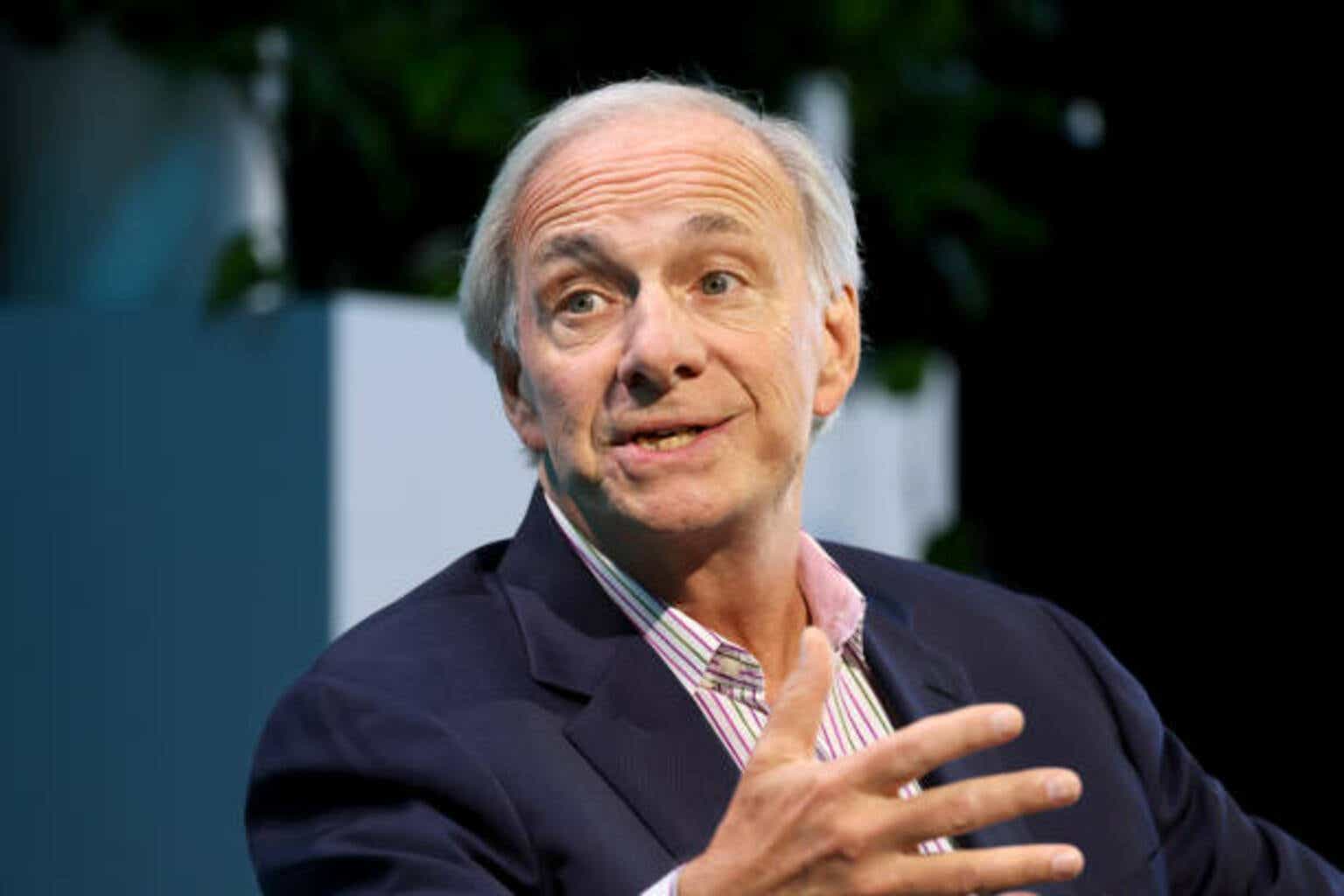

Ray Dalio's Debt Warning: U.S. Economy "Heart Attack" Imminent?

Is the United States teetering on the brink of a financial precipice? The chorus of warnings about the dangers of escalating U.S. government debt is reaching a fever pitch, with prominent figures like Ray Dalio cautioning of a potential "economic heart attack" within the next few years.

The past few days have seen a flurry of pronouncements from some of the most influential voices in the financial world regarding the burgeoning U.S. national debt. Among them, Ray Dalio, the founder of Bridgewater Associates, the world's largest hedge fund, has been particularly vocal, sparking a wave of concern across markets and among policymakers. Dalios warnings, shared publicly, are not mere speculation, but rather, a carefully considered assessment based on extensive research and experience navigating global financial crises.

Dalios concerns, however, aren't isolated. Jamie Dimon, the CEO of JPMorgan Chase, has also added his voice to the growing chorus of alarm. This convergence of warnings from two of the most respected figures in finance underscores the gravity of the situation. They are not the only ones sounding the alarm bells; a growing number of economists and financial analysts are pointing to the unsustainable trajectory of U.S. debt.

- Expert Guide Efficiently Removing Shower Knobs With Ease

- Ultimate Guide To Yellow Curly Hair Product Tips Benefits And Choices

The crux of the issue lies in the mounting levels of government debt, coupled with persistent budget deficits. The U.S. federal government ran a staggering $1.8 trillion deficit in the last fiscal year, contributing to a national debt that now surpasses $36.2 trillion. This debt burden, if left unchecked, poses a significant threat to the long-term health of the U.S. economy.

Dalio has emphasized the potential for a "financial heart attack" within the next three years, a stark prediction that has captured the attention of investors and policymakers alike. His warning, rooted in a deep understanding of economic cycles and historical precedents, points to the possibility of a severe economic downturn. He has drawn parallels to previous financial crises, suggesting that the current situation carries the potential for similar disruptive consequences.

Adding to the concerns, Dalio has suggested the possibility of currency devaluation. He believes that the government may try to print money to alleviate its debt burden, leading to an increase in inflation and a decline in the value of the dollar. To protect against this, he has suggested that investors turn to assets like Bitcoin and gold, which are considered safe havens during times of economic uncertainty.

- Alluring Beauty Lindsay Lohan No Makeup Revealed

- The Art And Evolution Of Dots Nail Gn A Trendy Manicure Style

The potential impact of this debt crisis extends far beyond the borders of the United States. The U.S. economy is the largest in the world, and its financial stability is crucial to global economic health. A downturn in the U.S. could trigger a domino effect, impacting economies worldwide. The interconnectedness of global markets means that any major shock to the U.S. economy could have far-reaching consequences.

Dalios assessment is not based on pessimism, but rather on a pragmatic understanding of economic realities. He and others are not predicting the end of the world, but instead, urging policymakers to address the root causes of the debt problem. They are calling for responsible fiscal policies and structural reforms to ensure the long-term stability of the U.S. economy.

The potential fallout from the current debt trajectory is significant. Dalio warns of a variety of possible scenarios, including increased inflation, higher interest rates, and a decline in investor confidence. These factors could trigger a recession, leading to job losses and reduced economic activity. Furthermore, a debt crisis could erode the U.S.'s global standing, undermining its ability to influence international affairs.

The response from the U.S. government will be crucial in the coming years. Policymakers will need to grapple with difficult choices, including balancing the need for economic stimulus with the imperative of fiscal responsibility. The decisions they make in the coming months and years will determine the long-term health and stability of the U.S. economy.

The warnings from Dalio and others serve as a wake-up call, urging immediate action to address the debt crisis. The time for complacency is over. The future of the U.S. economy depends on the willingness of policymakers and the public to confront this challenge head-on.

The concerns are not limited to the immediate future. The underlying trends of debt accumulation and deficit spending have been developing over many years. Without significant changes to fiscal policy, these trends are likely to continue, potentially exacerbating the risks to economic stability.

Dalio's warnings have been echoed by other prominent figures in the financial world. Many investors and economists share his concerns about the long-term implications of the rising debt. The collective message is clear: the United States must take decisive action to address its debt crisis, or face the consequences.

The economic and political context is also important. The rising debt burden is unfolding against a backdrop of other challenges, including geopolitical instability, technological disruption, and climate change. These factors add to the complexity of the situation, making the task of economic management even more challenging.

Furthermore, the current political climate adds to the uncertainty. The lack of consensus on fiscal policy and the potential for political gridlock make it more difficult to address the underlying challenges. The need for bipartisan cooperation on economic issues is more pressing than ever.

The warning from Dalio and others is a call to action. It is a plea for responsible fiscal management, structural reforms, and a renewed commitment to economic stability. The future of the U.S. economy depends on the willingness of policymakers and the public to heed these warnings and take decisive action.

The conversation is not just about the numbers. It is about the fundamental values of the American economy. The ability of the U.S. to sustain its economic leadership and provide opportunities for its citizens depends on its financial stability. Addressing the debt crisis is not only an economic imperative but a matter of national importance.

Dalio and others are not offering simple solutions. The economic challenges are complex, and there is no easy fix. The path forward will require a multifaceted approach, including fiscal discipline, structural reforms, and a commitment to long-term economic growth. The task is difficult, but the stakes are high.

Ultimately, the response to the debt crisis will determine the long-term trajectory of the U.S. economy. The warnings from Dalio and other leading financial figures should be taken seriously. The time for action is now, to ensure a stable and prosperous future for the United States.

| Ray Dalio - Biographical Information | |

|---|---|

| Full Name: | Raymond Thomas Dalio |

| Born: | August 8, 1949 (age 74 years), Jackson Heights, New York, USA |

| Net Worth: | Approximately $14 billion (as of October 2024) |

| Education: |

|

| Career: |

|

| Professional Background: |

|

| Key Publications: |

|

| Awards and Recognition: |

|

| Reference: | Bridgewater Associates Official Website |

The escalating U.S. debt is not merely a matter of numbers; it has the potential to disrupt the global economy. Massive government borrowing requires the U.S. Treasury to issue more bonds, which can cause a chain reaction with global impacts.

Beyond the immediate economic impact, the warnings also carry significant implications for investor confidence. Any perception of waning investor confidence can lead to increased volatility in financial markets, with a corresponding effect on asset prices and overall economic stability. Dalio expressed his concern about this prospect.

The issues cited by Dalio echo previous financial crises and their repercussions. Specifically, the Nixon administration's 1971 decision to abandon the gold standard provides a historical example of the kind of significant market shock and economic disruption that can occur when governments make major changes to their financial policies.

The potential fallout from the rising debt is multifaceted. Increased inflation, higher interest rates, and decreased investor confidence could trigger a recession, leading to job losses and reduced economic activity. Furthermore, any debt crisis could erode the U.S.'s global standing, undermining its ability to influence international affairs.

In an interview on NBC News' Meet the Press, Dalio also addressed other crucial aspects of the current economic climate, including growing debt and political tensions. These concerns underscore the interconnectedness of economic, political, and social factors in shaping the economic landscape.

The financial landscape is continually evolving. The convergence of rising government debt, changing monetary policy, and escalating geopolitical tensions is testing the resilience of the U.S. and global economies. The insights provided by experts such as Dalio offer valuable guidance on navigating these turbulent times.

In addition to the economic implications of mounting debt, Dalio also warns that the ongoing spending plans of the Trump administration could exacerbate the problem. He is concerned about the annual deficit, pointing out the need for pragmatic and responsible fiscal policies. The situation is particularly complex, given the many economic and political challenges facing the nation.

The overarching theme is clear: the current trajectory of the U.S. debt is unsustainable. Prudent financial management, responsible governance, and an open dialogue about the nation's economic future are of utmost importance.

Article Recommendations

- Ultimate Guide To Yellow Curly Hair Product Tips Benefits And Choices

- Compatibility Aries And Aries Love Friendship And More

Detail Author:

- Name : Prof. Donald Toy Sr.

- Username : queenie.walter

- Email : sweimann@fay.info

- Birthdate : 1971-07-29

- Address : 2951 Lora Squares Wildermantown, PA 53292-1795

- Phone : 1-870-446-6498

- Company : Hintz Inc

- Job : Home Health Aide

- Bio : Qui iusto ex temporibus qui rerum et. Quo et mollitia sapiente quam iure iusto repudiandae. Ratione deleniti ipsam totam id nihil vel quo.

Socials

instagram:

- url : https://instagram.com/darrick_franecki

- username : darrick_franecki

- bio : Magnam voluptatibus omnis ex ipsam. Et earum magni in iusto dicta error.

- followers : 5405

- following : 1072

twitter:

- url : https://twitter.com/darrick.franecki

- username : darrick.franecki

- bio : Qui minima aut iste dolorem cupiditate nihil modi. Incidunt praesentium animi aperiam et voluptas. Blanditiis dignissimos fugit asperiores possimus.

- followers : 5271

- following : 2313

facebook:

- url : https://facebook.com/darrickfranecki

- username : darrickfranecki

- bio : Mollitia atque qui nostrum sunt dignissimos enim rerum magni.

- followers : 6772

- following : 1476