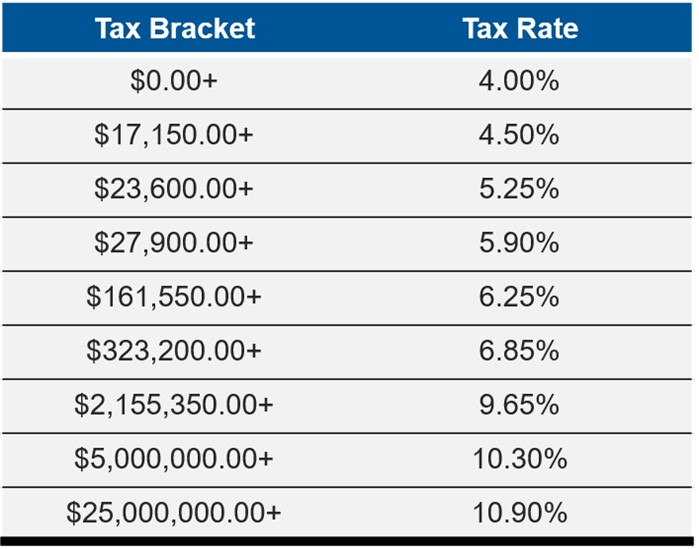

| Income Tax Rates | New York utilizes a progressive income tax system, with rates varying based on income levels and filing status. There are nine different income tax rates, ranging from 4% to 10.9%. | Taxpayers should familiarize themselves with the current tax brackets to accurately assess their liabilities. Consult the 2024 tax tables available on the NY Department of Taxation and Finance website. |

| Tax Brackets | Tax brackets define the income ranges to which specific tax rates apply. These brackets differ based on filing status, such as single, joint, head of household, and married filing separately. | Keep track of adjustments in tax brackets, which can impact the overall tax burden. |

| Filing Status | Filing status determines the tax rates, deductions, and credits available to a taxpayer. Common filing statuses include single, married filing jointly, married filing separately, and head of household. | Choose the filing status that best suits individual circumstances, potentially maximizing tax savings. |

| Residency | New York's tax laws distinguish between residents, nonresidents, and part-year residents. Residency status affects the taxation of income earned within and outside the state. | Determine the correct residency status to avoid potential tax complications. |

| Deductions and Exemptions | Taxpayers can reduce their taxable income through deductions and exemptions. These may include itemized deductions, such as state and local taxes, or standard deductions. | Identify all eligible deductions and exemptions to potentially lower tax liabilities. New York allows itemization regardless of federal itemization status. |

| Credits | Tax credits directly reduce the amount of tax owed. Numerous credits are available in New York, including those for child and dependent care, college tuition, and earned income. | Investigate eligibility for tax credits that can significantly lower the tax bill. |

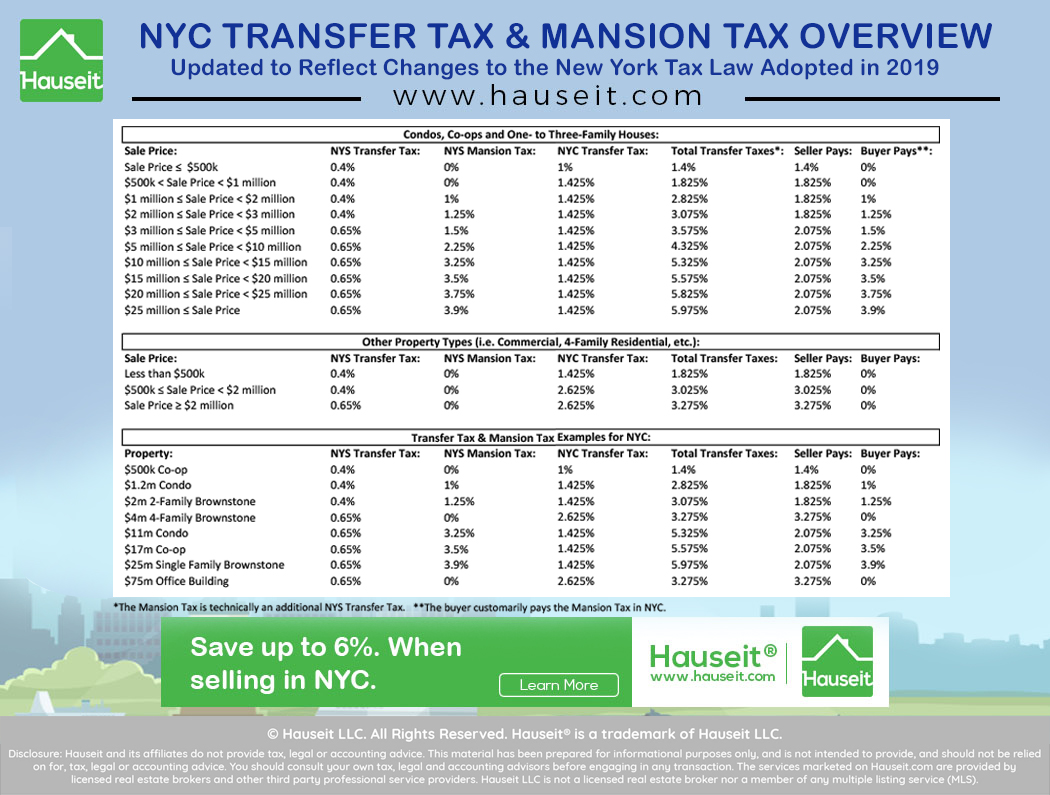

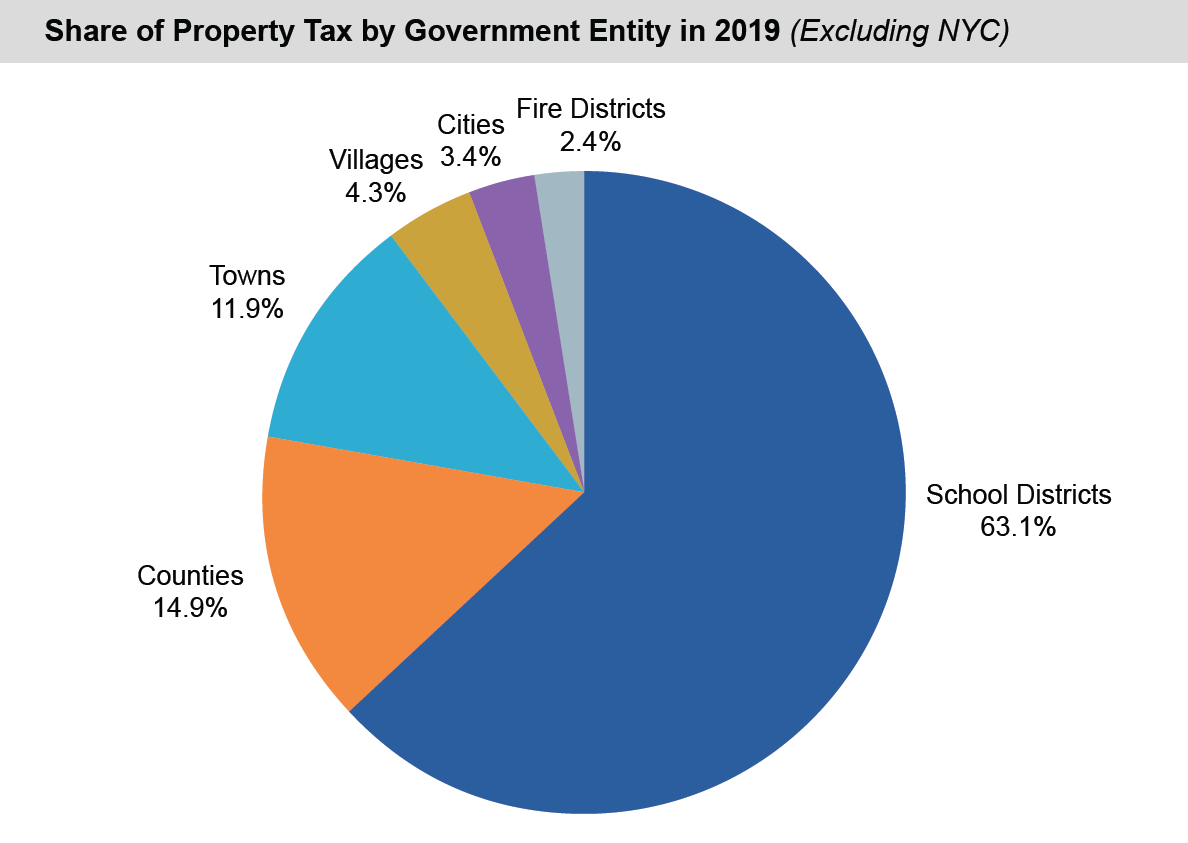

| Sales Tax | Sales tax is levied on the retail sale of certain goods and services in New York. The rate varies by locality, with both state and local components. | Understand the sales tax rates applicable in different locations to accurately calculate costs. |

| Withholding Tax | Employers withhold income tax from employees' wages and remit it to the state. The amount withheld depends on the employee's W-4 form and the applicable tax rates. | Ensure proper withholding to avoid underpayment penalties or significant tax liabilities. |

| Estimated Tax | Individuals with income not subject to withholding, such as self-employment income, may be required to make estimated tax payments quarterly. | Comply with estimated tax obligations to avoid penalties for underpayment. |

| Metropolitan Commuter Transportation Mobility Tax (MCTMT) | A tax levied on certain businesses and individuals within the Metropolitan Commuter Transportation District (MCTD) to fund transportation infrastructure. | Determine if the MCTMT applies and comply with associated tax obligations. |

| New York City and Yonkers Taxes | Residents of New York City and Yonkers may be subject to additional local income taxes. These taxes have their own rates and regulations. | Familiarize yourself with the specific tax rules applicable in New York City and Yonkers. |

Taxpayers should be aware of various services offered by the New York State Department of Taxation and Finance. These include online services, filing assistance, and methods for resolving tax debts.

Online Services: The New York State Department of Taxation and Finance offers a suite of online services accessible through www.tax.ny.gov/online. These tools allow taxpayers to manage their tax information securely and efficiently.

- Illuminati Secrets Discover The Hidden Truths

- Mccook Humane Society A Beacon Of Compassion And Care For Animals

With an online services account, you can:

- Make payments

- Respond to department notices

- File an income tax extension

- Sign up for refund notifications

- Access your tax information anytime, anywhere

Online services is the fastest, most convenient way to conduct business with the tax department, providing a secure and user-friendly platform to manage your tax obligations. The department recommends replacing any old login page bookmarks with ones to www.tax.ny.gov/online to ensure security and access the correct site.

Direct File: For qualifying taxpayers, Direct File is an option to complete their 2024 returns. This service offers a streamlined and secure way to file, and it is available until October 15, 2025, for eligible filers.

Payment Options:

- Online Payments: Regardless of how you file, you can pay your income tax online.

- Scheduling Payments: Payments can be scheduled up to the due date.

- Extension Payments: Extension payments must be made by the original due date if an extension is filed.

- Credit Card Payments: Credit card payments are accepted, with a 2.20% convenience fee.

Tax Forms and Filing:

- New York provides various forms for tax filing. Ensure the correct forms are used based on the filing requirements.

- If you fail to follow instructions, it may lead to interest and penalties.

- Filing status will affect how your tax return is processed.

Tax Credits: Numerous credits are available in New York to help reduce your tax liability.

- Child and Dependent Care Credit: Available at the state and city level to help with childcare expenses.

- College Tuition Credit: Taxpayers can claim credit to assist with tuition expenses.

- Earned Income Credit: Taxpayers can also claim the earned income credit (EIC) at the state and city levels.

- Household Credit: Available at the state and city level.

- Empire State Child Credit: Residents may be eligible for the Empire State Child Credit.

- Noncustodial Parent Earned Income Credit: Available to qualifying noncustodial parents.

The New York State Department of Taxation and Finance offers various resources to aid taxpayers in their tax-related duties.

Income Tax Filing Resource Center: Access the Income Tax Filing Resource Center for help and guidance. This hub is designed to assist taxpayers in navigating the filing process and understanding their tax responsibilities.

Tax Calculators:

- New York Tax Calculator: This tool, updated for the 2025/26 tax year, helps calculate federal, Medicare, and pension plan (FICA, etc.) taxes.

- It supports single, joint, and head of household filing statuses.

Forms and Publications: The state provides various tax forms and publications on its website. Taxpayers should use official documents and follow instructions when preparing their tax returns. For more comprehensive information, consult the official website of the NYS Department of Taxation and Finance.

Understanding Estimated Taxes: Estimated tax is required when no or not enough tax is withheld from income. This is common for individuals with self-employment earnings or income that does not have tax withheld. You may be required to make estimated tax payments to New York State if you receive certain types of taxable income and no tax is withheld, or if you are subject to the Metropolitan Commuter Transportation Mobility Tax (MCTMT).

Who Must Withhold Personal Income Tax? Employers are mandated to withhold personal income tax from employees' wages. Determining who to withhold tax for, the amount to deduct, and the information to report are critical responsibilities. Refer to the official guidelines for accurate withholding calculations and compliance.

Tax Rates and Tax Tables: Detailed information on tax rates and tables for New York State, New York City, Yonkers, and the Metropolitan Commuter Transportation Mobility Tax is available. These resources are indispensable for accurately calculating tax liabilities.

Tax Credits: The state of New York provides a range of credits to reduce your tax liability, including the Child and Dependent Care Credit, College Tuition Credit, Earned Income Credit, Household Credit, Empire State Child Credit, and Noncustodial Parent Earned Income Credit. These credits can provide substantial tax savings.

Avoid Supplemental Taxes: Taxpayers in New York City or Yonkers must be vigilant to avoid supplemental taxes. Carefully review the instructions and requirements specific to those locations when filing.

Interest and Penalties: Taxpayers should diligently follow instructions and meet deadlines to avoid interest and penalties on their taxes. Failure to do so may result in additional charges on the tax due.

Processing Your Tax Return: Once you submit your tax return, it goes through various stages of processing. Instant confirmation is provided by the New York State Tax Department, and you can confirm payment receipt through your bank statement. The statement will show an "NYS tax payment" line item for the authorized amount.

Stay Updated: Tax laws and regulations are subject to change. Staying informed about the latest updates and changes is essential for maintaining compliance. Continue to monitor the official website of the New York State Department of Taxation and Finance.

Disclaimer: The information provided in this guide is for informational purposes only and should not be construed as tax advice. Consult with a qualified tax professional for personalized advice tailored to your specific financial situation.

Tax season in New York requires diligence, accuracy, and a thorough understanding of the tax laws. By utilizing the resources provided and staying informed, taxpayers can effectively manage their tax obligations and potentially reduce their tax liabilities.

Article Recommendations

- Enhancing Mlb Pitcher Communication Strategies For Success

- Discover The Mysteries Of Realms And Their Significance

Detail Author:

- Name : Lavonne Bogan

- Username : ldamore

- Email : freddie.ward@gmail.com

- Birthdate : 1978-01-06

- Address : 1273 Turcotte Dam New Elwynville, ND 32742-1329

- Phone : 1-610-460-8818

- Company : VonRueden, Franecki and Reinger

- Job : Packer and Packager

- Bio : Deleniti et quae molestiae saepe. Molestiae pariatur et nostrum officiis dolorem cupiditate. Voluptatem necessitatibus autem unde libero sunt quam laboriosam. Laboriosam veritatis et nostrum aut.

Socials

instagram:

- url : https://instagram.com/mschmitt

- username : mschmitt

- bio : Et illum quis consequatur qui alias. Sint eos quae autem sit.

- followers : 3803

- following : 2561

twitter:

- url : https://twitter.com/markschmitt

- username : markschmitt

- bio : Voluptas deserunt repellat est deleniti et fugiat. Dolor impedit ad ullam quo officiis magni. Consequatur ad amet reprehenderit reprehenderit.

- followers : 6712

- following : 2407