Student Loan Repayment Updates & Key Info You Need Now!

Is the American Dream becoming a debt sentence? The weight of student loan debt, exceeding $1.6 trillion and affecting over 42.7 million borrowers, is reshaping the financial landscape for a generation.

The echoes of the recent economic shifts still reverberate through the halls of higher education and into the wallets of those who pursued it. The landscape of student loan repayment is undergoing a significant transformation, with millions navigating a complex web of rules, regulations, and potential pitfalls. The stakes are high, influencing not only individual financial well-being but also the broader economic health of the nation. Understanding these rules is no longer a matter of convenience; it's a necessity.

| Category | Details |

|---|---|

| Affected Population | 42.7 million borrowers |

| Total Debt Owed | Over $1.6 trillion |

| Delinquency Rate (as of February 2025, estimated) | Approximately 4 million borrowers were more than 90 days overdue on repayment, double the rate from six years prior. |

| Borrowers Behind on Payments (Estimates) | Over 5 million borrowers have not made a payment in 360 days or more; 4 million more are between 91 to 180 days behind. |

| Current Payment Status | Just over a third of borrowers (38%) are current on their student loans. |

| Key Action: Resumption of Collections | The Department of Education planned to resume collecting on student loans in early May. This puts millions of borrowers' retirement benefits and wages at risk. |

| Source of Information | studentaid.gov |

The fundamental structure of student loan repayment begins with understanding the source. Federal student loans, the most common type, are, in essence, financed by the American people. This means that every policy decision, every regulatory shift, and every individual payment directly impacts a broader societal obligation. The government's role in this process is multifaceted, encompassing everything from loan origination and disbursement to collection and, at times, forgiveness programs.

- Elegant Choices Gray Nail Polish Colors For Every Occasion

- Perfect Hairstyles Short Hair For Heart Shaped Face

A critical component of the current landscape is the resumption of collections. After periods of forbearance and relief measures, the Department of Education initiated the process of collecting on outstanding student loans. This has wide-ranging implications, including the potential garnishment of wages and the seizure of retirement benefits for borrowers who are behind on their payments. For many, this is a stark reality, as the specter of financial penalties looms large.

The sheer volume of debt is staggering. Today, the collective burden carried by 42.7 million borrowers exceeds $1.6 trillion. This massive debt load is not evenly distributed, and its impact is further complicated by the various loan types, repayment plans, and economic circumstances of individual borrowers. Some individuals are struggling to keep up with monthly bills, while others are strategically navigating repayment options to minimize the long-term financial impact.

The current state of repayment reflects a concerning trend. An estimated 4 million student loan borrowers were more than 90 days overdue on repayment by the end of February 2025, doubling the delinquency rate compared to six years prior. Moreover, the Department of Education estimates that over 5 million borrowers have not made a payment in 360 days, and an additional 4 million are between 91 to 180 days behind. This data paints a picture of widespread financial strain among borrowers.

- Discover Your Astrological Moon Sign What Is Your Moon Sign

- Permanent Retainer Pain Causes Solutions And Prevention

The Biden administration's policies have also played a role in this environment. Monthly student loan bills were resumed in the fall of 2023, but involuntary collections were deferred. This deferment provided a temporary respite for some, but the eventual implementation of standard repayment protocols highlighted the necessity for borrowers to understand their obligations and explore available options.

A significant concern for borrowers is the potential for default. Borrowers can check their loan status by logging into their account at studentaid.gov. If a loan enters default status, the consequences can be severe. The government can garnish wages, offset tax refunds, and damage credit scores, making it even more challenging for borrowers to manage their finances. Determining whether or not a loan is in default is a critical first step for borrowers.

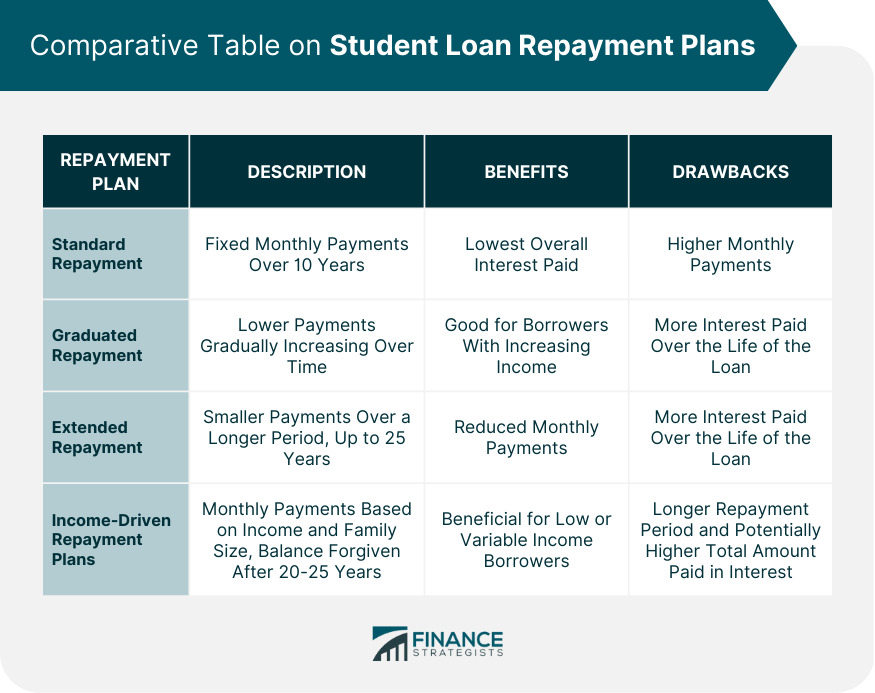

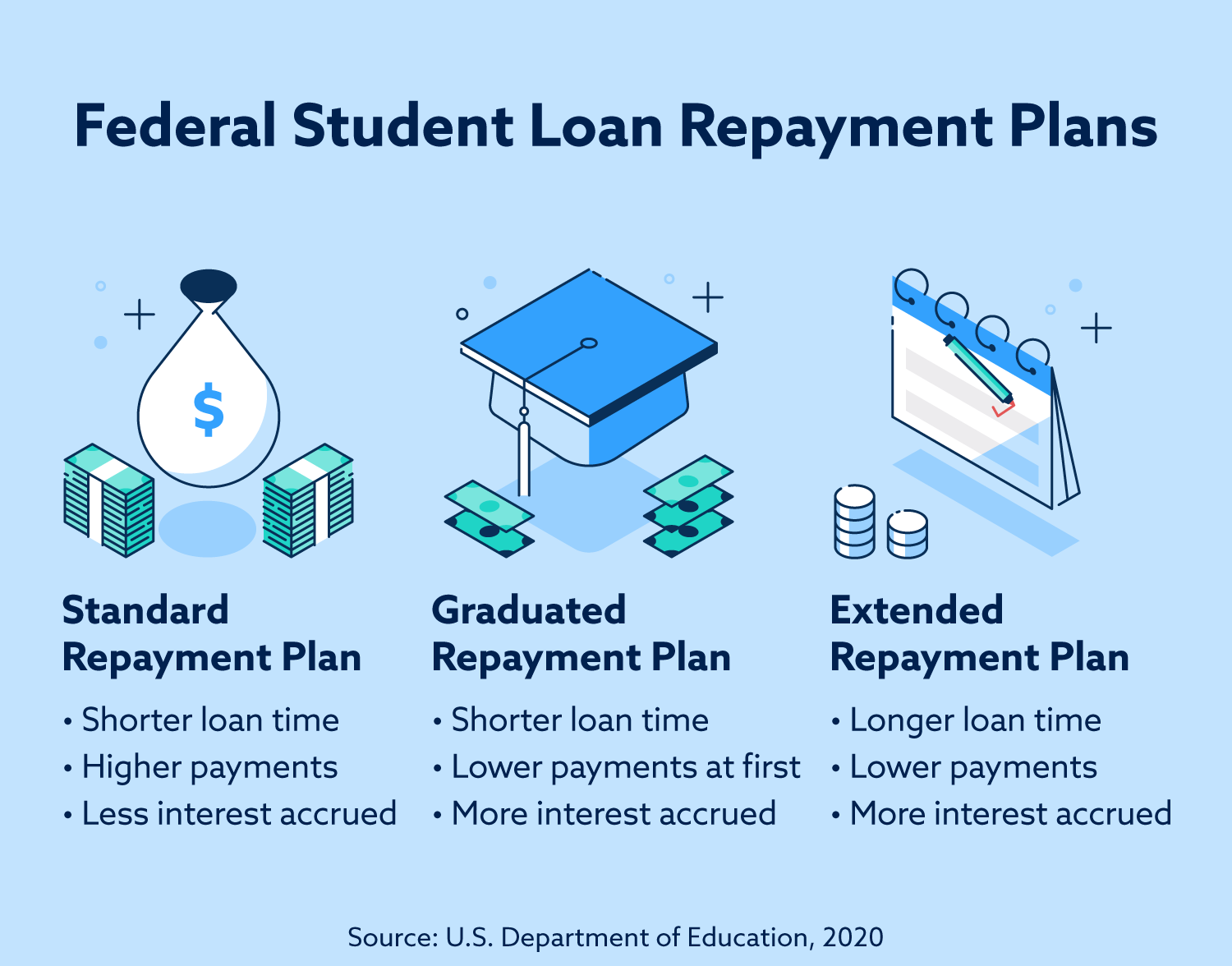

The government, aware of the challenges, offers various resources to assist borrowers. These include options for income-driven repayment plans, which base monthly payments on a borrowers income and family size. The goal is to make repayment more manageable, particularly for those with lower incomes or those working in public service. However, these plans can also extend the repayment period, leading to higher overall interest payments over time.

Navigating the complex world of student loan repayment requires diligence and awareness. The official website, studentaid.gov/repay, serves as a central hub for information. It provides detailed information on when repayment begins, what happens if a student returns to school after starting repayment, the latest interest rates, and a wide range of other relevant topics. It is imperative that students are aware of this resource.

For borrowers seeking to manage their debt, organizations like Mohela offer options to manage the repayment of loans, including repayment plans and ways to lower or postpone payments. The availability of multiple plans, including income-driven plans, provides borrowers with the flexibility to align their payments with their individual circumstances. Borrowers are encouraged to explore these plans to determine which best suits their financial situations.

The potential for loan forgiveness is another critical factor. Certain programs, such as Public Service Loan Forgiveness (PSLF), offer the opportunity for loan forgiveness after a specified period of qualifying employment in public service. The government has, from time to time, adjusted the rules surrounding these programs, and borrowers must stay informed of the evolving requirements. This limited PSLF waiver will apply to borrowers with direct loans, those who have already consolidated into the direct loan program, and those with other types of federal student loans who submit a consolidation application into the direct loan program while the waiver is in effect.

It is critical for borrowers to be aware of their options, to proactively manage their debt, and to stay informed about the ever-changing rules and regulations. A wealth of information exists to guide borrowers through the process, from exploring income-driven repayment plans to understanding the implications of potential default.

The Department of Education is the primary governing body and will resume collecting on student loans. Any action should be taken after checking studentaid.gov

The ability of the Department of Education to draft regulations expanding student loan relief could be curtailed. Policy is described at studentaid.ed.gov

Article Recommendations

- Discover Your Astrological Moon Sign What Is Your Moon Sign

- Elegant Wedding Updos For Black Hair Timeless Styles For Your Special Day

Detail Author:

- Name : Chaim Koch

- Username : brandt55

- Email : chegmann@douglas.com

- Birthdate : 1998-06-14

- Address : 114 Sanford Spring Steuberchester, SC 72911-1805

- Phone : +13149319405

- Company : Steuber Group

- Job : Social Science Research Assistant

- Bio : Enim ipsam maxime in illum a cumque. Numquam ea consectetur dolor blanditiis voluptas tempore. Consectetur cum officia laudantium nulla quis hic.

Socials

instagram:

- url : https://instagram.com/archibaldnikolaus

- username : archibaldnikolaus

- bio : Nihil voluptates dolore fuga aut. Adipisci sed eum consequatur aut ipsam.

- followers : 3967

- following : 2226

linkedin:

- url : https://linkedin.com/in/archibald.nikolaus

- username : archibald.nikolaus

- bio : Assumenda animi architecto nisi enim earum.

- followers : 3524

- following : 2473

twitter:

- url : https://twitter.com/nikolaus1977

- username : nikolaus1977

- bio : Est eos consectetur commodi in voluptas magni. Ea neque eum repellat qui eligendi magnam. Incidunt numquam sunt deserunt voluptatibus.

- followers : 272

- following : 1245

tiktok:

- url : https://tiktok.com/@archibald8939

- username : archibald8939

- bio : Quo quia assumenda corrupti quia cumque molestias.

- followers : 4027

- following : 1151

facebook:

- url : https://facebook.com/archibald.nikolaus

- username : archibald.nikolaus

- bio : Repellat laudantium est id vitae dicta id est. Aut accusantium ut dolor.

- followers : 716

- following : 1664